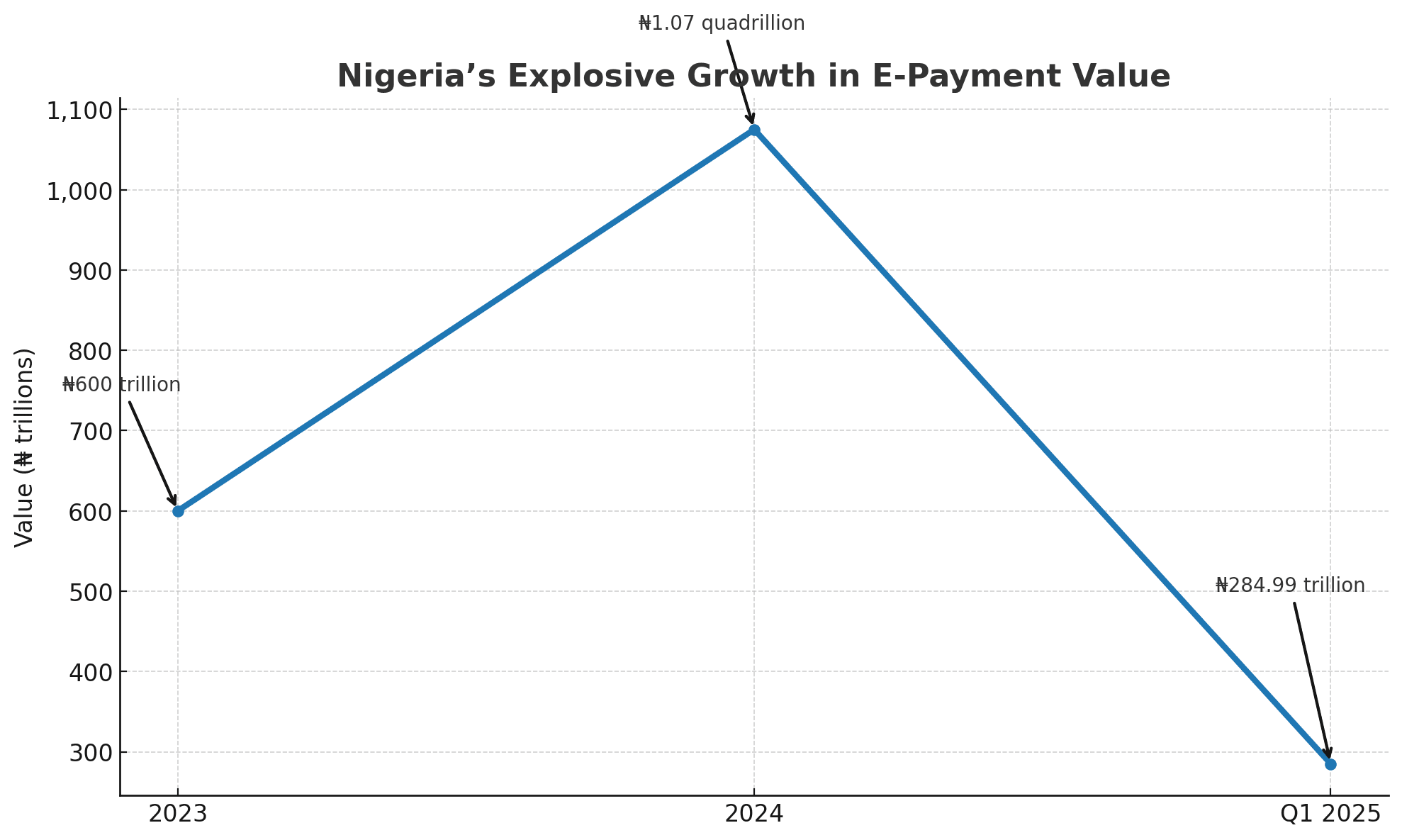

In 2024, Nigeria witnessed over ₦600 trillion flowing through its electronic payment systems, according to data from the Nigeria Inter-Bank Settlement System (NIBSS). This staggering volume is more than just a number-it signals a profound transformation reshaping the nation’s financial ecosystem.

