For a long time, startup investments in Africa have predominantly targeted the continent’s four major markets: Kenya, Nigeria, Egypt, and South Africa. Meanwhile, many promising tech enterprises emerging from smaller African nations have been largely neglected. During the 10th AfriLabs Annual Gathering, panelists highlighted how this uneven distribution of funding has hindered the development of robust and sustainable businesses across Africa.

The conversation, led by Sinazo Sibisi, Chief Investment Officer at Timbuktoo-a UNDP-supported initiative fostering a pan-African innovation ecosystem-focused on strategies to scale innovation financing throughout Africa. Joining her were Clara Mwangola, Vice President at Kuramo Capital Management; Adebayo Adewolu, CEO of Trium Limited; and Henry Chinedu Obike, Chief Innovation Officer at I&M Bank Rwanda.

Sibisi emphasized the importance of integrating speed, scale, and sustainability to transform African innovation from isolated success stories into globally competitive systems.

“To accelerate the emergence of investable early-stage ventures that embody speed, scale, and sustainability, it became clear that we needed to establish a comprehensive ecosystem. This ecosystem would nurture early-stage research and development, incubate nascent startups, and support their growth through acceleration programs, ultimately cultivating a strong cohort of ‘gazelle’ companies capable of propelling Africa onto the global stage,” Sibisi explained.

Launched in January 2024 by the United Nations Development Programme (UNDP), Rwanda, and seven other African nations, the Timbuktoo initiative plans to invest $1 billion over the next decade in 1,000 African tech startups.

Boasting the largest startup fund ever created on the continent, Timbuktoo allocates $350 million in risk-tolerant capital designed to attract an additional $650 million from private investors. The fund’s regional hubs focus on sectors such as fintech in Lagos, agritech in Accra, greentech in Nairobi, and health tech in Kigali, collaborating closely with local accelerators and academic institutions.

Edited for clarity and coherence.

Sibisi: Historically, early-stage investments have concentrated almost exclusively on the four dominant markets-Kenya, South Africa, Egypt, and Nigeria-and primarily within mature sectors like fintech and trade technology.

Why is it crucial to expand beyond these established markets and sectors? How does the Timbuktoo Accelerator Fund contribute to this broader vision?

Mwangola: Kuramo operates as a hybrid private equity fund, investing both in fund managers and directly across sub-Saharan Africa.

With over $500 million in assets under management, we have supported numerous first-time fund managers continent-wide, catalyzing approximately $3.5 billion in capital flow to these emerging managers.

Through our affiliate, Moremi Capital, Kuramo manages the Timbuktoo Accelerator Fund, which aims to deploy catalytic capital across diverse geographies and industries.

Investment has traditionally been concentrated in the big four markets because they are more mature and familiar to investors. However, as market dynamics evolve, it’s essential to broaden our focus to include emerging sectors like agritech, climate tech, and health tech, which are gaining prominence beyond these core countries.

This diversification not only mitigates risk for investors but also fosters the growth of local ecosystems and businesses in previously underrepresented regions.

The Accelerator Fund’s mission is to extend its reach into new territories and industries, nurturing ecosystems that support a wider array of ventures beyond the conventional fintech emphasis.

We are optimistic that catalytic capital will drive meaningful impact across the continent.

Sibisi: While many venture funds concentrate on identifying entrepreneurs with promising ideas and helping them scale, Trium takes a different approach as the fund manager for the Timbuktoo African Gazelles Fund.

How does your model innovate the way we stimulate innovation in Africa? Why is it important to move away from traditional venture capital methods?

Adewolu: Trium functions as the digital venture builder within one of Africa’s largest and most diversified financial services groups.

Initially, we intended to operate like a conventional venture capital firm, but by 2019, we recognized the need for a new approach-the venture builder model.

At that time, venture studios were still emerging globally. We understood that capital alone was insufficient; we needed specialized expertise to deploy funds effectively, technology to support operations, and an ecosystem that connects key stakeholders to ensure venture viability.

Our objective is to reduce startup failure rates significantly-from one in ten succeeding to six or seven thriving sustainably.

