As 2025 approaches its close, the focus in personal finance has evolved beyond just earning income to actively safeguarding it.

In today’s economic climate, characterized by inflation and currency instability, leaving a substantial amount like N1 million idle in a low-yield bank account quietly diminishes your wealth. Nigerian investors now require more than traditional banking-they need a robust financial ecosystem to protect and grow their assets.

Thankfully, a dynamic array of fintech platforms has surfaced, providing innovative solutions that transform dormant savings into proactive wealth accumulation. These apps grant users seamless access to high-yield local savings, SEC-regulated mutual funds, and global dollar-denominated investments.

Based on firsthand experience and feedback from everyday Nigerian users, alongside app ratings from reputable stores, we have compiled a list of the top fintech apps designed to build a diversified and resilient investment portfolio.

Below is an overview of our top 10 fintech platforms, detailing how each can help secure and enhance your funds, illustrated with potential returns on a N1 million investment.

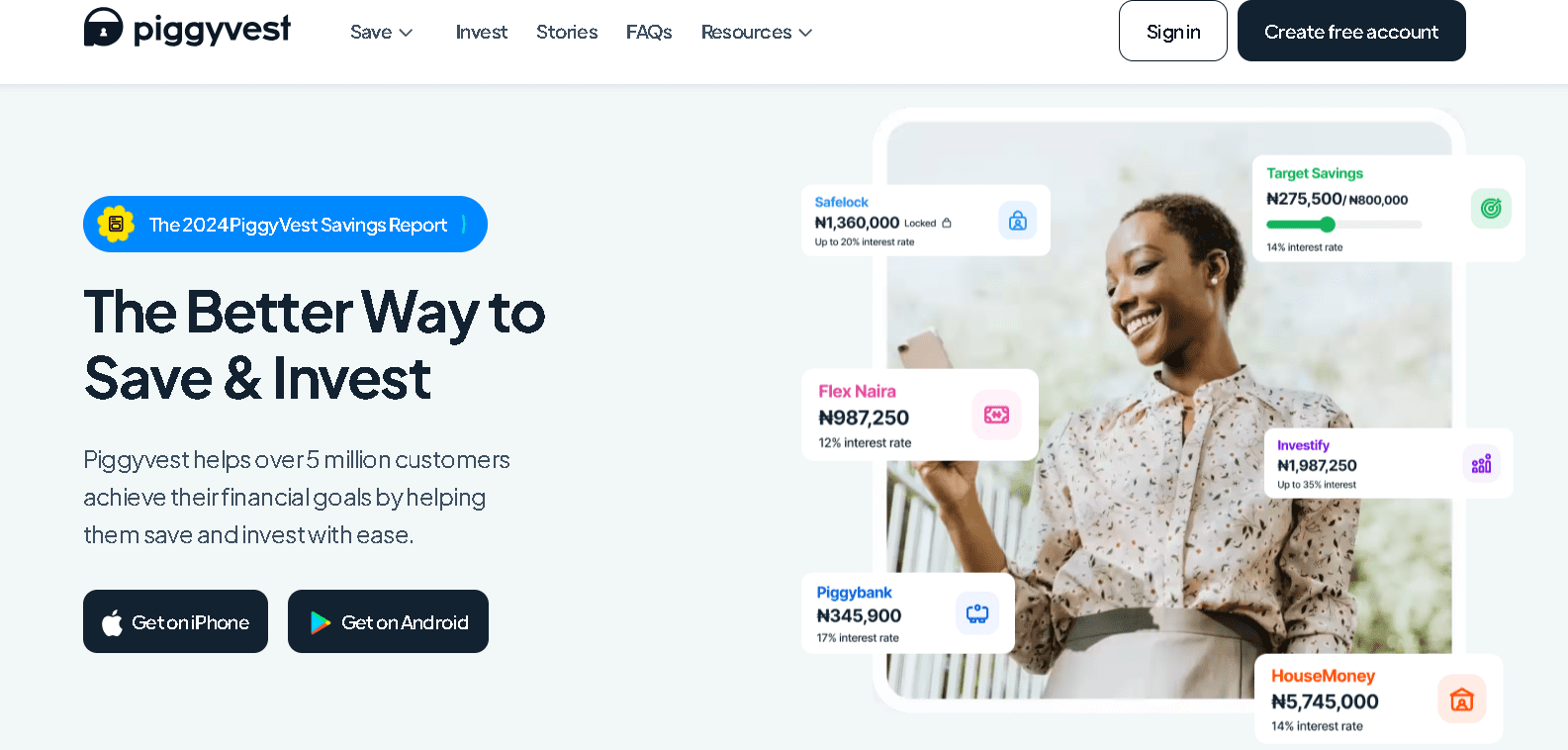

PiggyVest

PiggyVest is widely recognized as a platform that fosters financial discipline. It offers a secure online savings environment that blends structure with flexibility, empowering users to steadily grow their savings.