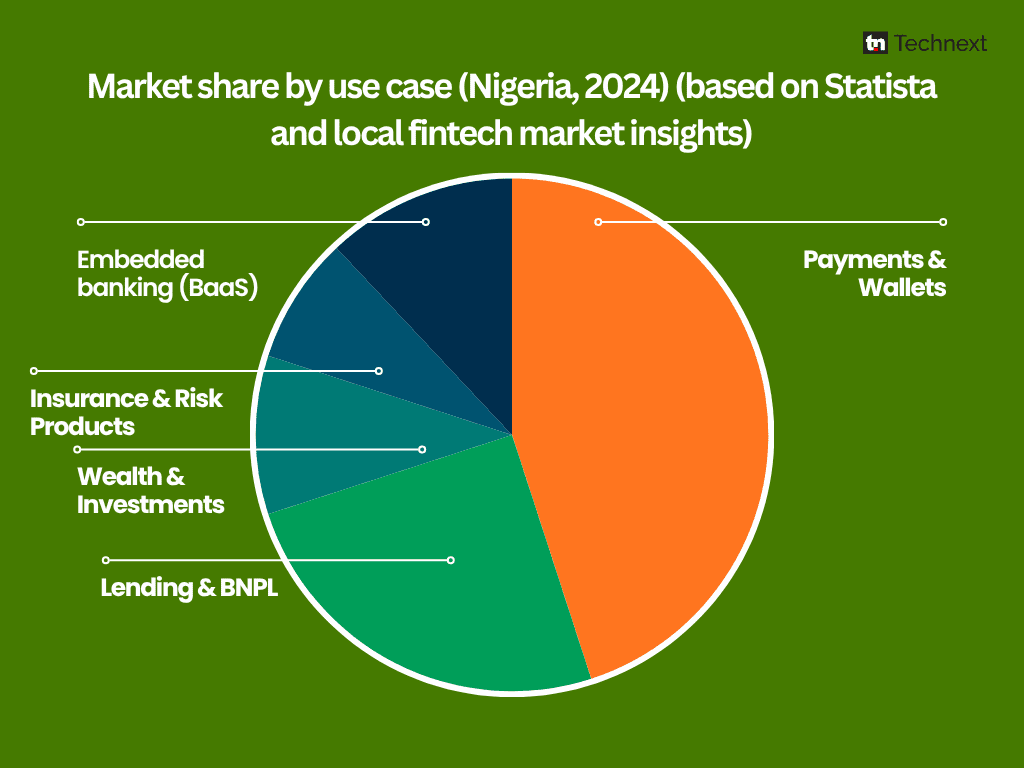

At the heart of this change lies a subtle yet powerful revolution: financial services such as payments, lending, and insurance are no longer restricted to traditional banks or standalone fintech applications. Instead, they are seamlessly embedded within everyday platforms like ride-hailing apps, retail point-of-sale systems, logistics management tools, and even informal market solutions.

This evolution, fueled by embedded finance, is redefining the concept of financial service providers and how money circulates within Nigeria’s economy.

From January to July 2024 alone, the NIBSS Instant Payments platform handled ₦566.4 trillion in real-time transactions, marking an 86% increase compared to the previous year. Furthermore, e-payment volumes surged to ₦295 trillion in the first quarter of 2025, up from ₦237.11 trillion in the same period of 2024.

Such rapid expansion is not merely a trend; it reflects a fundamental shift in the financial infrastructure.

Platforms Transforming into Financial Hubs (Without Becoming Banks)

This quiet revolution unfolds beneath the surface of daily life, reshaping how Nigerians interact with money.

Consider a market trader in Ojuelegba who uses a retail application not only to sell goods but also to accept cardless payments and obtain small loans. Similarly, a Lagos-based ride-hailing driver receives fare payments and short-term credit through the same app that supports their work. Meanwhile, a logistics company in Ibadan offers its merchants instant settlements and business insurance without requiring them to visit a bank.

