Corporate venture capital (CVC) remains an uncommon practice across Africa, as many prominent corporations choose to steer clear of the continent’s burgeoning startup scene, concentrating instead on their primary business activities. In contrast, on the global stage, corporate venture capitalists represent approximately 36% of the total venture capital deal value, highlighting a stark difference in engagement levels.

Nonetheless, a select group of African companies, including Orange, Standard Bank, Safaricom, and GB Corp, are challenging this trend by actively participating in the startup ecosystem. GB Corp, ranked as Egypt’s 26th largest publicly traded company, has invested in five early-stage startups over the last four years, positioning itself as both a financier and a strategic collaborator within Egypt’s entrepreneurial landscape.

Operating through its corporate venture capital arm, GB Ventures, headed by Nada Shaheen, the firm commits a minimum of $500,000 to Egyptian startups, with the potential to increase investments up to $5 million in subsequent funding rounds.

Though not widely recognized beyond its core markets, GB Corp boasts eight decades of expertise in automotive manufacturing and importation, financial services, and related sectors, with operations spanning Egypt, Jordan, Iraq, Kenya, Tanzania, and Rwanda.

Given GB Corp’s core focus on mobility and financial services, GB Ventures strategically targets startups in logistics, fintech, and mobility. “When crafting our venture capital approach, we deliberately selected sectors aligned with our key business areas to foster agility and innovation,” Shaheen explained.

This sector-specific focus enables GB Ventures to provide portfolio companies with access to its infrastructure, client base, and mentorship opportunities. “Our fund is designed to be strategic, primarily supporting the parent company’s core operations,” Shaheen added. “We integrate startups that complement our business sectors, effectively cultivating an internal ecosystem for innovation.”

In this week’s Ask an Investor feature, I had the opportunity to discuss with Nada Shaheen, Managing Director of GB Ventures, the firm’s investment philosophy, the ideal structure of a corporate venture capital entity, their support mechanisms, investment process, and the critical role startups play in the survival of corporates.

The following interview has been condensed and refined for clarity.

Corporate venture capital often prioritizes strategic value over pure financial returns. How do you reconcile financial gains with corporate objectives?

From the outset, we recognized that our corporate venture capital arm would not operate like a traditional VC focused solely on financial returns. Our investments are deeply strategic, emphasizing synergy and integration between startups and our core business rather than just monetary gains.

We view these investments as long-term commitments. In fact, we have increased our stakes in about half of our portfolio companies to strengthen these relationships. We actively integrate startups into our operations and establish commercial partnerships with them.

We measure returns on two fronts: first, the direct financial growth and valuation increase of the startup; second, the commercial benefits these startups bring to our business units. These startups contribute revenue streams and enhance our product and service offerings through their innovations. Thus, our ROI encompasses both financial and strategic dimensions.

Why is your current investment focus limited to Egypt?

The decision to concentrate on Egypt was driven by the corporation’s comfort level and strategic considerations. Corporate venture capital is still nascent in Africa, and many companies maintain a cautious stance toward startup investments. To ease this transition, we needed a familiar and secure environment.

Egypt serves as that foundation, housing our headquarters, extensive networks, and regulatory familiarity. This made it the ideal starting point to build trust between the corporate and startup communities before exploring other markets.

For example, I recently attended GITEX in Nigeria to explore opportunities. Our approach is to first invest in startups within new regions to gain insights and understand the ecosystem before expanding our core business there. This gradual, strategic expansion aligns with our risk tolerance and aims to shift corporate mindsets incrementally.

If you were to develop a crash course on corporate venture capital, what key elements would it include?

Launching a corporate venture capital initiative requires significant dedication. While not a formal curriculum, I can share the essential steps we followed from inception.

Corporates must first grasp that two distinct ecosystems exist: their own and the startup environment. They need to clearly define their purpose: Why are we investing? How will we execute this? What outcomes and KPIs do we expect from these startups?

Often, companies are attracted to the idea of CVC without a clear strategy, which can lead to misaligned efforts.

On the startup side, founders should approach corporates with confidence and clarity about their vision. It’s common for startups to feel intimidated and compromise their business models to appease corporate partners, which can undermine their potential.

Patience is crucial, as CVC investments are impactful and strategic rather than purely ROI-driven. Corporates must offer more than capital-providing mentorship, resources, and access to networks is vital. This often allows them to negotiate favorable terms while delivering substantial value to startups.

Structurally, it’s important to establish a dedicated CVC entity that operates independently yet remains aligned with the parent company’s strategy. This separation prevents day-to-day corporate interference while ensuring strategic coherence.

We faced challenges initially, with heavy board involvement complicating operations. Educating leadership on effective CVC practices was essential and time-consuming. Starting with a clear governance model would have saved considerable effort.

Can you share a success story where a portfolio company gained from GB’s support?

One standout example is an e-commerce startup specializing in automotive spare parts. For three years, we struggled to develop an in-house e-commerce platform due to limited expertise and resource constraints.

