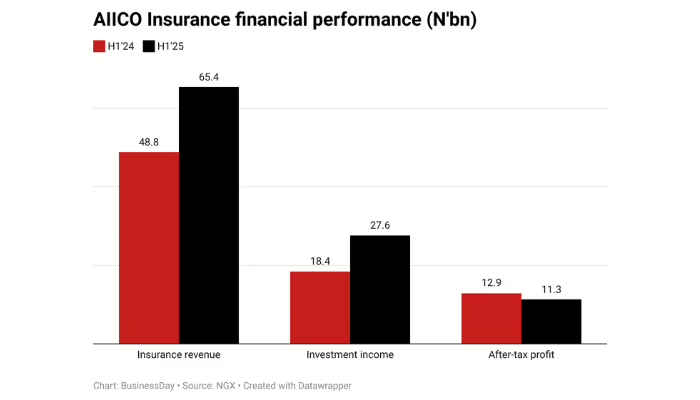

AIICO Insurance Sees 54% Surge in Investment Income Amid Stronger Fixed-Income Yields

AIICO Insurance Plc has announced a remarkable 54% increase in its investment income compared to the previous year. This significant growth is primarily attributed to improved returns from fixed-income securities, reflecting the company’s strategic focus on optimizing its investment portfolio.

Boost in Fixed-Income Returns Drives Financial Growth

The insurer’s enhanced performance in fixed-income assets, such as government bonds and corporate debt instruments, has been a key factor behind the surge. With global interest rates experiencing fluctuations, AIICO’s timely adjustments to its investment strategy have allowed it to capitalize on higher yields, thereby strengthening its overall financial position.

Contextualizing AIICO’s Performance in the Insurance Sector

In the broader Nigerian insurance market, companies are increasingly leveraging fixed-income investments to stabilize earnings amid economic uncertainties. For instance, similar firms have reported double-digit growth in investment returns by diversifying their portfolios and focusing on low-risk assets. AIICO’s 54% rise stands out as a testament to effective asset management and market responsiveness.

Looking Ahead: Sustaining Investment Momentum

As the economic landscape evolves, AIICO Insurance is expected to continue refining its investment approach to maintain robust income streams. Industry analysts suggest that with Nigeria’s fixed-income market projected to grow by over 10% annually, insurers like AIICO are well-positioned to benefit from these trends.

0 Comments