Contents Overview

PiggyVest Overview

Renmoney Features

FairMoney Savings Plans

Cowrywise Investment and Savings

Kuda Bank Digital Savings

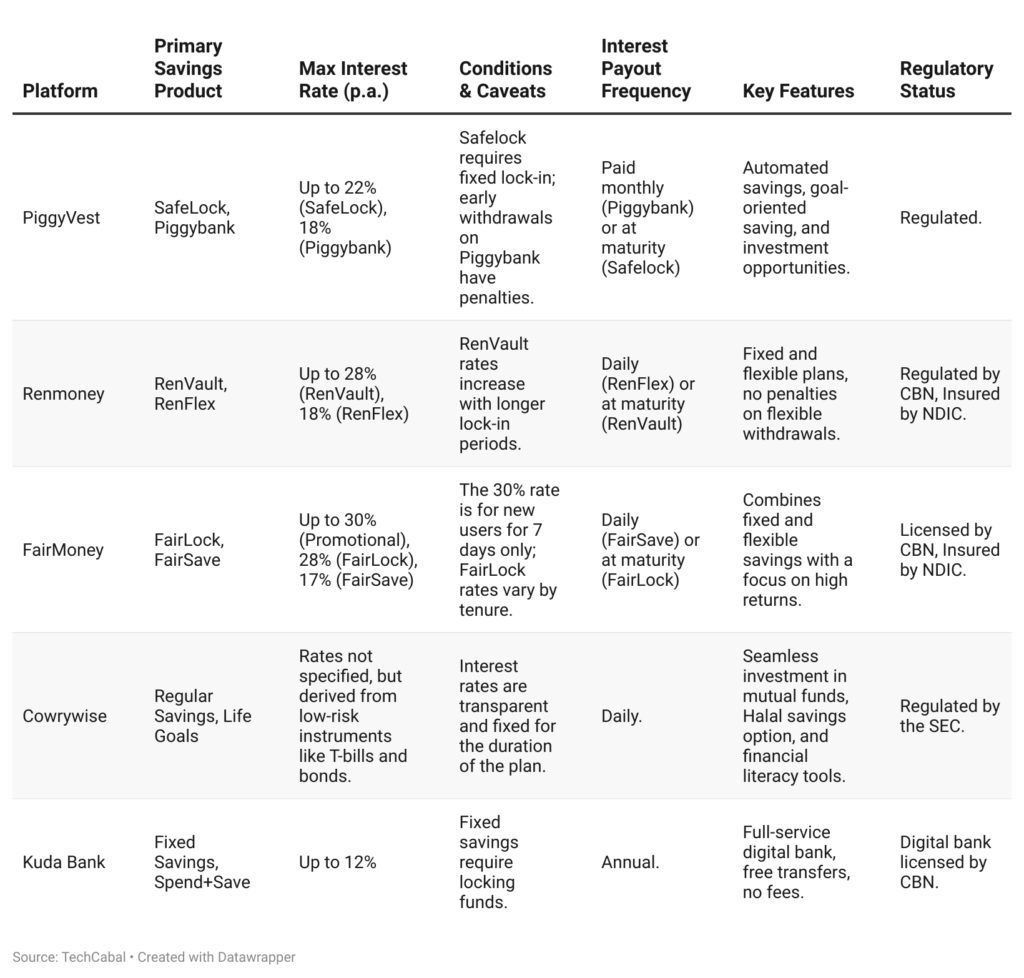

Comparative Table of Nigerian Fintech Savings Apps

Not long ago, my savings were confined to a conventional bank account, where the interest barely made a dent in my balance. It felt more like a secure holding place than a growth tool. Then, a friend mentioned earning “20% interest in a year” through a savings app, which piqued my curiosity immediately.

Like many, I downloaded a popular fintech savings app. The registration was seamless, the design user-friendly, and the interest rates enticing. However, I soon discovered that these impressive rates often came with conditions-such as locking funds for extended periods or promotional rates limited to new users. The reality was more complex than the initial pitch.

To provide a clearer picture, I engaged with actual users who shared their successes and frustrations. If you’re exploring fintech savings options in Nigeria, this guide highlights the platforms that genuinely offer competitive returns and what to watch out for.

Top 5 Nigerian Fintech Savings Apps Offering Attractive Interest Rates

The Nigerian fintech savings ecosystem is bustling with numerous apps aiming to help users save efficiently, earn interest, and meet financial goals. Below is an analysis of key players, their savings products, and unique features.

