For the two million banking agents across Nigeria currently operating Moniepoint, OPay, or PalmPay POS terminals, a significant change is on the horizon. Starting April 1, 2026, Point of Sale (PoS) agents will be required to affiliate exclusively with a single principal-whether that be a bank, mobile money operator, microfinance bank, or payment service bank-under new regulations introduced by the Central Bank of Nigeria (CBN).

Unveiled on October 6, 2025, these updated guidelines represent the most extensive reform in agent banking since its inception in 2013. The CBN’s objective is to establish baseline regulatory standards that govern agent banking operations, boost financial inclusion by enhancing service delivery, promote ethical market behavior, and elevate the quality of services provided by agents.

Historically, PoS operators have served customers across multiple platforms, juggling relationships with various financial institutions. The new directive mandates that agents partner with only one principal or a licensed super agent, streamlining accountability and oversight.

To support transparency and compliance, banks, fintech firms, and other principals must publish current lists of their agents along with their locations on official websites. This measure is designed to reinforce the enforcement of daily withdrawal caps set at ₦1.2 million (approximately $816.18) and to ensure agents operate within designated geographic zones, as the CBN steps up supervision of the burgeoning agent banking ecosystem.

Principals are now tasked with clearly separating agent banking activities from merchant transactions and closely monitoring agents’ Bank Verification Numbers (BVNs) to detect any unauthorized operations beyond approved accounts and limits. Agents themselves are obligated to keep detailed transaction records and report any suspicious activities or incidents promptly to their principals. Importantly, the CBN reserves the right to request transaction records directly from agents at any time, bypassing principals if necessary.

The sector has a six-month window to align with these new rules, a transition that could significantly reshape Nigeria’s financial services landscape and impact millions of daily cash transactions in both urban centers and rural areas. All agent transactions must be processed through a dedicated agent account or wallet linked to their principal institution. Transactions conducted outside this framework will be considered violations, potentially resulting in penalties such as account termination, blacklisting, or legal action.

Nigeria’s agent banking network has experienced rapid growth over the last decade, largely propelled by fintech innovators like Moniepoint, OPay, and PalmPay. As of March 2025, the country boasted 8.36 million registered PoS terminals, with 5.90 million actively deployed. The volume of transactions surged to a record ₦10.51 trillion ($7.15 billion) in the first quarter of 2025, marking a staggering 301.67% increase compared to the same period in 2024, underscoring agents’ role as vital conduits for cash flow.

However, this expansion coincides with inflationary pressures, as the CBN continues efforts to stabilize the economy. Currency circulating outside formal banking channels reached ₦4.45 trillion ($3.03 billion) in August 2025, while inflation hovered at 20.12%, highlighting the delicate balance between financial inclusion and macroeconomic stability.

These reforms are part of the CBN’s broader strategy to fortify the financial system’s resilience. Currently, many operators are upgrading their systems and implementing geo-fencing technologies to comply with the new standards.

Note: Exchange rate applied is ₦1,470.26 to $1.

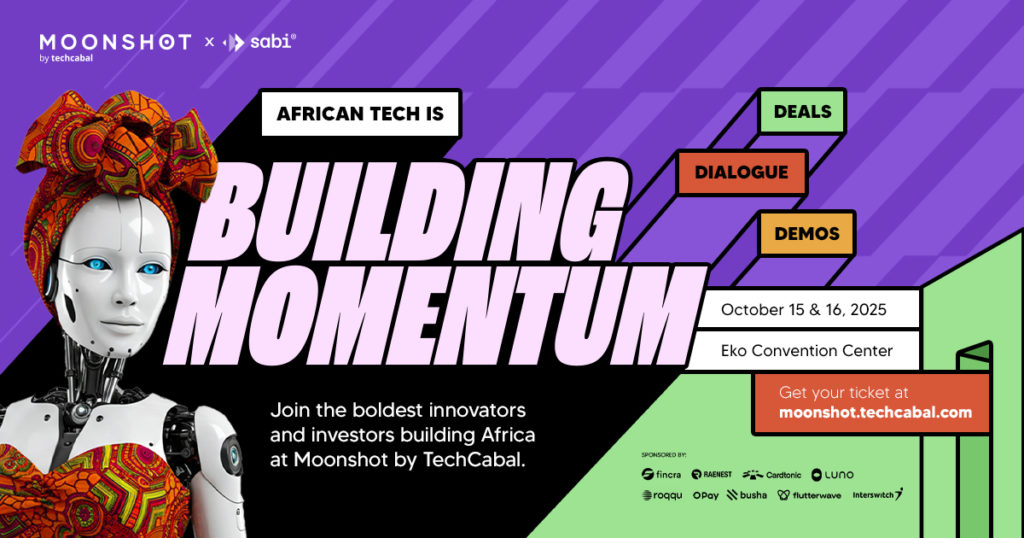

Don’t miss out! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days packed with inspiring keynotes, networking events, and forward-thinking discussions. Secure your spot now at moonshot.techcabal.com.

0 Comments