Partnering with this local startup, which had proven experience in automotive e-commerce, allowed us to quickly deploy a solution integrated with our spare parts division. They became a brand ambassador for us and benefited from financing options through our fintech subsidiaries.

This collaboration accelerated their growth and innovation capabilities, leveraging their specialized technology rather than building from scratch internally.

What does your investment decision-making process entail?

Our investment decisions are made by a committee comprising myself and key corporate executives overseeing the relevant business units. This includes CEOs from our fintech, automotive, and logistics divisions, as well as the group CEO and myself as the venture capital lead.

Decisions are primarily made through voting, with business unit leaders having significant influence since they assess the strategic fit of startups for their operations. After thorough technical evaluations and discussions with startups, we finalize our decisions.

I prepare detailed documentation outlining the startup’s strategic importance and expected returns. When co-investing with other VCs, their perspectives also weigh heavily in our evaluation.

How does your investment pace compare to traditional venture capital firms?

Our process balances the agility of venture capital with the strategic oversight of a corporate entity. While we may not move as swiftly as some independent VCs due to internal governance, our deep integration with the parent company allows us to offer unique value beyond capital, justifying a slightly longer decision timeline.

The evaluation process typically spans four to six weeks. During this period, we thoroughly assess the concept, examine potential synergies, and evaluate the dynamics between our team and the prospective company.

Once a decision is reached, we move swiftly to implement the investment.

Occasionally, we initiate a pilot phase to further validate the opportunity. Even if the idea is promising, we prefer to test it through a pilot project within one of the company’s business units. This approach allows us to gain deeper insight into their customer base, team capabilities, decision-making processes, and overall ability to meet market demands. In some cases, this pilot phase can last up to three months, providing us with a comprehensive understanding of the startup.

Do you provide follow-up investments?

Absolutely, follow-on investments are a key part of our strategy. We have extended additional funding to three of our portfolio companies so far. As long as the startups remain strategically aligned and demonstrate strong performance, we continue to support them financially. We conduct quarterly reviews with all portfolio companies to monitor their progress.

When companies meet their targets and key performance indicators, we are open to follow-on funding upon their request. This approach is reassuring for us since we already have a solid relationship with the team and understand their business. In some cases, follow-on investments can reach up to $5 million, reflecting our confidence in their growth trajectory and potential.

Do you typically take seats on the board?

Yes, we generally secure board seats. Occasionally, we invest through simple agreements for future equity (SAFE notes). Since our operations are relatively new, we remain adaptable and experiment with various investment structures. While SAFE notes have been used, the majority of our investments involve holding board positions. Currently, we have board representation in all our portfolio companies.

How do you discover new investment opportunities?

Our deal sourcing is multifaceted. Primarily, we leverage our venture capital partner network. Additionally, I proactively identify and approach talented entrepreneurs and founders, as it’s often clear who stands out in the ecosystem.

Startups and founders also frequently reach out to us directly. I make it a point to attend demo days and key ecosystem events regularly. Our group’s extensive presence in the market and my 12 years of involvement in the Egyptian startup scene provide us with excellent visibility into emerging opportunities.

What is the difference between your six-month program and direct investments?

We previously operated a six-month acceleration program tailored for early-stage startups. However, we decided to discontinue it due to the operational challenges it presented. Instead, we now collaborate with external accelerators and utilize their programs as a source for potential investments. Managing the program internally proved to be too resource-intensive, so partnering externally has become our preferred approach.

Beyond capital, what additional support do you offer your portfolio companies?

Our support extends well beyond funding. We provide strategic guidance, mentorship, and access to our extensive network of industry experts and partners. This holistic approach helps startups refine their business models, scale operations, and navigate market challenges effectively. We also facilitate connections with potential clients and investors, ensuring our portfolio companies have the resources they need to thrive.

Our core mission centers on empowering startups to establish a strong market foothold, ensuring their security and long-term viability. The initial step involves seamlessly integrating these startups within our corporate framework, which opens up diverse revenue opportunities. Depending on the situation, they may act as suppliers, collaborators, or clients.

What sets a Corporate Venture Capital (CVC) apart from traditional venture capital is the access to our extensive resources. This unique advantage enables us to actively accelerate their business growth and market penetration. Additionally, our expansive network of affiliated companies and robust partnerships across Egypt provide startups with valuable market entry points and increased visibility.

Mentorship is another pillar of our support system. Startups gain direct access to our executive leadership, including board members, C-suite officers, and vice presidents. This one-on-one guidance helps them validate strategies and decisions, offering deep market insights and expert advice.

Moreover, endorsement from a reputable corporate entity significantly boosts a startup’s credibility within the ecosystem. All companies in our portfolio are profitable, reinforcing their reputation for reliability and seriousness.

We also facilitate introductions to potential investors, further supporting their growth journey.

What is your outlook on the expansion of corporate venture capital (CVC) across Africa in the near future?