The standout feature is SafeLock, a structured savings tool that enforces fixed-term locking, crucial for preserving capital. By locking your N1 million in SafeLock, you remove the temptation to spend, earning up to 22% per annum-translating to a potential N220,000 in interest, often credited upfront.

Alternatively, the automated Piggybank savings plan, which allows daily, weekly, or monthly contributions, offers up to 18% interest annually.

Cowrywise

Cowrywise stands out as a trusted platform for straightforward and regulated fund management. It enables Nigerians to save and invest consistently while providing access to a broad selection of licensed mutual funds managed by professional asset managers.

Investing N1 million here could yield returns around 17.35% per annum, potentially earning you up to N200,000 in a secure, professionally overseen investment. Fixed savings options offer up to 15% annual returns when funds are locked for 3, 6, 9, or 12 months as of April 2025.

By placing your money in money market or balanced funds, you gain instant diversification and expert management, significantly mitigating concentration risk.

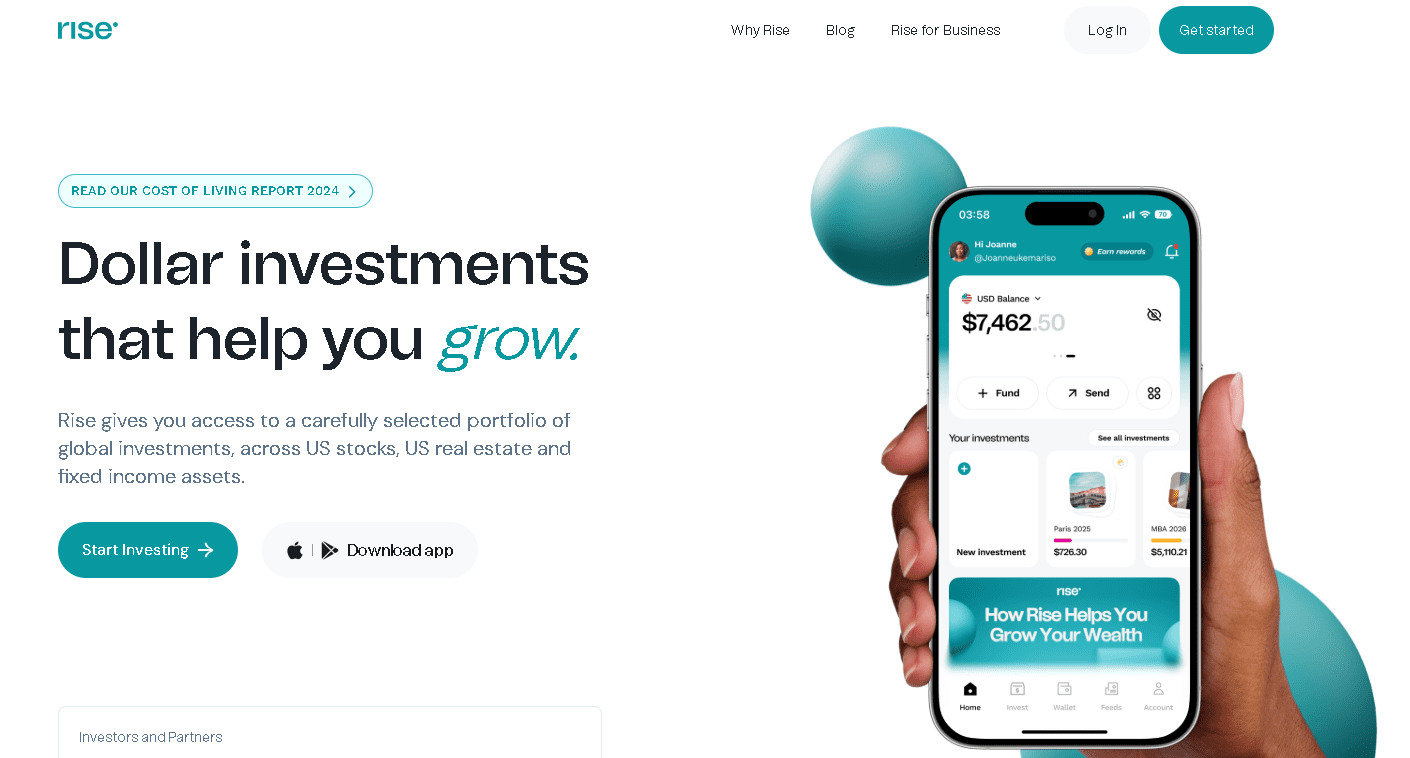

Risevest

Risevest specializes in shielding investors from currency depreciation by offering access to dollar-denominated assets. Acting as a personal investment advisor on your phone, it facilitates investments in US stocks, rental properties, and global fixed income assets-all denominated in dollars.

Your N1 million is converted into dollars and invested internationally, protecting your capital from Naira fluctuations while providing stable returns in a stronger currency. Expected annual returns are approximately 14% for stocks, 15% for real estate, and 10% for fixed income.

FairMoney

Initially known for lending, FairMoney has expanded to offer dependable savings products, making it a versatile digital finance platform. It provides both flexible and fixed savings options under the Fairlock scheme, regulated by the CBN and insured by the NDIC.

Locked savings yield between 17% and 28% annually, depending on the lock-in period, while daily savings accrue interest daily. Investing N1 million could generate between N170,000 and N280,000 in guaranteed returns, positioning FairMoney as a strong contender in the high-yield savings arena.

Renmoney

Renmoney is renowned for its high-yield savings products backed by full licensing and regulatory compliance. It focuses on fixed deposit offerings that provide predictable and secure returns.

The RenVault Fixed Savings product is among the highest-paying digital fixed deposits, ideal for conservatively growing a portion of your N1 million. It offers up to 28% per annum, potentially earning N280,000 in interest over a year, making it perfect for maximizing short-term fixed income.

Bamboo

