ntel, the telecommunications company under NatCom Development & Investment Limited (NATCOM), has recently secured undisclosed new funding aimed at resuming its operations by early 2026. This financial boost, arranged through the Asset Management Corporation of Nigeria (AMCON), is a critical step in the company’s efforts to overcome previous financial setbacks and reestablish its presence in Nigeria’s fiercely competitive telecom sector.

This capital injection arrives approximately one year after AMCON took full control of ntel following the company’s bankruptcy in 2024. An insider revealed that the fresh funds will enable ntel to reconstruct its network infrastructure, reinstate both voice and data services, and implement a streamlined business model designed for sustainability.

Requests for comments from AMCON regarding this development were not answered.

The infusion of capital and the planned relaunch are integral components of a larger plan to ready ntel for a future without AMCON’s involvement. Currently, AMCON holds a majority stake of 55% in ntel and intends to divest its shares to new investors once the company achieves operational stability.

AMCON’s stake in ntel dates back to its 2015 intervention when it stepped in to salvage the telecom operator, which was then struggling under NATCOM-a consortium that had acquired the defunct NITEL and MTel. Acting as both creditor and equity holder, AMCON intervened after the original private investors failed to inject additional capital necessary to preserve critical national telecom assets such as spectrum licenses, fibre-optic infrastructure, and submarine cable landing rights.

Although AMCON’s involvement has prevented ntel’s complete collapse, its extended control has deterred private investors concerned about government dominance and unresolved legacy liabilities. Despite President Bola Tinubu’s directive to sell the telecom company-even if only for scrap value-AMCON maintains that stabilizing ntel must be the priority before any sale.

Revival through a dual operational approach

ntel’s comeback strategy involves adopting a hybrid operational model, functioning both as a mobile virtual network operator (MVNO) and as a service provider utilizing its own infrastructure, according to insiders. The company currently manages over 3,500 kilometres of fibre-optic cables across Nigeria and operates more than 600 base stations-assets largely inherited from its former national backbone and metropolitan systems.

In anticipation of its market re-entry, ntel has quietly initiated recruitment efforts, targeting new hires in administrative, technical, and financial roles. Positions such as Regional Administrative Coordinator, Front Desk Officer, and Assistant Manager of Financial Planning have been advertised, signaling the gradual revival of the once dormant operator.

Meanwhile, AMCON continues to generate revenue by leasing parts of ntel’s infrastructure. For instance, a spectrum lease deal with MTN Nigeria permits MTN to utilize ntel’s frequencies in several states, providing a temporary income stream as ntel prepares for a full commercial relaunch.

If the recovery proceeds as planned, ntel could become Nigeria’s first telecom operator rescued by the state to successfully re-enter the market.

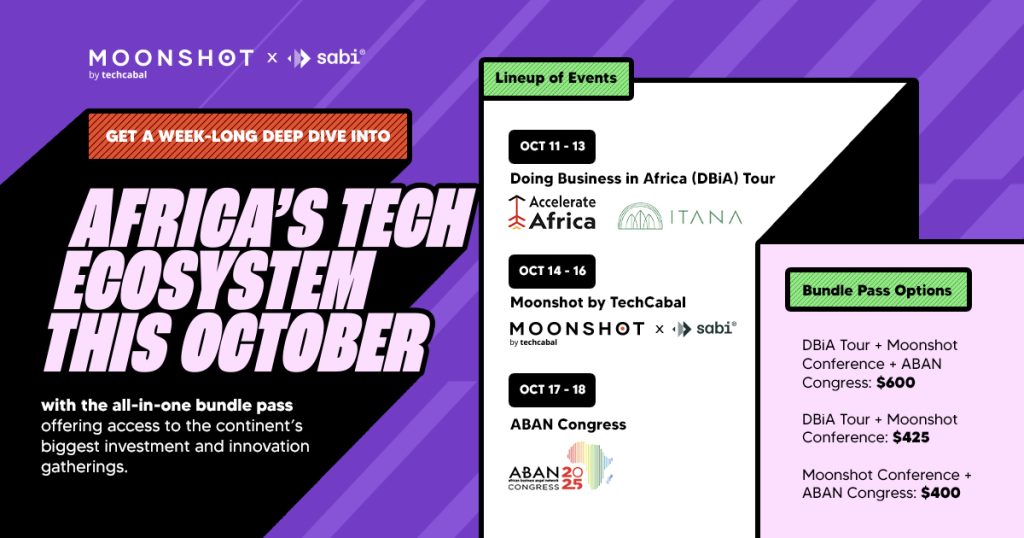

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16! Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Secure your tickets now at moonshot.techcabal.com

0 Comments