US Treasury Secretary signals potential interventions to stabilise Argentina amid sharp asset selloff.

The administration of US President Donald Trump has expressed readiness to intervene in Argentina’s financial turmoil as the nation faces intense market instability.

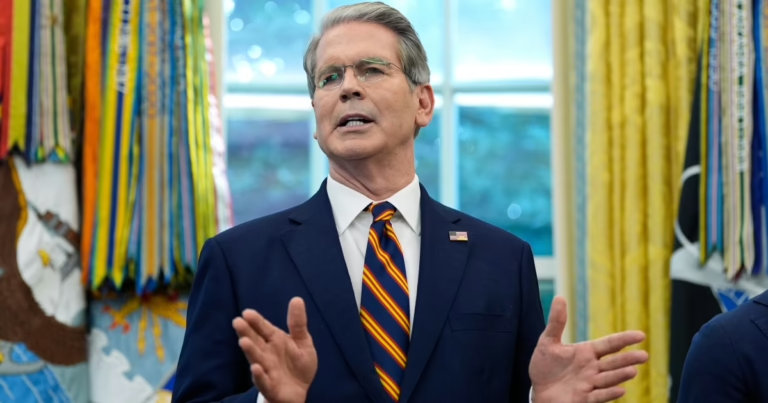

Scott Bessent, the US Treasury Secretary, affirmed on Monday that Washington is prepared to take necessary actions to support Argentina’s economy amid a significant selloff of its financial assets.

Among the strategies being evaluated are currency swap agreements with Argentina’s central bank, direct interventions in the foreign exchange market through dollar purchases, and acquiring Argentine government bonds denominated in US dollars.

More comprehensive plans are expected to be revealed following discussions scheduled in New York between Trump, Bessent, and Argentine President Javier Milei on Tuesday.

On social media platform X, Bessent highlighted the vast potential for private sector investment in Argentina, referring to the country as a “strategically vital US partner” and expressing optimism that “Argentina will thrive once again.”

Following these statements, the Argentine peso, along with local equities and bonds, experienced a notable rebound.

President Milei, who gained unexpected victory in the 2023 elections by pledging to curb inflation and reverse years of economic decline, publicly acknowledged the Trump administration’s “steadfast support.”

“Those committed to the principles of liberty must unite to enhance the prosperity of our nations,” Milei remarked on X.

Milei has become a prominent ally of Trump within the Western Hemisphere and enjoys considerable backing among US conservative circles, frequently appearing on their media outlets.

This US intervention follows a sharp retreat by investors from Argentine pesos and government securities, triggered by Milei’s La Libertad Avanza coalition’s poor showing in recent local elections.

The setback in Buenos Aires province has cast doubts over Milei’s chances in the upcoming nationwide midterm elections, which he views as critical to expanding his mandate for implementing right-leaning economic reforms.

Earlier this year, Argentina secured a $42 billion financial rescue package from the International Monetary Fund, World Bank, and Inter-American Development Bank aimed at stabilising its economy.

Having endured recurrent economic crises over decades, Argentina remains the IMF’s largest debtor, owing the institution over $40 billion.