Accessing quick loans has become simpler thanks to digital lending platforms. Yet, beneath this ease lies a serious concern: predatory loan applications that prioritize harvesting your personal data over providing genuine financial assistance.

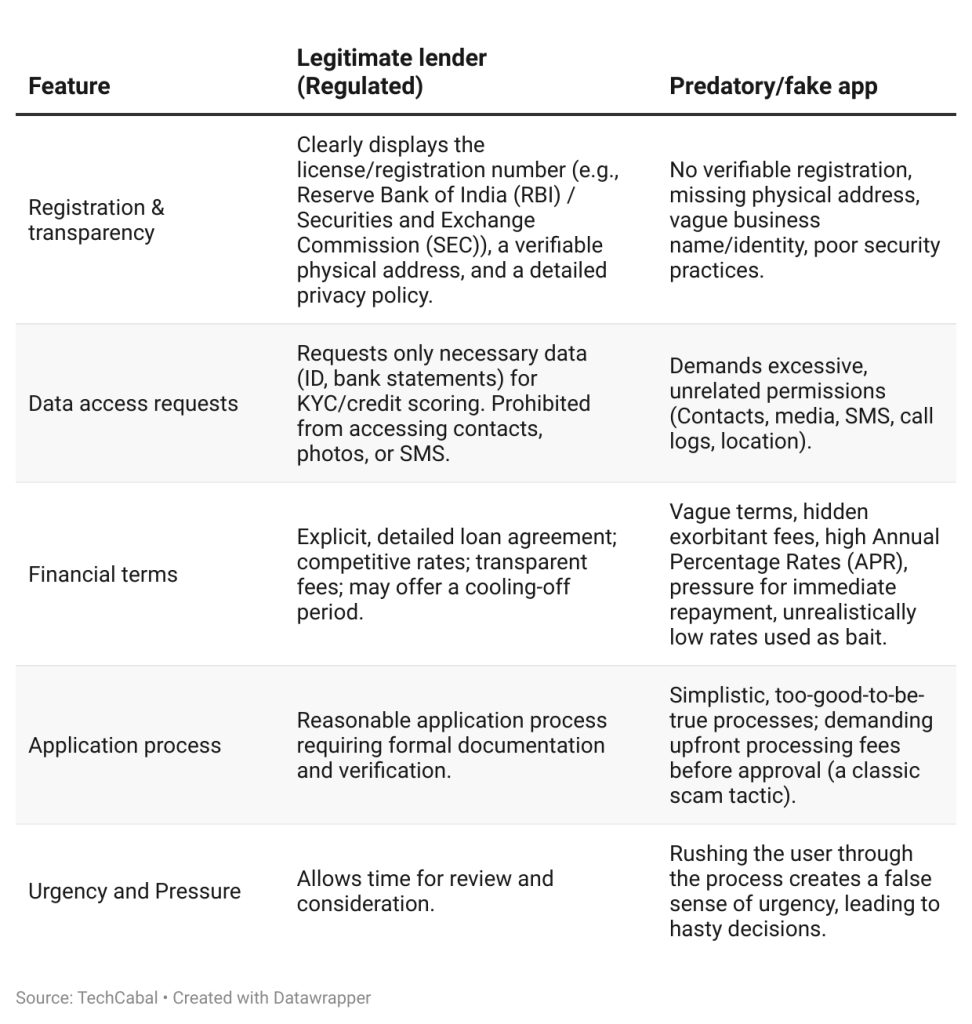

The critical issue is learning how to differentiate trustworthy lending services from deceptive apps designed to exploit your information.

Understanding the tactics of predatory loan apps

Many fraudulent loan apps lure users with promises of rapid, hassle-free loans. However, once installed, they often request intrusive permissions unrelated to loan processing. Authentic lenders usually ask for essential details like identification, income proof, and bank information to assess creditworthiness and comply with legal standards.

In contrast, predatory apps demand excessive access, including your contacts, text messages, photos, call logs, and calendar entries. Such requests are clear warning signs, as no legitimate lender requires this level of access to approve a loan.

From data collection to coercion

These malicious apps don’t gather your data for credit evaluation but to exploit it. Once granted access, they extract sensitive information from your device. If you miss payments, they leverage your contacts to intimidate, embarrass, and pressure you into repaying.

Victims have reported receiving threatening calls and messages, while some have had personal images manipulated and distributed among acquaintances. In extreme cases, debt collectors create group chats to publicly shame borrowers.

The borrowed funds serve merely as bait; the true objective is your private data. Rather than focusing on financial recovery, these operators rely on fear and humiliation to enforce repayment. Tragically, some victims have suffered severe emotional distress, leading to self-harm.