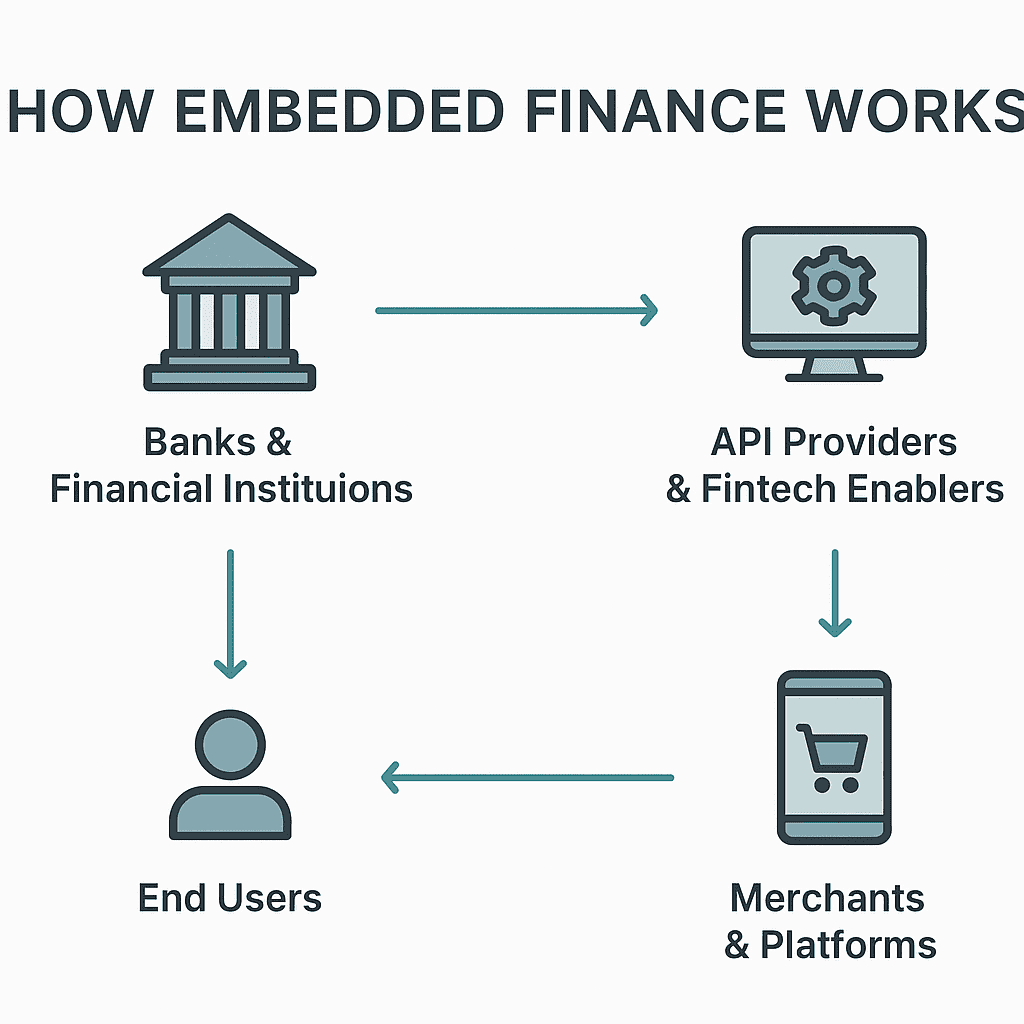

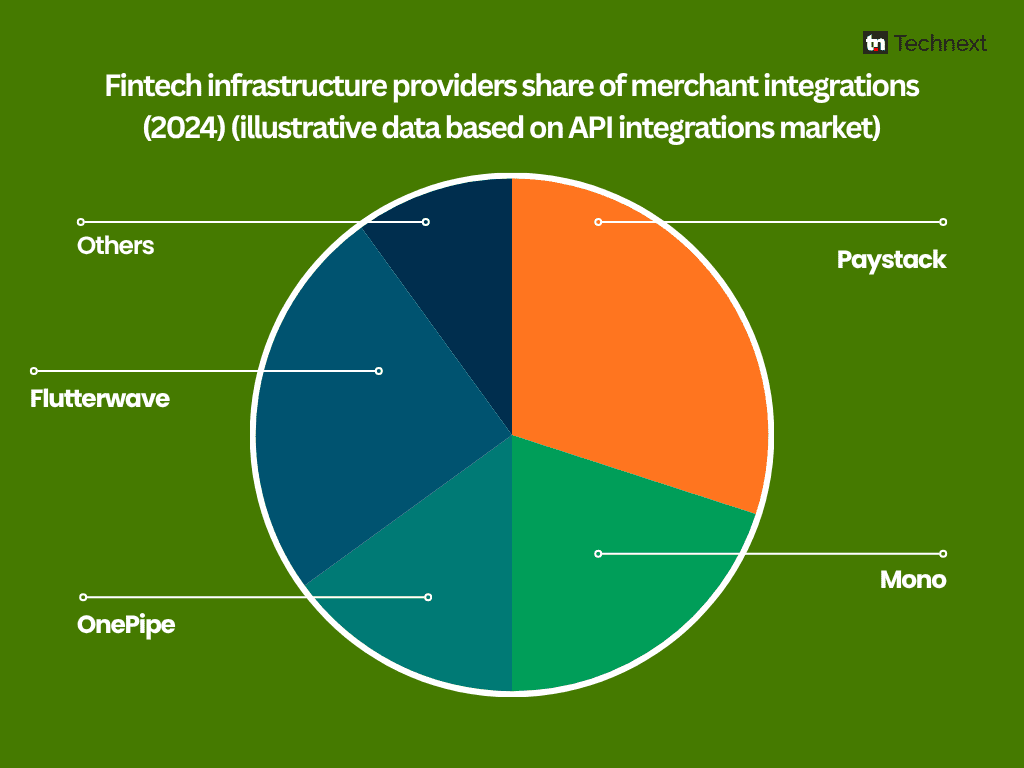

These examples are part of a rapidly growing embedded finance ecosystem. Infrastructure providers such as Mono, Okra, OnePipe, and Paystack have developed APIs that serve as foundational tools for thousands of enterprises.

For instance, Paystack supports over 200,000 businesses and processed ₦1 trillion in transactions in July 2024 alone-a milestone unimaginable just a few years ago. Mono, specializing in open banking APIs, reports handling more than 150 billion transactions and serving upwards of 7 million users nationwide.

OnePipe has leveraged its technology to offer banks-as-a-service, enabling businesses to integrate account opening, lending, and payment functionalities directly into their platforms. Collaborations with Nigerian banks like Fidelity and Access Bank empower merchants to provide financial services without becoming banks themselves.

This encapsulates the essence of embedded finance: financial capabilities are discreetly woven into non-financial platforms, facilitating transactions behind the scenes. This explains why retail outlets function like mini-banks, ride-hailing apps extend credit, and e-commerce sites offer instant insurance coverage.

