Established in 2016, Lisk is a Swiss-based blockchain platform that has recently introduced a $15 million investment fund aimed at supporting Web3 entrepreneurs across Africa, Latin America, and Southeast Asia. Gideon Greaves, Head of Investments, shared with Techcabal in September that the fund prioritizes startups addressing tangible challenges with practical applications rather than speculative ventures.

This initiative seeks to bridge a significant gap by tapping into a $5.2 trillion investment opportunity that many traditional venture capitalists overlook, particularly those startups that are organically growing and mission-driven within emerging economies.

“While global venture capital firms often focus on speculative investments, the reality in rapidly developing markets is quite different. Here, founders are creating solutions with genuine utility, and these are the ventures poised to become the next industry leaders,” Greaves explained.

Lisk plans to initiate investments with initial checks of $250,000, with a maximum commitment of $750,000 per company. The firm deliberately avoids the inflated valuations common in more mature markets.

The following is an edited transcript of the full interview for clarity.

Had Lisk previously invested in African startups through equity, grants, or competitions before launching this fund? If not, what prompted the timing?

Prior to this fund, Lisk had not made direct equity investments or launched a formal fund. Instead, the company focused on issuing grants and running incubation programs globally throughout 2024. These initiatives have been instrumental in sourcing promising startups, gaining insights into local ecosystems, and establishing a foothold in diverse regions.

Each emerging market presents unique characteristics. For example, Kenya, Vietnam, and Argentina differ significantly beyond their status as developing economies. To effectively engage, Lisk collaborates with local partners such as CV Labs and AyaHQ in Africa, alongside similar organizations in other regions.

Currently, Lisk supports seven incubation programs worldwide, including two in Africa. These programs, lasting between three to six months, cover operational expenses and assist startups in refining their business strategies, preparing for fundraising, and scaling. Graduates from these programs may also qualify for grants.

This fund marks Lisk’s first direct capital deployment, where they will take ownership stakes in startups.

Lisk’s strategic shift reflects an adaptation to evolving market dynamics. Originally launched as a layer-one blockchain alongside Ethereum in 2016, with community funding amounting to 14,000 bitcoins, Lisk aimed to attract startups to build on its platform.

Over time, recognizing that most skilled developers gravitated towards Ethereum, Lisk transitioned from a layer-one to an Ethereum-compatible layer-two blockchain. Concurrently, the company pivoted its focus towards emerging markets, initially concentrating on Africa and now expanding to other regions. The blockchain landscape has become highly competitive; whereas in 2017 many platforms boasted about speed and cost, today these features are standard. Therefore, Lisk is positioning itself as a comprehensive growth ecosystem rather than merely an infrastructure provider.

The fund is designed to invest across multiple blockchain platforms, not limited to the Lisk ecosystem. Startups built on Solana or other chains are also eligible. This approach aims to attract broader attention to the ecosystem and provide startups access to a wide array of tools, products, and infrastructure.

The decision to launch the fund this year was driven by these strategic realignments and the readiness to actively invest.

Could you share details about the fund’s size, typical investment amounts, and the primary African markets of focus?

The fund totals $15 million, with initial investments starting at $250,000. Approximately 30% of the capital is reserved for follow-on investments, allowing for second checks up to $500,000. The maximum exposure per startup is capped at $750,000.

While the fund is open to startups across Africa-from Egypt to South Africa and even Burkina Faso-the primary focus is on countries with established tech ecosystems and large populations, such as South Africa, Kenya, and Nigeria. Ghana is also emerging as a market of interest.

In Latin America, the fund currently targets Argentina, with Brazil under observation. In Southeast Asia, Vietnam and Indonesia are the main focus areas.

You mentioned the fund is tokenised. What does this entail practically, and is this model intended solely for internal use or broader adoption?

Tokenisation in this context means digitizing the entire investment process without altering the fundamental nature of the capital or how it is deployed.

Currently, investing in venture funds involves cumbersome manual procedures, including signing extensive documentation and undergoing Know Your Customer (KYC) checks via email exchanges. Tokenisation streamlines this by enabling investors to complete onboarding digitally-uploading KYC documents, transferring funds via crypto wallets, credit cards, or bank transfers-and receiving tokens that represent their ownership shares in the fund.

These tokens are not speculative assets but rather digital certificates of equity within the fund.

A key advantage of tokenisation is enhanced liquidity. Venture capital is traditionally illiquid, often locking investors’ capital for a decade. This illiquidity demands higher returns compared to more liquid investments like mutual funds or hedge funds, where investors can redeem their shares relatively quickly.

With the advent of tokenization, investors now have the flexibility to list their holdings. For instance, after a two-year period, if the fund’s value has doubled due to successful investments in startups that secured further funding at increased valuations, an investor seeking liquidity can easily list their tokenized shares on our platform or marketplace. This streamlined process allows potential buyers to view shares priced, say, at $1 each, and purchase them directly.

This trend is gaining momentum globally, as companies increasingly tokenize tangible assets, often referred to as real-world assets (RWAs). These assets can range from financial instruments to physical properties. A notable leader in this space is Securitize, which has tokenized substantial funds including those managed by Kohlberg Kravis Roberts (KKR), BlackRock, and Hamilton Lane.

While tokenization has made inroads in the industry, tokenized venture capital funds remain scarce, especially in emerging markets. Based on our extensive research, we appear to be pioneers in launching a tokenized VC fund focused on these regions.

What equity stakes do you typically seek for investments up to $250,000, and how do you plan to secure follow-on funding for larger financing rounds?

