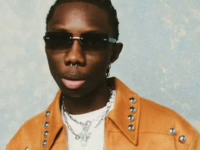

Generation Z entrepreneurs are actively crafting the financial systems tailored to their unique needs. Victor Alade, co-founder and CEO of Raenest-a platform facilitating cross-border payments-describes Gen Z as a pragmatic cohort that clearly understands their goals and pursues them relentlessly.

“Having grown up immersed in technology, they expect processes to be swift and seamless,” Alade shared during a fireside discussion at Moonshot by TechCabal on October 16.

Representing 31.2% of Africa’s population, Gen Z wields significant economic influence. In Sub-Saharan Africa, their purchasing power rivals that of Millennials, with both groups contributing roughly 30% each to consumer expenditure. However, their interaction with financial services diverges markedly from previous generations.

Notably, around 36% of individuals aged 18 to 24 prefer fintech solutions over conventional banks for online transactions.

For innovators like Alade, these figures reflect real-world experiences. Raenest was conceived not as a competitor to banks but as a solution to a personal challenge: enabling African freelancers and entrepreneurs to access international payment networks without incurring exorbitant fees.

What sets Gen Z founders apart is their commitment to embedding core principles into every stage of product creation. Raenest follows an internal ethos known as Raenest Craft, which emphasizes transparency, dependability, equity, independence, and teamwork.

These guiding values are more than mere slogans; they influence product development priorities, user experience design, and crucially, the structuring of fees.

Compliance, however, remains the foundation. “Eighty percent of payment systems revolve around compliance, with technology accounting for the remaining twenty,” Alade noted. “From the outset, compliance must be integral to any payment platform.”

This philosophy is rooted in Alade’s own journey. After enduring a five-week wait for his remote salary and losing 15% to transaction fees, he questioned the fairness of such costs. “Why should I surrender 15% of my earnings after a month’s work?” This frustration became the driving force behind Raenest’s commitment to transparent fees and eliminating hidden charges.

With Gen Z making up 80% of Raenest’s clientele, the company’s development roadmap is heavily influenced by user insights and data analytics. “Our users are central to everything we do,” Alade emphasized. “Before launching new features, we engage with our community to understand their needs and analyze spending patterns.”

This user-first mindset recently inspired a comprehensive redesign of Raenest’s interface. “Initially, our focus was purely functional-we wanted to get the job done,” Alade explained. The revamp prioritized ease of use and accessibility, enabling users to complete onboarding in mere seconds rather than minutes.

“For Gen Z, banking must be fast and reliable. There’s no tolerance for delays or excuses,” he added. “Payments have evolved beyond transactions; they’re now integral to lifestyle management. This generation demands full control over their finances.”

Currently, Raenest facilitates payments to over 100 countries worldwide, including emerging markets like India, with plans for further expansion. “Our mission is to empower individuals to manage their money effortlessly, no matter where they are,” Alade stated.

Looking ahead, Alade recognizes the transformative impact of AI and blockchain on financial services. “AI is pervasive. We must learn to harness it effectively to boost productivity and innovation,” he remarked.

While traditional banks attempt to modernize by integrating fintech features, Alade believes fintech startups will maintain their lead by catering specifically to digitally native, younger users who expect instant, fully online services rather than cumbersome in-branch procedures.

The takeaway is unmistakable: Africa’s 428 million Gen Z individuals-mobile-first and globally connected-are poised to drive the continent’s digital banking revolution. For these young founders, embedding transparency and regulatory compliance into digital finance is not just a strategy but an essential foundation.

0 Comments