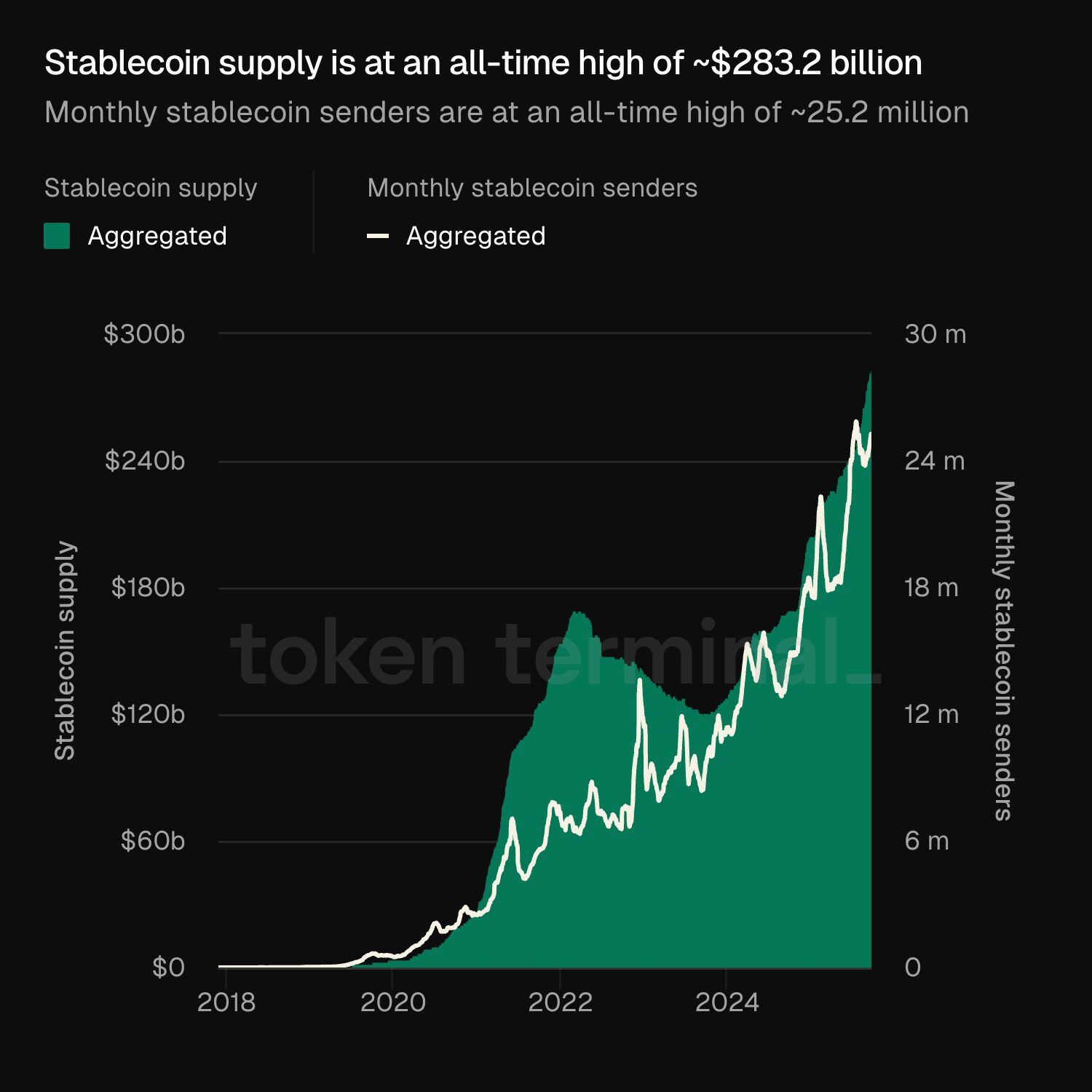

The stablecoin sector has recently shattered multiple milestones simultaneously. Token Terminal’s latest figures reveal that the total stablecoin supply has soared to an all-time high of $283.2 billion, accompanied by a surge in monthly active senders reaching 25.2 million.