1. PiggyVest: Flexible and High-Yield Savings

PiggyVest stands out as a favorite among Nigerian savers, especially for those seeking discipline and attractive returns.

- SafeLock: Secure your funds for 3 to 12 months and earn up to 22% per annum. Withdrawals before maturity are not permitted.

- Piggybank (Autosave): Automate your savings daily, weekly, or monthly with interest rates reaching 18% yearly. Early withdrawals outside scheduled dates incur a 3.5% fee.

- Flex Naira & Flex Dollar: Enjoy instant access to your money with flexible accounts. Flex Naira offers 12% annual interest, while Flex Dollar provides 7%, helping hedge against Naira depreciation.

Young Nigerians, including NYSC members like Bunmi from Lagos, appreciate PiggyVest for its balance of flexibility and rewarding interest rates. “Despite my modest allowance, PiggyVest helps me save consistently and earn more than traditional banks,” she shares.

2. Renmoney: Trusted and Regulated Savings Solutions

Renmoney emphasizes security and regulatory compliance, making it a reliable choice for cautious savers.

- RenVault: Fixed-term savings offering up to 28% annual interest, depending on the lock-in period, which can extend up to two years.

- RenFlex: A flexible savings plan with 18% yearly interest and no penalties on withdrawals. Interest accrues daily.

- Smart Goal: Tailored savings for specific objectives like rent or education, yielding 16% per annum.

3. FairMoney: Attractive Promotions with Sustainable Options

FairMoney initially draws users with high promotional rates before transitioning to steady, long-term returns.

- Introductory Offer: Up to 30% interest for the first 7 days after account opening.

- FairLock: Fixed savings plans with rates between 16% and 28%, depending on the duration from one week to two years.

- FairSave: Flexible savings with up to 17% annual interest, daily interest payments, and no withdrawal penalties.

While the initial high rates are eye-catching, the consistent value lies in FairLock and FairSave’s reliable returns.

4. Cowrywise: Combining Savings with Investment Opportunities

Cowrywise offers more than just savings-it integrates investment options to help users build wealth over time.

- Savings Plans: Includes Regular Savings, Life Goals, Group Saving Circles, and Halal Savings tailored for Muslim users seeking Sharia-compliant options.

- Investment Access: Direct investment in SEC-regulated mutual funds, facilitating long-term wealth accumulation.

Unlike fixed interest rates, Cowrywise’s returns fluctuate based on mutual fund performance, often delivering double-digit yields well above traditional bank rates.

In 2024, Cowrywise’s investment portfolio achieved a 24.17% return, while the United Capital Money Market Fund returned 22.27%. Tola, a 27-year-old digital marketer, credits Cowrywise for bringing structure to her finances: “I now save methodically every month without stress, and watching my money grow motivates me to save more.”

5. Kuda Bank: Seamless Digital Banking with Savings Perks

Kuda Bank merges everyday banking with savings features, appealing to users who want convenience and cost-efficiency.

- Fixed Savings: Lock funds to earn up to 12% interest annually.

- Spend+Save: Automatically save a small percentage each time you make a purchase.

Kuda’s zero fees on transfers and card maintenance make it a favorite for entrepreneurs like Kaka in Yaba, Lagos. “Kuda simplifies my finances. I use it for daily transactions and savings, and the free transfers reduce my business costs,” he explains.

Additional Fintech Savings Platforms Worth Considering

- Nearpays: Offers locked savings with interest rates up to 24% per annum.

- ALAT by Wema: A digital banking platform featuring savings goals with returns up to 17% yearly.

- Risevest: Provides dollar-denominated savings and investment options to shield funds from Naira inflation.

In-Depth Review of Nigerian Fintech Savings Applications

Key Takeaways for Savers

Fintech savings platforms in Nigeria offer significantly higher returns compared to traditional banks, but they come with certain compromises. Consider the following before committing:

- Evaluate Beyond Interest Rates: Higher yields often mean reduced liquidity or longer lock-in periods.

- Test Withdrawal Processes: Confirm that accessing your funds is hassle-free and timely.

- Research User Feedback: Customer service quality and app reliability are crucial for a smooth experience.

- Confirm Regulatory Compliance: Opt for platforms that are licensed and insured to safeguard your money.

Ultimately, the ideal savings app balances competitive returns with ease of access, trustworthiness, and excellent customer support-not just the highest interest rate.

0 Comments