Good morning.

Congratulations to Electronic Arts (EA) on their monumental $55 billion acquisition!  This is undoubtedly a huge milestone. However, gamers everywhere (including us) have one humble plea: please preserve the integrity of FIFA’s Ultimate Team experience. Some traditions are worth protecting.

This is undoubtedly a huge milestone. However, gamers everywhere (including us) have one humble plea: please preserve the integrity of FIFA’s Ultimate Team experience. Some traditions are worth protecting.

Now, let’s dive into today’s highlights.

- Nigeria introduces taxation on remote workers

- Mobile money fees in Kenya set for reduction

- Telkom Kenya faces steep subscriber losses

- Egypt achieves new remittance milestone

- Innovative Tech Developments

- Global Web3 Updates

- Upcoming Events

Nigeria plans to tax earnings of remote workers

Remote workers based in Nigeria will face new tax regulations starting January 2026. Individuals employed by foreign companies-ranging from software engineers to marketing professionals-must now register with the Nigerian tax authorities and submit local tax filings.

What if they don’t comply? The consequences are severe: fines up to ₦1 million ($672), imprisonment for up to three years, or both. The Nigeria Revenue Service (NRS) intends to monitor real-time payment data to enforce these rules.

Why is this significant? Historically, many Nigerian remote workers have operated outside the formal tax system. For example, a freelancer earning $2,000 monthly currently pays roughly 23% in taxes, which could substantially reduce their take-home pay.

Context: Nigeria joins countries like Kenya, South Africa, and Ghana in tightening tax compliance for remote workers earning foreign income. This initiative aligns with Nigeria’s goal to raise its tax-to-GDP ratio to 18% by 2027, targeting foreign currency earners as a key revenue source. The critical question remains whether these measures will ultimately benefit Nigerian workers.

Seamless Global eCommerce Payments

Whether your customers shop from Lagos or Nairobi, they prefer paying in their local currency using cards, bank transfers, or mobile money. Enable smooth payment experiences for your international online store with Fincra today.

Mobile Money

Kenya aims to reduce mobile money transaction fees

The Central Bank of Kenya (CBK) has identified mobile money transfer fees as a barrier to financial inclusion and innovation. Currently averaging $0.18 per transaction in 2024, the CBK’s 2025-2028 National Financial Inclusion Strategy targets a reduction to $0.078 by 2028.

What’s driving this move? Despite mobile money’s widespread adoption in Kenya-processing $67.3 billion in 2024-growth has plateaued. High fees discourage users from exploring services beyond basic transfers and exclude low-income populations from digital finance. The regulator believes lowering fees will stimulate innovation and broaden access.

Historical context: In 2020, major operators like Safaricom’s M-PESA temporarily waived fees on transfers below $7.73 (KES 1,000) to boost digital payments, but fees were reinstated two years later.

Implications: Mobile money is a major revenue source for telecom companies; for instance, M-PESA generated $1.2 billion for Safaricom in 2024. Reducing fees may impact profits but will provide users with more affordable access to digital financial services.

Broader view: While cheaper transfers could enhance financial inclusion, it remains to be seen if this will attract more low-income users or primarily affect telecom operators’ earnings.

Paga Launches in the United States

Exciting update! Paga Group has expanded its digital banking services to the US, catering to Africa’s diaspora. Qualified users can now send money, make payments, and bank in both US Dollars and Naira with secure, regulated, and borderless solutions. Discover more.

Telecommunications

Telkom Kenya drops to fourth place after losing 40% of its subscribers

In the past year, Telkom Kenya has seen a dramatic 40% drop in its subscriber base, pushing it down to fourth place behind competitors like Safaricom and Airtel. Equity Bank’s mobile operator, Equitel, which operates on Airtel’s network, now holds third place with 1.5 million users, while Safaricom and Airtel continue to dominate the top two spots.