The growth of CVCs across Africa is inevitable and accelerating. During my time at GB Ventures, I had the opportunity to host a roundtable in Morocco, bringing together corporate leaders eager to explore the potential of corporate venture capital.

Today, numerous corporations, including financial institutions, are adopting this mindset. Just four years ago, the concept of CVC was virtually unheard of on the continent. Now, many organizations approach me to learn how we established our program and navigated challenges.

For instance, I am currently advising Bosch on developing their own CVC initiative. Similarly, several Egyptian corporations have launched their venture funds. I anticipate the number of CVCs in Africa will at least double this year. With the rapid pace of startup and tech innovation, companies that fail to engage with this ecosystem risk obsolescence.

Could you elaborate on what you mean by corporates facing extinction?

Startups bring a level of innovation, flexibility, and scalability that traditional corporations often struggle to match. Corporates tend to be slower in adapting to change. Therefore, fostering close ties with startups and innovation hubs is essential for maintaining a competitive edge and preserving their influence within the market.

Which sectors do you believe are currently undervalued or overlooked in Africa?

While AI is undeniably a hot topic, our focus remains on fintech, logistics, and automotive sectors. However, several other industries deserve more attention, such as edtech, biotech, agritech, and proptech. These areas are gaining traction among venture capitalists and show promising growth potential.

AI is certainly significant and ripe for investment, but I caution against the hype-driven rush to invest solely because of fear of missing out. Hence, while AI is on the radar, it is not our primary focus.

How do you approach exit strategies for your investments?

At this stage, it is premature to consider exits for our portfolio companies. Our approach is grounded in long-term partnerships rather than quick returns. When we invest, our priority is growth and development rather than immediate exit plans.

That said, we are laying the groundwork for future exits by cultivating relationships with other venture capital firms. These alliances will facilitate smoother exit processes down the line. Nonetheless, for the next few years, we intend to maintain our investments without pursuing exits.

What is your vision for the future of GB Ventures and its evolution?

GB Ventures feels deeply personal to me. Although it is backed by a large corporation, I regard it as my own creation-something I passionately built from the ground up over the past four years. I see myself as a representative of this initiative.

My ambition is to make a tangible impact on the startup ecosystems in Egypt and across Africa. For emerging markets to thrive, corporate investment in startups is crucial. Corporates possess the capital, resources, influence, and networks necessary to drive growth. Startups, especially in their early stages, require more than just funding-they need strategic support to contribute meaningfully to national economies.

I firmly believe that corporate venture capital can transform economies and lives. I am committed to inspiring more corporations to partner with startups and create success stories, encouraging others to establish their own venture arms.

When I first conceptualized GB Ventures, I found no local precedents in Egypt, which was disheartening. This motivated me to set a pioneering example, dedicating myself not only to GbCorp but to the broader ecosystem.

At a recent event in Morocco, I was told I am the first woman leading a corporate venture capital firm in Africa. While this was an honor, it also highlighted the need for more female leadership in this space. I aim to build a platform that empowers other corporates-and especially women within them-to launch their own ventures. The form may vary, but the impact will be equally profound.

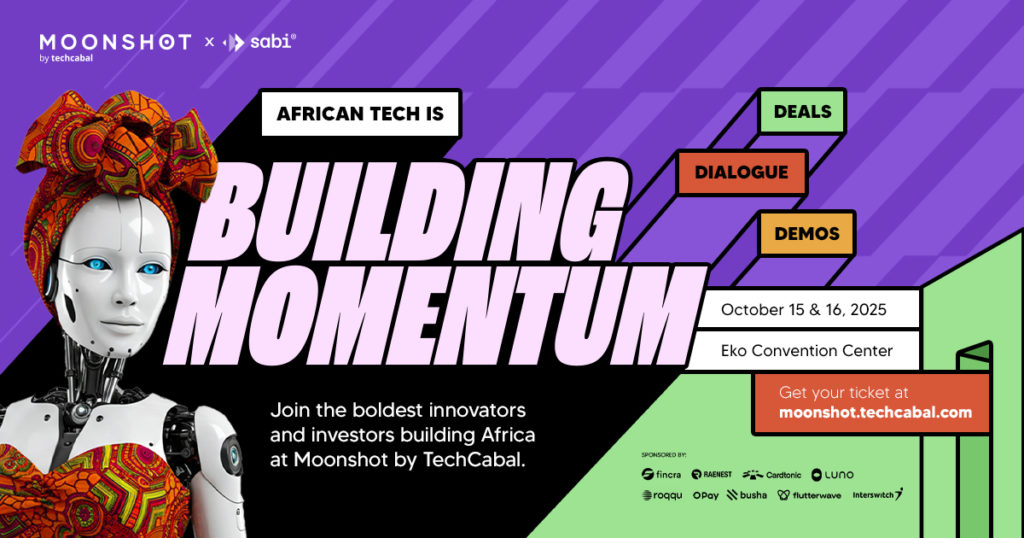

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Secure your tickets now at moonshot.techcabal.com

0 Comments