There is a growing call among stakeholders for the implementation of rent control measures within the real estate sector, as unchecked rent increases by some landlords are causing significant distress for tenants nationwide.

At present, renters face a heavy financial load, including agency fees, security deposits, maintenance charges, service fees, and inflated commissions from brokers, which can amount to 25 to 30 percent of the annual rent.

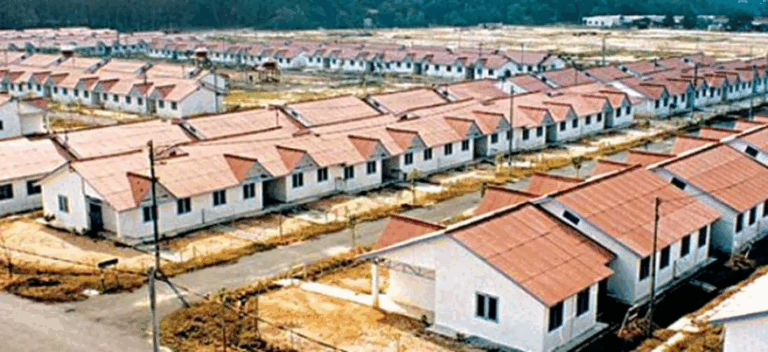

These expenses consume a large portion of household budgets, compelling many individuals and families to move to suburban or rural areas where rental prices are more affordable.

This shift results in longer daily commutes, which negatively impacts productivity, diminishes overall living standards, and places additional financial strain on already tight household incomes.

The lack of effective rent regulation and oversight has allowed landlords to impose arbitrary rent hikes and engage in exploitative practices, exacerbating social inequalities and contributing to issues such as homelessness, poverty, and social marginalization.

Stakeholders warn that without intervention, residential landlords may continue to escalate rents uncontrollably, further deepening the housing affordability crisis faced by many Nigerians.

Moreover, the rising rental costs place immense pressure on families who depend on irregular or daily wages, making arbitrary rent increases a catalyst for a prolonged housing sector crisis.

In a conversation with a landlord from the Ojodu Berger area of Lagos, Dipo Karounwi, a retired civil servant who invested five years in constructing a modest two-story home, expressed frustration over recent tax policies and housing reforms. He described these measures as burdensome, stating that the costs of building materials, ongoing repairs, and annual property taxes are already substantial.

Karounwi remarked, “Many tenants assume landlords are wealthy, but they don’t see the expenses for cement, repairs, and yearly ground taxes. Now, the government demands house insurance and wants to regulate rent while requiring tenants to pay three months’ rent upfront. How are landlords supposed to manage? Banks and contractors expect timely payments.”

Similarly, Kemi Ajibade, a secondary school teacher residing in Meiran, Lagos, shared her struggles: “I earn N120,000 monthly, yet my landlord demanded N800,000 for a two-bedroom apartment. I had to borrow from friends and our cooperative savings to cover the rent. It was almost overwhelming. Government intervention to regulate unscrupulous landlords and agents within a few months would greatly ease our burden.”

For many Lagos residents, the practice of paying one to two years’ rent in advance has long been a source of hardship. This system excludes numerous families from accessing decent housing, confines others to overcrowded spaces, and traps many in cycles of debt.

Advocacy organizations argue that such practices exploit tenants in a city where affordable housing is scarce and incomes are limited. They view the proposed Lagos Tenancy Bill as a necessary reform to address these issues.

Recently, the Lagos State House of Assembly reviewed a comprehensive tenancy bill aimed at reforming rent collection methods, regulating estate agents, clarifying landlord and tenant rights and obligations, and improving dispute resolution processes.

The legislation, titled “A Bill for a Law to Regulate the Relationship Between Landlords and Tenants, Including the Procedure for the Recovery of Premises in Lagos State, and for Other Connected Matters,” intends to repeal the existing Tenancy Law Cap. T1, Laws of Lagos State 2015. It prohibits landlords or agents from demanding more than three months’ rent in advance for monthly tenancies or more than one year’s rent upfront for annual tenancies, regardless of prior agreements.

Gbenga Ismail, former chairman of the Lagos chapter of the Nigerian Institution of Estate Surveyors and Valuers (NIESV), highlighted that many landlords view rental income as a form of retirement security. The current system of collecting lump-sum rents one or two years in advance offers protection against Nigeria’s unstable economy, where inflation diminishes monthly rent value and irregular income streams complicate financial planning.

He cautioned that imposing taxes on this income could reduce housing availability, as landlords might withdraw properties from the market, worsening the accommodation shortage for tenants.

Ezekiel Oke, CEO of Greenchell Homes and Property, acknowledged the rationale behind protective taxes but warned that Nigeria’s economic conditions make blanket enforcement impractical. “Landlords may respond by raising rents, adding hidden fees, or removing properties from the rental market entirely. Ultimately, tenants bear the brunt of these consequences,” he explained.

Analysts echo these concerns, noting Nigeria’s history of weak regulatory enforcement. While laws are often enacted with enthusiasm, they frequently falter during implementation due to underfunded institutions and systemic corruption. This raises the risk that new regulations could become bureaucratic hurdles that penalize compliant landlords while allowing unscrupulous actors to operate unchecked.

Beyond capping advance rent payments, the proposed Lagos tenancy law includes provisions requiring landlords to provide receipts for all rent payments, with penalties for non-compliance. It also sets clear eviction notice periods, promotes alternative dispute resolution, and mandates the registration of estate agents with regulated commission fees.

Chudi Ubosi, chairman of the Association of Capital Markets Valuers (ACMV), warned that punitive taxes could further reduce rental housing stock as landlords withdraw properties, intensifying the housing shortage for both renters and owners.

Ubosi stated, “Policies that succeed in other countries rarely have the same effect in Nigeria due to differences in economic structures and institutional strength. Punitive taxes on landlords are unlikely to lower rents; instead, these costs will be passed on to tenants, driving rents higher.”

He urged the government to address the root causes of high rents-such as land scarcity, lack of mortgage options, high interest rates, and bureaucratic hurdles-through long-term strategies rather than short-term political measures.