What triggered this decline? The downturn began in 2023 when American Tower Corporation (ATC) shut down nearly 900 of Telkom’s cell towers due to $55 million in unpaid lease fees. This led to network disruptions, prompting customers to switch to providers with more reliable coverage.

Why is this important? A shrinking customer base reduces revenue, limiting Telkom’s ability to invest in network improvements or repay debts. Falling to fourth place diminishes its chances of attracting investors or funding for 4G and 5G upgrades, leaving the company’s infrastructure vulnerable and its future uncertain.

Broader perspective: Telkom still controls valuable assets like 4,000 km of fiber and data centers, but recovery seems challenging. Its situation resembles Nigeria’s T2 (formerly 9mobile), which defaulted on $1.2 billion in loans in 2017 and has yet to regain its market position. Both cases highlight how financial troubles can rapidly erode subscriber loyalty. The key question is how Telkom will strategize its comeback.

Integrate Paystack with Leading Business Tools

The Paystack Integrations Directory connects your business to over 60 powerful applications, streamlining operations and boosting efficiency. Find out more here →

Fintech

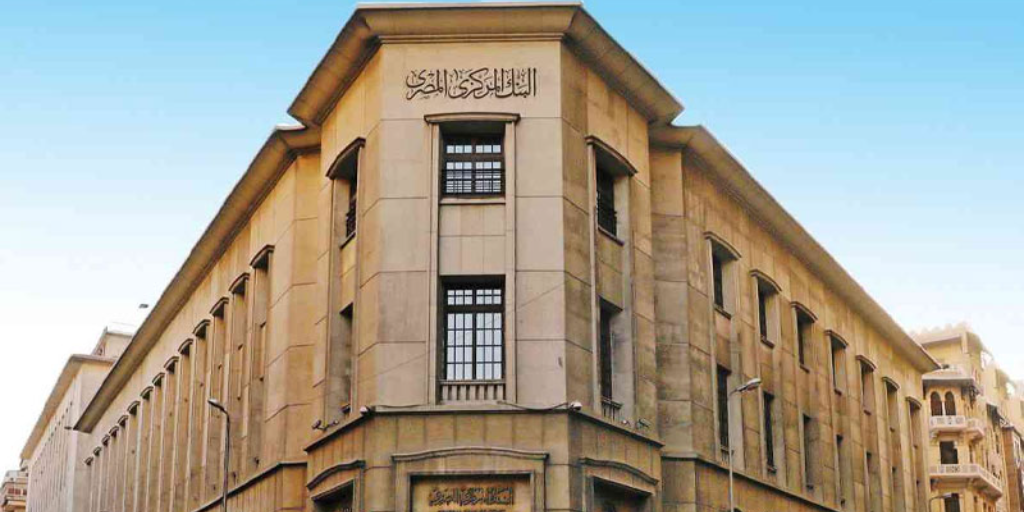

Egypt sets new record for remittance inflows

Egypt has achieved a historic high in remittance inflows, with funds from its diaspora more than doubling over the past decade. In the 2024/2025 fiscal year, remittances reached $36.5 billion, up from $17.1 billion in 2015/2016. July alone recorded $3.8 billion, the highest monthly total ever.

What factors contributed to this surge? The Central Bank of Egypt’s cautious monetary policies, including balanced interest rates and stable foreign exchange management, have bolstered confidence among Egyptians abroad, assuring them their money retains value upon transfer.

Additionally, the expansion of digital remittance platforms and fintech innovations has simplified cross-border payments, channeling more funds through formal systems.

What does this imply? Egypt’s booming remittance market is attracting fintech startups like LemFi, eager to capture a share of these flows. The growing market promises increased competition and innovation, benefiting consumers and challenging local players to adapt.

Vban: The Freelancer’s All-in-One App

Designed specifically for African freelancers and digital nomads, Vban offers multi-currency accounts, competitive foreign exchange rates, virtual cards, and instant currency swaps-all within a single app. No payment caps, no hidden FX fees. Experience Vban today-download now!

INNOVATIVE TECH!