Our target equity range generally falls below 10%, typically between 3% and 9%. Regarding follow-on investments, this initial fund is just the starting point. Currently, we manage a $15 million fund, which we intend to deploy over the next three years by investing in approximately 40 startups. Although the fund’s lifespan is ten years, we anticipate raising a larger fund exceeding $50 million to support subsequent growth stages.

What insights from your experience with incubators and accelerators influenced your decision to invest directly in startups?

Each cohort we engage with culminates in a demo day where around 20 founders present their solutions. The relevance of these startups to pressing challenges in Africa is striking. However, a recurring theme is the difficulty many founders face in accessing initial capital. Securing that first investment is crucial for validating product-market fit and achieving steady growth.

Venture capital is fundamentally about fueling companies that demonstrate momentum and scaling potential, rather than rescuing stagnant ventures. Our accelerator programs play a vital role by equipping founders with the expertise and strategic guidance needed to elevate their startups to an investable stage, effectively serving as a pipeline for our fund.

How do you assess the credibility and resilience of founders in regions where Web3 expertise is limited?

We begin by evaluating the founders’ backgrounds, favoring those with prior entrepreneurial experience or relevant industry knowledge. While exceptions exist-such as a young visionary creating a breakthrough company-our preference is for founders who have demonstrated capability in building or managing businesses.

Emotional investment in their product is another key factor. Founders who view their venture as a personal mission tend to exhibit the perseverance and adaptability necessary to navigate challenges. Our ideal entrepreneur is not only capable of launching a successful startup but also scaling it into a $100 million enterprise, which involves securing multiple funding rounds and managing complex leadership dynamics.

We also consider strategic partnerships that enhance market access. For example, a fintech startup collaborating with major players like Safaricom or Equity Bank gains credibility and distribution advantages. Additionally, having a strong advisory board composed of seasoned professionals provides valuable mentorship and further validates the team’s potential.

Which sectors within African Web3 startups-such as payments, decentralized finance (DeFi), NFTs, gaming, supply chain management, carbon trading, or DAOs-are you most eager to support currently, and what drives that interest?

Given Africa’s significant underbanked population, fintech applications leveraging Web3 technology naturally capture our attention. Payment solutions, in particular, hold immense promise. Africa’s digital landscape is unique; many individuals first accessed the internet via mobile devices rather than traditional computers. This mobile-first environment suggests that Web3 wallets could become more widespread than conventional bank accounts, representing a natural evolution from mobile money platforms to stablecoin adoption. Consequently, fintech remains a core area of focus, even if it’s a well-trodden path.

In addition to fintech, we are intrigued by use cases that enhance transparency and verification processes. This includes sectors like regulatory technology (RegTech), property rights management, supply chain traceability, and government procurement systems. These applications have the potential to significantly improve accountability and trust across various industries.

Aside from funding, how does Lisk support founders in overcoming challenges such as regulatory complexities, infrastructure limitations, and scaling across borders?

Lisk distinguishes itself not only through its focus on Web3 startups in emerging markets but also through its strategic approach to capital deployment. As startups grow, they require substantial Series A and B investments, which often originate from investors outside Africa. To bridge this gap, Lisk is assembling an internal advisory team dedicated to helping founders craft compelling narratives that resonate with institutional venture capitalists in developed markets. This team also facilitates connections to larger funding sources, enabling startups to access the capital needed for expansion.

Importantly, Lisk refrains from taking board seats during early-stage investments to avoid burdening founders with excessive bureaucracy. Instead, governance and strategic oversight are reserved for later-stage investors who specialize in Series A and B rounds, allowing founders to maintain agility during critical growth phases.

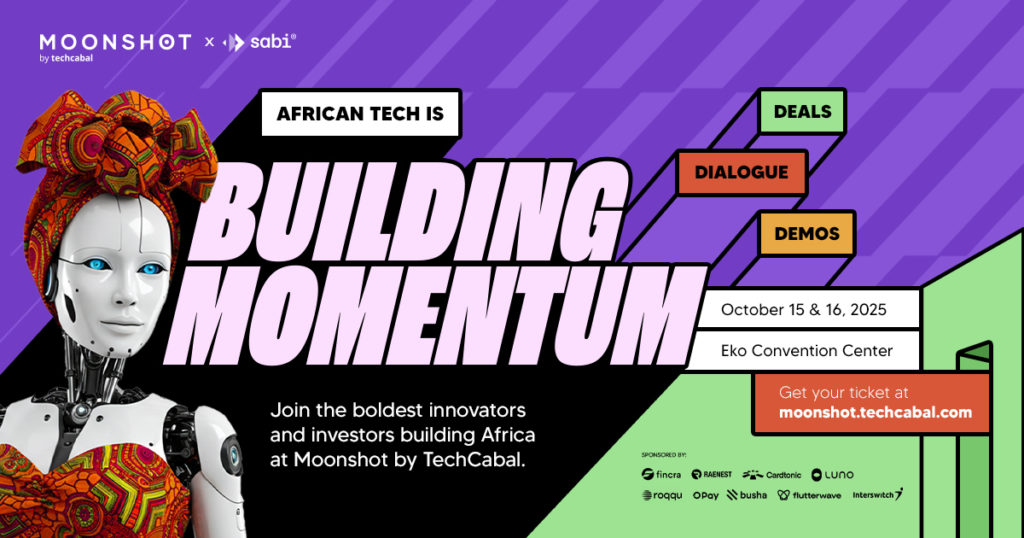

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days filled with inspiring keynotes, networking opportunities, and forward-thinking discussions. Secure your spot now at moonshot.techcabal.com

0 Comments