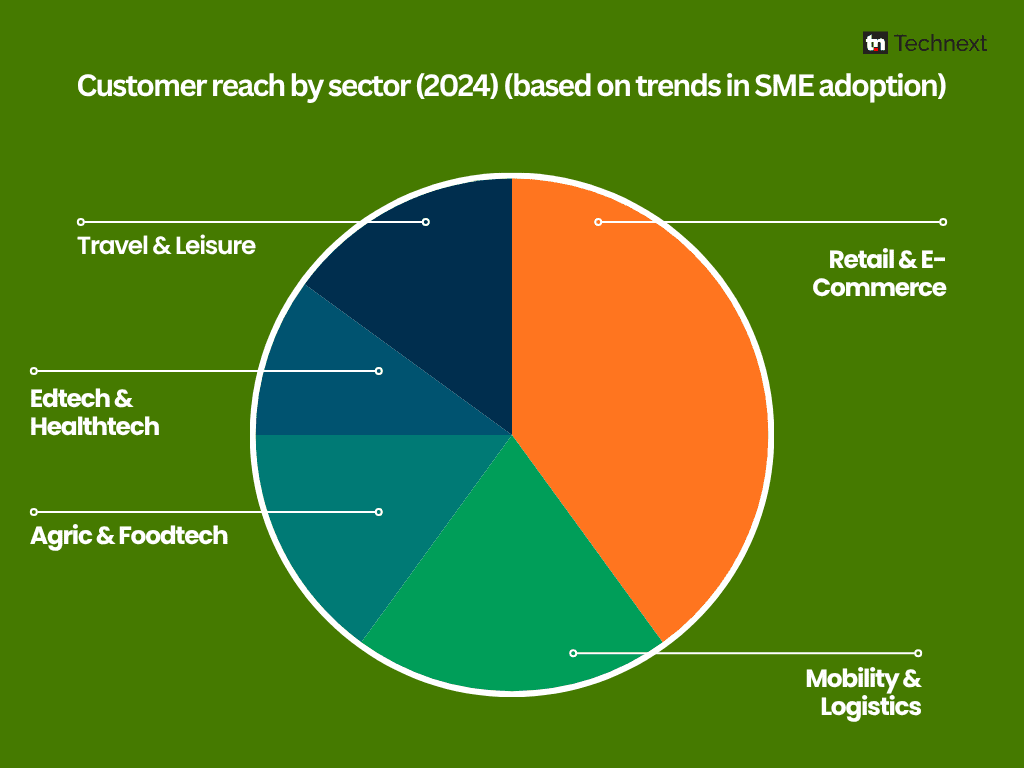

Embedded finance is also a lucrative sector. Valued at approximately $3.99 billion in 2024, Nigeria’s embedded finance market is expected to grow to $4.34 billion by 2025, with an annual growth rate between 8% and 13%. The embedded lending segment alone is projected to reach $1.62 billion next year.

Even traditional players are adapting. Payment Service Banks such as 9 Payment Service Bank, Hope PSB, MoneyMaster, MOMO, and SmartCash are integrating with the fintech-built infrastructure, blurring the lines between banks, telecommunications companies, and fintech startups.

Looking Ahead

The impressive figures tell a compelling story but also highlight emerging challenges. As embedded finance becomes mainstream, the critical question shifts from its impact on Nigeria’s digital economy to how effectively the ecosystem can be governed at scale.

Regulators, especially the Central Bank of Nigeria, have already established frameworks such as open banking guidelines and regulations for payment service providers. However, embedded finance differs from conventional fintech by dispersing financial services across diverse industries, complicating oversight. A single retail platform might now handle transaction volumes comparable to a small bank, without appearing as one.

This dynamic presents both opportunities and regulatory pressures. For businesses, embedded finance lowers entry barriers to financial services and fosters stronger customer engagement. Consumers benefit from quicker payments, easier credit access, and streamlined service delivery. Conversely, regulators must develop mechanisms to supervise not only banks but also the myriad platforms functioning as financial intermediaries.

The swift growth of embedded finance also raises concerns about infrastructure concentration. A handful of API providers support a vast network of businesses, meaning that any disruption to a major provider could have widespread consequences.

Therefore, Nigeria’s future in embedded finance hinges not only on scaling but also on building resilience. Key questions include: How can trillions of naira be secured as they flow through multiple third-party platforms? How can regulators oversee thousands of merchants acting as financial gateways? And how can consumer protection be ensured when the financial service provider is not always visible to users?

The evidence is unmistakable: embedded finance has moved beyond a fintech buzzword to become a foundational element of Nigeria’s financial infrastructure. It operates quietly and efficiently within apps and platforms, handling transactions on an unprecedented scale.

Policymakers now face a pivotal decision. With the right infrastructure, security protocols, and regulatory clarity, embedded finance could accelerate financial inclusion more effectively than any traditional bank. Without these safeguards, however, it risks creating regulatory blind spots that could undermine the very stability it has fostered.

The decision is no longer about whether to adopt embedded finance-the market has already embraced it. The real challenge lies in how to effectively shape and safeguard this transformative financial landscape.

0 Comments