In 2021, Wale Akanbi, the former CTO and co-founder of Aella-a Nigerian firm specializing in financial and credit solutions-faced significant hurdles when he moved to the UK. His credit history from Nigeria did not transfer internationally, leaving him unable to access essential financial services.

“I had to rely on a friend’s card just to make purchases,” Akanbi recalls, highlighting a common challenge faced by many immigrants.

This issue is widespread among migrants worldwide: credit records typically do not follow individuals across borders. As a result, newcomers often start with a blank financial profile, making it difficult to obtain credit cards or loans that depend on established credit histories.

To address this gap, Akanbi launched Bleyt in 2025. This innovative fintech platform leverages artificial intelligence to gather financial data from local credit bureaus and lenders, enabling immigrants to transfer their credit histories seamlessly to their new countries. Additionally, Bleyt provides a multi-currency account and card, helping users avoid the usual delays in accessing financial services abroad.

While many fintech companies have focused on remittances and cross-border payments, credit accessibility remains a significant barrier for migrants. According to Tata Consultancy Services, nearly 300 million people worldwide relocate to countries where their credit records become inaccessible.

“Many remittance-focused fintechs like Lemfi, Nala, and Taptap Send offer one-way money transfer services but lack solutions for credit portability,” Akanbi explained.

Bleyt’s platform not only offers multi-currency banking but also uses AI to evaluate users’ creditworthiness for financial institutions in their new locations. By consolidating traditional credit data and alternative financial information, it generates a portable credit score that reflects the user’s financial reliability.

How Bleyt Operates

With user consent, Bleyt collects financial information from various sources, including credit bureaus and lenders, and synthesizes this data into a clear, transparent credit score. The system also forecasts how this score translates within the financial frameworks of the user’s new country.

The company collaborates with credit providers in its target markets to integrate these portable scores into local credit systems, enabling immigrants to access credit products with favorable terms. Although Bleyt has not publicly named its partners due to its pre-launch status, Akanbi confirmed their readiness to onboard users’ credit profiles.

Currently in closed beta and approximately 98% complete, Bleyt plans to officially launch in October. The initial rollout will cover 20 countries with significant migration flows, including the United States, Canada, the United Kingdom, and select European nations, with ambitions to expand further.

Bleyt’s Know-Your-Customer (KYC) process requires users to submit personal identification details and undergo fraud detection checks. Importantly, the platform empowers users with control over their data, offering options to delete information in compliance with data protection regulations across its operational regions.

Competitors such as Monzo, Wise, and Lemfi provide similar financial services, but Bleyt distinguishes itself by combining these offerings with credit portability-a feature crucial for migrant users.

The company’s revenue model includes transaction fees from card usage and transfers, subscription fees for credit portability services, and profit-sharing agreements with lending partners. Plans for a business-to-business (B2B) revenue stream are also underway. “We generate income through revenue sharing with lending partners who provide credit to our customers, and we foresee expanding into B2B services,” Akanbi noted.

One of the biggest challenges Bleyt faces is navigating the complex regulatory environments across its target countries. Establishing a platform that reports and transfers credit histories internationally requires multiple licenses and partnerships with credit bureaus and financial institutions.

“While we continue to secure licenses in various jurisdictions, we have already obtained a Money Services Business (MSB) license in Canada and operate in other countries through strategic partnerships,” Akanbi said.

The company is also pursuing additional licenses to broaden its service offerings, including those related to cryptocurrency.

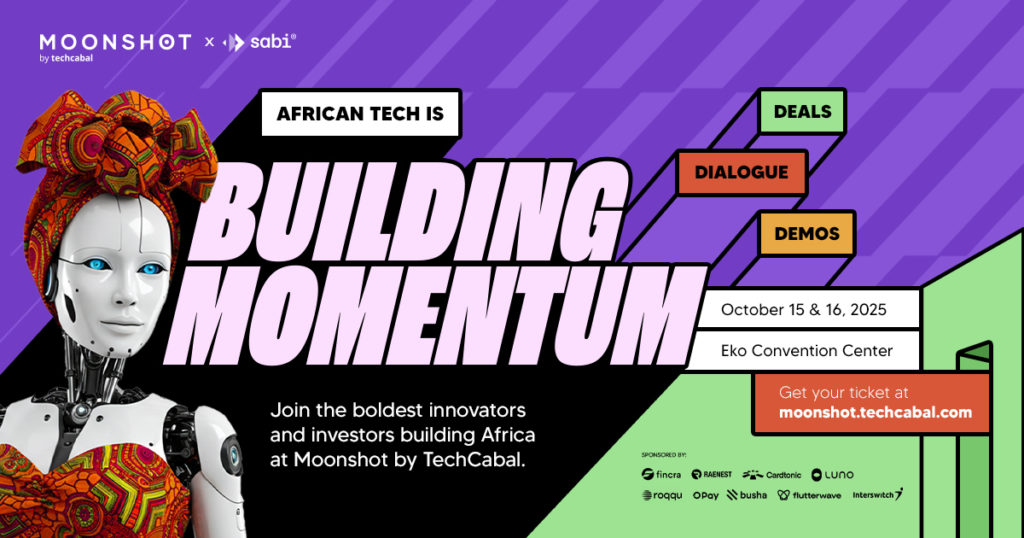

Don’t miss out! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Secure your tickets now at moonshot.techcabal.com.

0 Comments