Over the past year, the Central Bank of Kenya (CBK) has persistently reduced interest rates and urged commercial banks to follow this downward trend. However, despite numerous inspections, warnings, and threats of penalties, borrowing costs for everyday Kenyans have remained largely unchanged.

Interest rate reductions failing to benefit borrowers

Since October 2024, under the leadership of Governor Kamau Thugge, the CBK has progressively lowered the central bank rate from 13% in August last year to the current 9.5%. The objective behind these cuts was to make credit more affordable, stimulate economic activity by encouraging businesses to take loans and invest, and ease financial pressure on households.

Despite the CBK’s 3.5 percentage point reduction in the policy rate, commercial banks have only marginally decreased their lending rates by about two percentage points-from an average of 17.2% down to 15.2%. This slight adjustment offers minimal relief to small enterprises and startups grappling with cash flow challenges.

The central bank governor’s mounting impatience

The sluggish pace at which banks have adjusted their rates has frustrated the CBK. Governor Thugge has openly voiced his dissatisfaction during media briefings and industry forums.

“We simply expect banks to act fairly and as swiftly in lowering lending rates as they did when rates were rising,” Thugge remarked in December 2024.

In February 2025, the CBK escalated its stance by threatening daily fines of KES 100,000 for banks that failed to comply. By May, institutions such as Access Bank and ABC Bank were publicly criticized for increasing their lending rates despite the downward trend.

“We will soon engage with the boards of these institutions through comprehensive audits. Based on findings, appropriate sanctions may be imposed,” Thugge informed reporters in May.

To eliminate ambiguity, the CBK introduced a new loan pricing framework in August, linking rates to the Kenya Shilling Overnight Interbank Average (Kesonia) plus a risk premium “K.”

This transparent model sets the lending rate within a 0.75 percentage point band around the Central Bank Rate (CBR), allowing banks to add a clearly disclosed premium that accounts for borrower risk, operational costs, and shareholder returns.

On September 18, Governor Thugge emphasized, “Banks will no longer have any justification for not lowering their rates. Once we reduce the policy rate, banks must follow suit immediately.”

It remains uncertain whether the CBK has enforced fines on defiant banks since June. Thugge has urged swift compliance but has not detailed the specific repercussions for banks or their boards if they fail to adjust rates accordingly.

“If I were in your position, I would act promptly to adopt this framework because Kenyan borrowers will gravitate towards banks offering transparent and fair pricing,” Thugge stated on September 18.

Banks highlight complexities behind rate adjustments

Representing commercial banks, the Kenya Bankers Association (KBA) contends that the situation is more complicated. In September, KBA CEO Raymond Molenje told Business Daily that previous loan pricing mechanisms were flawed and many banks never fully implemented them.

“Due to intense competition, most banks avoided seeking external help. Feedback indicated that interest rates were predominantly rising, which led some banks to abandon their pricing frameworks altogether,” Molenje explained.

In essence, the outdated pricing system was disorganized, prompting banks to disregard it. Meanwhile, the regulator has oscillated between appeals, warnings, and threats, while lenders seem confident that severe penalties will not be enforced.

Banks also argue that the economy remains fragile, with many businesses under strain and households financially stretched. Hastily cutting rates could increase the volume of non-performing loans, worsening the financial sector’s stability.

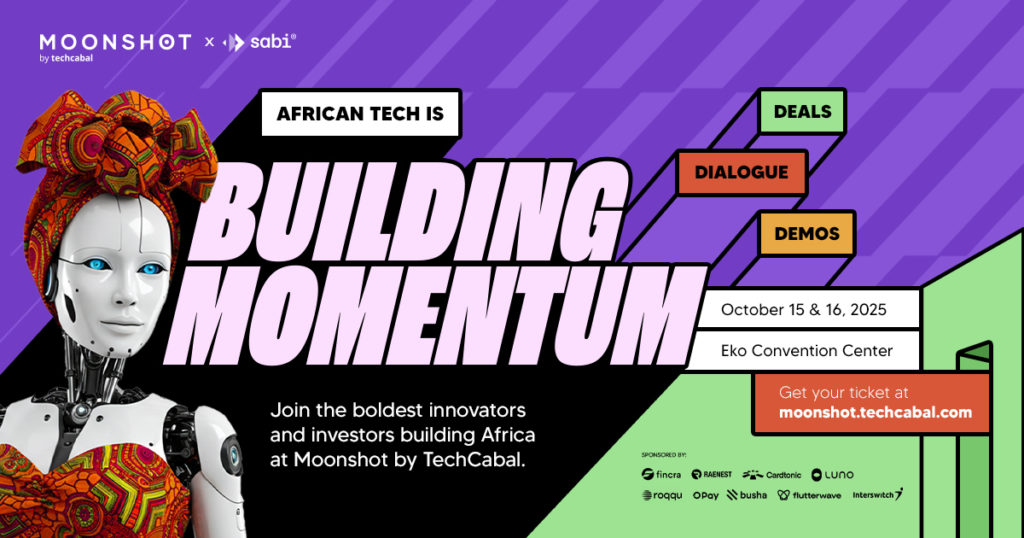

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days of inspiring talks, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com.

0 Comments