The importance of safeguarding your data

While traditional scams aim to steal money or identities, predatory loan apps inflict deeper damage by harming your reputation and relationships. Protecting yourself goes beyond scrutinizing loan agreements-it requires vigilant control over the data you share and restricting app permissions from the outset.

Identifying risky loan apps before installation

Preventing data theft starts with caution before downloading any loan application. Many fall victim by hastily installing apps without verifying their legitimacy. Conducting a simple background check can shield you from fraud, data breaches, and harassment.

1. Verify the lender’s authenticity

Start by confirming the lender’s registration with your country’s financial regulatory body. For instance, in Nigeria, lenders should be registered with the Central Bank of Nigeria, while in Kenya, the Central Bank oversees licensing. Official government portals provide this information.

Examine the lender’s website and contact details. Genuine companies display a physical address, valid phone numbers, and accessible customer support. Absence of verifiable contact information or suspicious details should raise concerns.

Additionally, review their privacy policy. Reputable lenders clearly outline what data they collect and how it’s protected. Fraudulent apps often use ambiguous language to trick users into sharing excessive information.

2. Be cautious of excessive permission requests

A major warning sign is when an app demands access to your contacts, photos, or location-permissions that legitimate loan apps typically do not require. Such requests often indicate intentions to misuse your data.

Also, beware of upfront fees labeled as “processing” or “insurance” charges before loan approval. This is a common scam tactic that results in immediate financial loss. Even if the loan is denied, your personal data may be exploited for identity theft.

3. Analyze user feedback and download from trusted sources

Before installing, scrutinize user reviews. Frequent complaints about hidden fees, harassment, or unclear terms are red flags. Avoid downloading apps from unofficial links or third-party stores, no matter how convincing they seem. Official app stores offer safer downloads and mechanisms to report suspicious activity.

Checklist for spotting predatory loan apps

Manage app permissions to safeguard your privacy

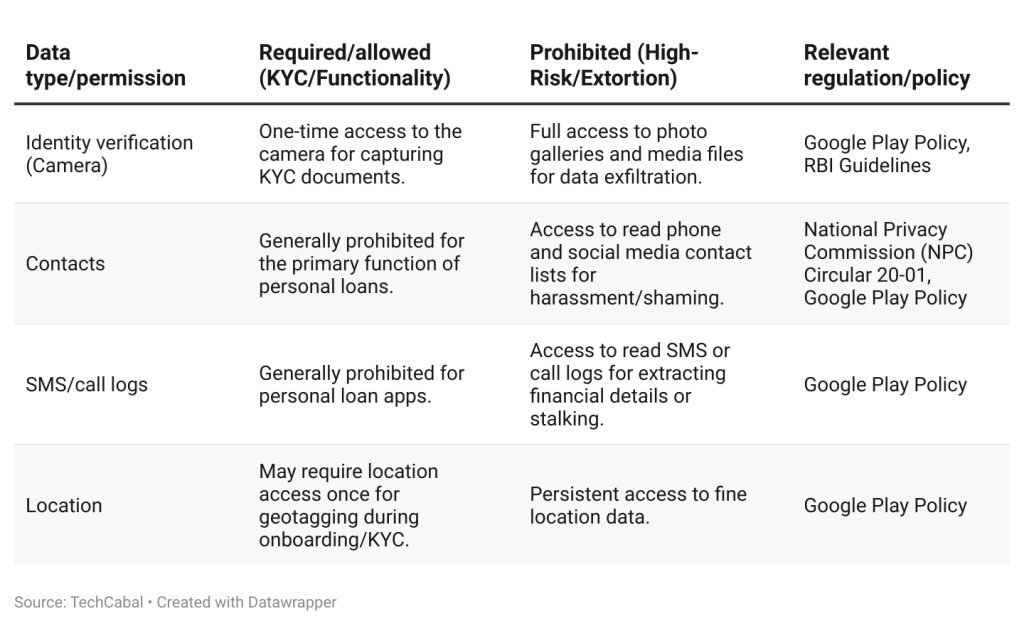

Even if a loan app appears trustworthy, the most effective way to protect your personal data is by controlling its access permissions. Predatory apps often exploit careless permission approvals to extract sensitive information. By carefully managing permissions, you can block unauthorized data access.

1. Regulatory frameworks support your privacy

Leading platforms like Google enforce strict rules for loan apps. For example, apps on the Play Store are prohibited from requesting access to contacts, photos, storage, location, or phone numbers-permissions commonly abused by scammers.

Regulators worldwide have introduced similar protections. In South Africa, the National Credit Regulator restricts lenders from accessing unnecessary personal data. These laws empower you to refuse unwarranted permission requests.