Meanwhile, startups focused on stablecoin innovation have amassed over $621 million in funding during 2025 alone-an almost sevenfold increase compared to last year’s investments. Yet, beyond these impressive statistics, one narrative stands out prominently: Africa, with Nigeria at the forefront, is emerging as a pivotal force driving this extraordinary expansion.

Historically viewed as mere instruments for crypto traders, stablecoins have evolved into vital facilitators of remittances, cross-border commerce, and everyday financial transactions throughout the Global South.

In regions like Africa, where currency instability, limited foreign exchange availability, and exorbitant remittance costs have long posed challenges, stablecoins are bridging critical gaps left by traditional banks and mobile money platforms.

According to a recent Yellow Card report, stablecoins represent 43% of all cryptocurrency transaction volume in Sub-Saharan Africa. Nigeria spearheads this trend, boasting nearly $22 billion in stablecoin transactions from July 2023 through June 2024, making it the continent’s largest market.

Nigeria: Africa’s Pioneer in Stablecoin Adoption

For the past three years, Nigeria has consistently ranked among the global leaders in digital asset adoption.

Facing a depreciating naira and rising inflation that erodes purchasing power, millions of Nigerians are increasingly turning to dollar-pegged stablecoins such as USDT and USDC for financial stability and practical use. Local fintech companies are embedding stablecoins into digital wallets, payroll systems, and point-of-sale terminals, providing essential support to small enterprises and freelancers earning income from abroad.

Chainalysis’ recent Geography of Cryptocurrency report highlights that Nigeria processed $92.1 billion in on-chain transactions between July 2024 and June 2025-accounting for nearly half of Sub-Saharan Africa’s total $205 billion volume.

This robust activity contributes to the global record of 25.2 million monthly stablecoin senders, with African corridors playing a significant role due to their reliance on stablecoins for remittances and international trade.

In major cities like Lagos, Nairobi, and Accra, merchants familiar with cryptocurrency now accept USDT payments as seamlessly as cash or traditional bank transfers.

The surge in funding also bears the mark of African innovation. Startups across the continent are attracting significant investor interest by rapidly scaling stablecoin-based solutions in markets eager for alternatives to conventional banking systems.

Nigerian ventures, often supported by international venture capital, are pioneering projects in stablecoin remittances, decentralized lending platforms, and payment APIs that integrate directly with African e-commerce ecosystems.

Also read: “Nigeria’s crypto adoption isn’t fading,” says Emmanuel Onuoha of Web3 Nigeria on the latest rankings.

While Hong Kong’s OSL Group grabbed headlines with a $300 million funding round in July, African startups are quietly securing substantial investments, highlighting the global competition to develop stablecoin infrastructure.

On the regulatory side, the U.S. GENIUS Act has established a benchmark for regulatory clarity, influencing policies in Nigeria and across Africa.

With clearer international regulations, global partners are increasingly confident in incorporating stablecoins into African payment systems. Simultaneously, regulators such as Nigeria’s SEC are crafting frameworks aimed at fostering innovation while safeguarding consumers.

Industry experts remain divided on future valuations: Coinbase analysts predict the stablecoin market could reach $1.2 trillion by 2028, whereas J.P. Morgan offers a more conservative estimate of $500 billion.

Goldman Sachs has dubbed 2025 the “Summer of Stablecoins,” emphasizing their role not in replacing banks but in modernizing the global financial infrastructure.

Also read: Nigeria drives Sub-Saharan Africa’s $205 billion crypto boom despite a dip in global rankings.

For Africa, the impact is tangible: stablecoins are no longer theoretical financial instruments but practical solutions addressing everyday challenges. In Nigeria, they help families protect their wealth, enable businesses to expand, and facilitate cross-border payments for workers.

With record-breaking supply, usage, and investment, stablecoins are transforming digital finance’s landscape. From Lagos to Nairobi, Africa is not merely a participant but a key catalyst in this remarkable growth story.

0 Comments