HabariPay, the fintech subsidiary of Guaranty Trust Holding Company (GTCO), has experienced an extraordinary surge in profitability, multiplying its earnings twelvefold over three years. The company reported a landmark profit of ₦4.02 billion ($2.70 million) in the first half of 2025, a significant rise from ₦322.9 million ($217,094) recorded in the same period of 2022, as detailed in GTCO’s recent half-year financial report.

This remarkable performance positions HabariPay as Nigeria’s leading bank-affiliated fintech in terms of profitability, outpacing competitors such as Access Bank’s Hydrogen, which posted ₦283 million ($190,268) in Q1 2025, and Stanbic IBTC’s Zest, which reported a loss of ₦389 million ($261,535) in the first half of the year.

Despite this impressive growth, HabariPay remains relatively modest compared to its parent company’s profit of ₦449 billion ($301.88 million), contributing just 0.89% to GTCO’s overall earnings. Within the broader fintech ecosystem, HabariPay still trails behind major players like Flutterwave, Paystack, OPay, PalmPay, and Moniepoint.

While many fintech firms keep their financials private, estimates from the Financial Times for 2023 suggest that PalmPay generated approximately $63.90 million in revenue, whereas Moniepoint earned around $264.51 million.

GTCO initially launched Habari in 2018 as a multifunctional super-app but rebranded and refocused the venture in 2022 as HabariPay, a specialized fintech entity dedicated to digital payment solutions. Its core offering, the Squad platform, integrates a payment gateway, e-commerce capabilities, and a point-of-sale (PoS) system tailored for businesses.

HabariPay facilitates transactions through various channels including virtual accounts, USSD, card payments, and bank transfers, serving merchants with payment processing and providing switching services for seamless account-to-account and card transactions.

The company’s revenue streams primarily derive from net commissions on merchant transactions and profit margins on bill payments, such as airtime sales and bulk SMS services.

Operating income has skyrocketed over tenfold, reaching ₦5.05 billion ($3.39 million) in H1 2025, up from ₦447.86 million ($301,108) in H1 2022. Meanwhile, operating expenses have increased thirteen times to ₦1.03 billion ($692,497) from ₦70.64 million ($47,493) during the same timeframe. As of June 2025, HabariPay held a cash reserve of ₦2.18 billion ($1.47 million).

In a March interview, CEO Eduofon Japhet emphasized that despite the rapid expansion, the company aims to scale further to strengthen its role within GTCO’s portfolio. She highlighted that HabariPay’s multiple payment and switching licenses will be instrumental in broadening its PoS terminal services for merchants and enhancing the fluidity of mobile transfers to match the ease of card payments.

“The future of financial transactions in Africa lies in transfers, and we are exploring innovative ways to make transfer payments as intuitive and convenient as card transactions,” Japhet remarked.

During GTCO’s investor briefing in April, Group CEO Segun Agbaje revealed plans to accelerate the deployment of PoS terminals to expand Squad’s market penetration throughout 2025.

Note: Exchange rate applied is ₦1,487.37 to $1.

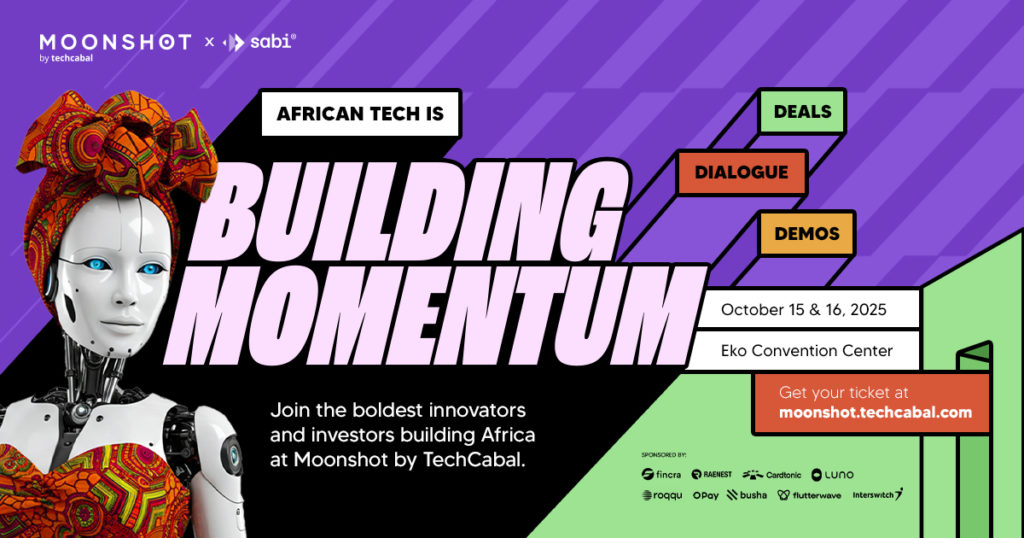

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days filled with inspiring keynotes, networking opportunities, and forward-thinking discussions. Secure your spot now at moonshot.techcabal.com

0 Comments