2. Regularly audit and adjust app permissions

Users often grant excessive permissions without realizing it and forget to review them later. Conducting monthly permission audits helps maintain control.

For Android devices:

- Navigate to Settings → Apps.

- Select the loan app, tap Permissions, and disable any unnecessary access.

- Use the Permission Manager under Privacy settings to review all apps’ access to sensitive data like contacts or photos, and revoke permissions that seem unwarranted.

For iOS devices:

- Open Settings → Privacy & Security.

- Choose a data category (e.g., Contacts or Photos) to see which apps have access, then toggle off suspicious permissions.

- Enable App Privacy Report to monitor how frequently apps use your data.

3. Make permission reviews a routine

Check your app permissions at least once a month to catch any changes. Some apps gain additional access through updates without explicit notification. Whenever possible, grant temporary permissions for one-time tasks instead of permanent access.

This proactive approach, supported by platform policies and privacy laws, offers robust defense against data misuse by loan apps.

Data permission overview: What loan apps can and cannot access

Enhanced privacy: Isolating loan apps to minimize data risks

If you frequently use loan apps but want to maximize privacy, isolating these apps offers an additional safeguard. The concept is straightforward: run the app in a separate environment that restricts access to your personal contacts, photos, and messages. This limits the damage if the app is malicious.

1. Utilize guest profiles or multiple user accounts on Android

Most Android devices support Guest Mode or Multiple Users, allowing you to create a temporary profile free of personal data.

To set this up:

- Go to Settings → System → Multiple users.

- Select “Add user” or “Guest” to create a new profile.

- Install the loan app within this profile, isolating it from your main data.

- After use, switch back to your primary profile and delete the guest session to erase residual data.

This method effectively quarantines the loan app.

2. Employ secure folders or app cloning features

Some Android models, like Samsung phones, offer Secure Folder or Private Mode, which encrypts a separate space on your device. Installing sensitive apps here prevents them from accessing your main data.

Alternatively, use Dual Apps or App Cloners to create isolated copies of apps. These duplicates operate independently, safeguarding your primary data from potential breaches.

3. Use a dedicated secondary phone number

Predatory lenders often harass borrowers via their main phone numbers. To avoid this, register loan apps with a secondary number, such as one from a VoIP service like Skype or a second SIM card. This separation protects your personal communications.

4. Maintain a separate device for financial activities

For ultimate security, consider using an old smartphone exclusively for financial transactions. Remove personal apps, contacts, and media, limiting this device to banking and loan-related apps. This containment prevents predatory apps from accessing your private information.

Your rights and steps to take if a loan app abuses your data

Protecting your privacy involves more than technical measures; consumer protection laws empower you to act against lenders who misuse your data or engage in harassment. Understanding your rights and how to enforce them is crucial.

Legal protections when using loan applications

Many jurisdictions mandate transparency from lenders regarding data collection. You must provide explicit, informed consent before any personal information is gathered. Lenders are only permitted to collect data essential for credit assessment or identity verification; any additional data collection is unlawful.

Some countries require that personal data be stored domestically. For example, South Africa’s Protection of Personal Information Act (POPIA) enforces strict data handling rules. Lenders are prohibited from collecting biometric data unless legally authorized and must provide clear privacy notices detailing data usage and protection.

You retain control over your data post-sharing:

- You can withdraw consent at any time.

- Request deletion of your data, subject to legal exceptions.

- Correct inaccuracies in your records.

- Utilize cooling-off periods where available, allowing loan cancellation without penalties by repaying principal and interest-offering a safeguard against exploitative practices.

Actions to take if you face harassment from a loan app

If a lender threatens or abuses your data, start by gathering evidence-save screenshots of messages, record call logs, and document privacy breaches. This documentation is vital for complaints to regulators or law enforcement.

File formal complaints with your country’s financial or data protection authorities, emphasizing privacy violations to strengthen your case. Report the app to Google Play or Apple App Store, which have removed numerous predatory apps following user reports.

For regulated lenders, contact their official grievance officer and keep detailed records of all communications. If identity theft occurs, follow national procedures to mitigate further damage.

Conclusion

The clearest warning sign is when a loan app requests access to your contacts, photos, messages, or location-deny such requests immediately.

Always verify the lender’s registration with financial authorities before downloading any loan app. Review privacy policies carefully to understand data usage. If you’ve already installed an app, use your device’s permission settings to restrict risky access.

Should problems arise, don’t hesitate to collect evidence, report violations, and assert your legal rights. By doing so, you protect your privacy and contribute to removing unscrupulous actors from the lending ecosystem.

0 Comments