For investors seeking direct exposure to global blue-chip companies, Bamboo is the preferred app. It enables Nigerians to purchase fractional shares of stocks and ETFs listed on U.S. exchanges.

Allocating part of your N1 million to globally recognized firms such as Apple or Microsoft offers growth potential and a robust dollar-denominated hedge. Bamboo simplifies trading with minimal paperwork, requiring only your contact information and National Identification Number (NIN).

While stock market returns fluctuate, a well-planned N1 million investment could yield an average annual growth of 8% in USD terms and 21.4% when converted to Naira.

Trove

Trove offers extensive investment opportunities across global and African markets, enabling comprehensive diversification. The platform provides access to stocks from the U.S., China, and Nigeria, as well as bonds, all within a user-friendly interface.

This allows you to distribute your N1 million across various regions and asset classes. Additionally, Trove features a Naira savings option with yields up to 20% per annum, potentially earning N200,000 annually, alongside a 5.5% return on U.S. dollar savings.

Chaka

Chaka, a subsidiary of Risevest, is a fully regulated investment platform emphasizing both local and international trading. As an SEC-licensed brokerage, it offers direct access to the Nigerian Exchange and global stock markets.

This platform is ideal for investors who prefer hands-on control over selecting specific local and foreign stocks. Your N1 million investment benefits from transparent operations and strong regulatory oversight.

Returns depend on individual trading success and dividends, with the key advantage being the potential for high gains through well-informed stock selections supported by a solid regulatory framework.

Kuda

Kuda functions as a comprehensive digital bank, with its fixed savings feature offering accessible fixed income and liquidity. It provides a low-cost option for securing the most liquid portion of your N1 million while earning reasonable returns.

The platform offers up to 12% per annum on fixed savings. Depositing N1 million here could generate up to N120,000 annually, complemented by an integrated digital banking experience that streamlines transfers and daily money management.

Ladda by Money Africa

Ladda is a holistic wealth management app that emphasizes financial education and goal-oriented investing. It offers various savings plans alongside a marketplace for mutual funds and stocks.

This platform encourages users to align their investments with their financial literacy and objectives. Savings options include regular, group (savetogether), one-off, and emergency savings, available in both Naira and dollars.

A one-off savings plan can yield up to 20% per annum, while the Presto savings option pays 10% interest immediately upon saving. Locking N1 million for 12 months could earn you N200,000 in interest after the term or N100,000 upfront at the start of the savings period.

0 Comments