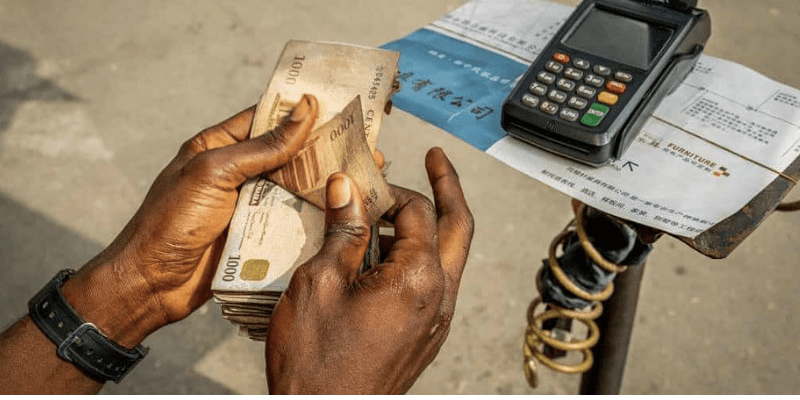

The Central Bank of Nigeria (CBN) has rolled out fresh regulations targeting agency banking providers and Point of Sale (POS) operators. This move is designed to bring order to the swiftly growing agency banking sector, which has seen a proliferation of operators nationwide over the last five years.

Agency banking, facilitated largely by POS operators, has become an essential channel for Nigerians to access cash and conduct payments, especially in regions where traditional bank branches are scarce. However, this rapid expansion has introduced challenges such as fraudulent activities, cloned POS devices, and opaque transaction locations.

According to the CBN, these newly introduced rules are intended to reduce risks, improve the traceability of transactions, and safeguard consumers. With billions of naira transacted daily through agency banking, the regulator is intensifying oversight to match the sector’s scale and complexity.

For fintech firms and operators, these changes demand substantial adjustments in device usage and location management. Below, we break down the five key provisions of the new directive and their implications.

The 10-Meter Restriction: Halting Mobile POS Operations

A cornerstone of the new policy is the geographic constraint placed on POS terminals. Each device must now operate strictly within a 10-meter radius of its registered business address. This means agents are prohibited from moving their POS devices to different locations such as markets, bus stops, or other shops unless these spots fall within the 10-meter boundary of their registered site.

For instance, if a POS is registered at Store X, it cannot be used at Store Y located a few blocks away. Violating this rule could trigger transaction alerts or lead to the terminal being disabled.

This measure is designed to curb the misuse of “roaming terminals,” which criminals often exploit by using stolen or cloned devices in unfamiliar areas. By anchoring each POS to a fixed location, the CBN can more effectively monitor suspicious movements and prevent fraudulent activities. For customers, this reduces the risk of handing their cards to unverified agents.

However, this restriction may negatively impact agents and operators whose business models rely on mobility, potentially reducing their earning potential as they lose the freedom to operate across multiple locations.

Geo-Tagging for Instant Transaction Location Verification

The guidelines also mandate that all POS devices be geo-tagged, requiring the capture and registration of their GPS coordinates. This enables real-time tracking of every transaction’s exact location, making it much harder for “ghost terminals” – devices processing payments from unauthorized or hidden locations – to function undetected.

If a cloned POS device is used outside its registered GPS coordinates, the system can immediately flag the transaction and potentially deactivate the terminal. Geo-tagging empowers regulators to monitor transactions closely and identify suspicious activities, thereby enhancing fraud prevention and protecting both operators and customers.

New devices must be geo-tagged before activation, while existing devices have a 60-day window from the announcement date to comply. The CBN recommends using “native geolocation services” combined with dual-frequency GPS receivers to ensure precise location tracking.

Adoption of ISO 20022 Messaging Standard

The third significant update involves upgrading to the ISO 20022 messaging standard, a globally recognized format for financial communications. All banks, processors, and POS systems are required to implement this standard by October 31, 2025.

ISO 20022 allows transactions to carry richer, more structured data, including detailed payer and payee information, merchant identifiers, and other metadata often missing in older systems.

This enhancement improves transaction traceability, reduces reconciliation errors, speeds up dispute resolution, and strengthens fraud detection capabilities. It also aligns Nigeria’s payment ecosystem with international standards, which is increasingly important given the rise in cross-border payments and fintech partnerships.

POS operators will need to coordinate closely with their Payment Terminal Service Providers (PTSPs) to upgrade software and avoid service interruptions as the deadline approaches.

Mandatory Routing via Licensed Aggregators and Device Certification

The CBN is also enforcing stricter controls on transaction routing. All POS terminals must now route transactions through licensed Payment Terminal Service Aggregators (PTSAs), such as NIBSS or Unified Payment Services.

Furthermore, devices and their software must be certified by the National Central Switch (NCS) and equipped with a geolocation tracking software development kit (SDK) before they can process payments.

This ensures that all transactions flow through a secure, regulated network. Certification confirms that terminals meet required security and technical standards. Operators using outdated or uncertified devices will need to upgrade to comply with these new rules.

Enforcement Inspections Starting October 20, 2025

Beginning October 20, 2025, the CBN will conduct physical inspections to verify adherence to the new regulations.

Inspectors will check that POS terminals are properly geo-tagged, operating within the mandated 10-meter radius, and running updated software compliant with ISO 20022. Devices running outdated operating systems, such as Android versions below 10, risk failing inspections and being disconnected.

This enforcement phase is critical to ensuring the new framework is effectively implemented. Non-compliant devices will be deactivated, causing immediate revenue loss for agents who rely on daily transaction volumes.

Overall Impact and Future Outlook

These reforms mark the most comprehensive update to Nigeria’s agency banking regulations in recent years. They introduce greater discipline in POS terminal deployment, transaction monitoring, and data management.

Related read: CAC registers 100,000 PoS operators out of 250,000 projection

For POS operators, meeting these requirements will involve investing in new hardware, updating software, and exercising tighter control over terminal locations. While this transition may pose challenges for smaller operators, the ultimate objective is to foster a safer, more transparent payment ecosystem.

When fully implemented, these measures are expected to curb fraud, boost consumer trust, and strengthen agency banking’s role as a vital tool for financial inclusion across Nigeria.

0 Comments