The African Gazelles Fund focuses on building “gazelle” companies-businesses valued between $100 million and just under $1 billion-rather than chasing unicorns. While unicorns are welcome, our priority is cultivating resilient, mid-sized enterprises that can scale across sectors and countries.

These gazelles are vital for Africa’s economic growth, filling the gap between a handful of large corporations and numerous small startups.

We identify and develop ventures that address substantial market needs, creating both economic value and social impact while delivering returns to investors.

Sibisi: Henry, access to capital remains a significant hurdle across Africa.

How can innovative debt instruments help bridge this gap? Specifically, how does I&M Bank Rwanda collaborate with Timbuktoo as an issuer of Timbuktoo innovation bonds to address this challenge?

Obike: Our bank’s origins date back to the 1960s, when a group of families pooled resources to build a business alongside friends and entrepreneurs. Since then, we have expanded into a major corporate entity with subsidiaries in Rwanda, Uganda, Tanzania, Kenya, and an office in Mauritius.

Having experienced firsthand the difficulties of raising capital-starting with angel investors and family seed funding-we understand the challenges faced by SMEs and accelerators.

We believe the key to fostering growth is creating financing options that are both affordable and carry lower risk.

Many investors perceive African businesses as high-risk, which drives up borrowing costs-interest rates can reach 30-35% in some countries. To counter this, we are designing innovative debt products with built-in risk mitigation.

Our approach involves partnering with philanthropic and development finance institutions to provide first-loss guarantees, which reduce risk exposure for larger investors like pension funds.

Through the Timbuktoo Innovation Bond, we aim to raise long-term capital to support African accelerators. We plan to launch this bond early next year, mobilizing investment within Africa to provide patient capital for startups.

Recently, I met members of the first Timbuktoo cohort working on health tech innovations in Rwanda. Many had bootstrapped their ventures and sought modest funding of around $100,000. With bank interest rates at 17-18%, such financing is often out of reach.

Our goal is to change this reality by offering sustainable, long-term debt solutions that enable founders to grow their businesses while minimizing financial risk.

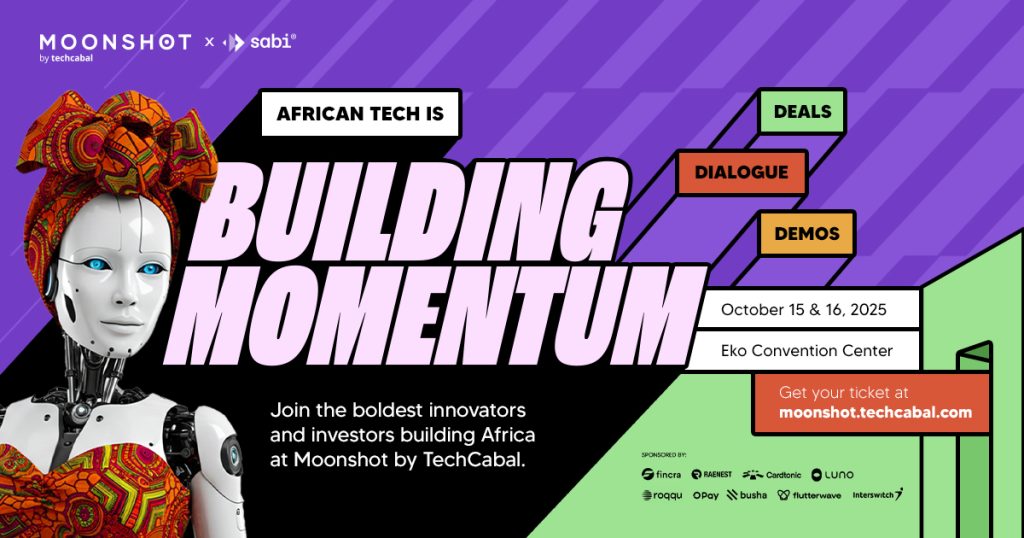

Don’t miss Moonshot by TechCabal, returning to Lagos on October 15-16! Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com.

0 Comments