While many were scrolling through social media last weekend, a creative mind developed a smart cane equipped with sensors and AI to detect obstacles and alert visually impaired users before collisions. This practical assistive technology has the potential to enhance the lives of over 26 million Africans living with vision impairments.

In an era dominated by flashy AI software, it’s inspiring to witness technology applied to create tangible, life-improving devices.

Kudos to Ugo for this meaningful innovation.

CRYPTO UPDATE

Global Web3 Market Overview

Source:

| Coin Name | Current Value | Day | Month |

|---|---|---|---|

| $114,577 |

+2.05% |

+4.93% |

|

| $4,192 |

+1.72% |

−6.92% |

|

| $2.88 |

+0.76% |

+1.25% |

|

| $210.58 |

+0.17% |

+3.03% |

* Data accurate as of 6:00 AM WAT, September 30, 2025.

Flash Sale: 25% Off Moonshot Tickets

Flash Sale: 25% Off Moonshot Tickets

For a limited period, secure your spot at Africa’s premier tech event with a special 25% discount. On October 15 and 16, the Eko Convention Centre in Lagos will host entrepreneurs, investors, policymakers, creatives, and innovators shaping Africa’s tech future. Moonshot 2025 features deal rooms, investor lounges, immersive exhibits, and the TC Startup Battlefield. This event is crafted for meaningful connections and lasting impact. Don’t miss out-offer ends soon.

Grab your Moonshot ticket now with 25% off. Buy tickets.

Grab your Moonshot ticket now with 25% off. Buy tickets.

Events

- Entertainment Week Africa (EWA), formerly Entertainment Week Lagos, returns November 18-23, 2025. As a pan-African platform for the $58.4 billion creative economy, EWA has attracted over 53,000 attendees across film, music, fashion, and tech. This year introduces a dedicated film and music content market for artists, labels, directors, and publishers to pitch, license, and sell directly to buyers and investors, supported by practical clinics. Additional highlights include a 50-company job fair, an expanded deal room accelerator with ₦25 million seed funding, and more film premieres under the theme “Close the Gap.” Learn more here.

- The 10th FATE Business Conference will be held on September 26 in Lagos, themed “AI-Powered Business: Innovate. Automate. Accelerate.” Keynotes from Kofo Akinkugbe (SecureID) and Adedeji Olowe (Lendsqr) will be featured, alongside panels with policymakers and business leaders such as Olatunbosun Alake (Lagos State Government), Prof. Peter Adewale Obadare (Digital Encode), and Bode Abifarin (Strata). Expect actionable insights on AI’s impact across industries. Register here.

- Following the success of its inaugural event in 2024, Growth Padi announces Growth Africa Summit 2025 (GAS 2.0) with the theme “Redefining the Growth Playbook.” This summit challenges outdated business strategies and introduces resilient, innovative growth models tailored for African enterprises. Register by November 1.

- TECA Heat Action Wave (THAW) launches in Nigeria to support startups addressing extreme heat challenges. Supported by BFA Global, FSD Africa, ClimateWorks Foundation, and FCDO Nigeria, the program offers up to $50K in non-dilutive funding, venture-building assistance, and global networking. Open to startups with prototypes or pilots in early warning systems, climate fintech, insurance, health, agriculture, logistics, and worker safety. Apply by September 30.

Written by: Opeyemi Kareem and Ifeoluwa Aigbiniode

Edited by: Ganiu Oloruntade

Craving more from TechCabal?

Subscribe to our newsletters for in-depth coverage of Africa’s tech business and economy.

- The Next Wave: forward-looking analysis of Africa’s tech business landscape.

- TC Scoops: breaking news from TechCabal.

- TNW: Francophone Africa: exclusive insights into Francophone Africa’s tech ecosystem.

P.S. If you often miss TC Daily in your inbox, check your Promotions folder and move any TC Daily emails to your Primary or Main inbox to ensure you never miss an edition.

0 Comments