Arch.Law reports that the global legal technology sector was valued at $27 billion in 2024, with forecasts predicting it will soar to $65 billion by 2034. Although the integration of artificial intelligence and other advanced technologies within the legal system is still in its nascent stages, the trajectory points toward a more entrenched and widespread adoption in the near future.

The evolution of legal tech worldwide is progressing steadily. Legal institutions are increasingly digitizing laws and court records, aiming to enhance accessibility not only for legal professionals but also for the general public. This digital transformation seeks to demystify the legal process and make information more readily available to all stakeholders.

Historically, the legal system has been perceived as an intricate and opaque domain, often leaving ordinary citizens unaware of their fundamental rights or the existence of certain laws that impact their everyday lives. This gap in understanding has long hindered equitable access to justice.

With substantial investments flowing into technology and AI, law firms and startups are reshaping the landscape by boosting operational efficiency and democratizing access to legal resources.

While the global legal tech industry is undergoing significant advancements, Africa’s legal technology sector is developing at a more gradual pace. Compared to the rapid adoption of technology in sectors like healthcare, agriculture, and finance, legal tech remains in an early growth phase, though it is steadily gaining momentum.

The impressive expansion witnessed in Africa’s fintech industry may serve as a hopeful indicator for the continent’s legal tech future. Since the aftermath of the COVID-19 pandemic, fintech companies such as Flutterwave, M-Kopa, and Lemfi have not only achieved remarkable milestones within Africa but have also extended their influence internationally.

Moreover, African fintech leaders are gaining global recognition. Nigerian fintech powerhouses Moniepoint and Flutterwave were featured in the TIME100 Most Influential Companies list for 2025. Additionally, Egypt’s MyFawry and PayMob, South Africa’s Yoco, alongside Nigeria’s Piggyvest and Palmpay, earned spots on CNBC and Statista’s 2025 list of the World’s Top 250 Fintech Companies.

The fintech sector in Africa has become a catalyst for innovation and financial inclusion, with projected revenues expected to hit $47 billion by 2028-an almost fivefold increase from $10 billion in 2023.

Looking ahead, the question remains: will fintech be the sole driver of technological innovation and adoption across Africa? The answer depends largely on how swiftly the legal tech ecosystem evolves.

While fintechs are addressing practical challenges by facilitating more inclusive and efficient local and cross-border payments, the legal sector aims to revolutionize the delivery of legal services through technology integration.

Despite optimistic trends and forecasts, critical questions linger: When will African legal tech reach maturity, and what factors will drive this transformation?

Also Read: Case Radar leverages AI to make legal information accessible to everyday people, much like Google Search.

Current Landscape of Legal Technology in Africa

Africa’s legal tech sector is widely recognized as being in its infancy but holds significant promise. Platforms such as Case Radar have recently accelerated AI adoption for tasks like legal research and document analysis.

Additionally, the continent is witnessing a surge of tech-savvy legal professionals who actively incorporate digital tools to optimize their workflows. The post-pandemic era has also seen the rise of virtual law firms, offering remote legal services and reshaping traditional practice models.

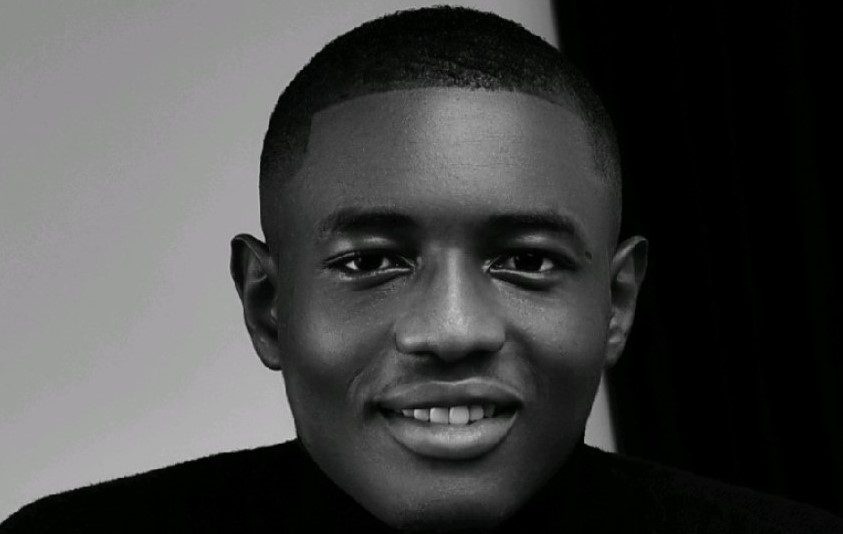

Agbo Obinnaya, Co-founder and CEO of Case Radar, confirms a noticeable uptick in technology adoption within Africa’s legal domain. However, he emphasizes that the sector remains in its early stages, especially when compared to the fintech industry’s rapid growth.

Obinnaya explains that the slow initial pace is largely due to the entrenched traditional frameworks governing African legal systems. Yet, he is optimistic that once technology gains full acceptance, growth will accelerate dramatically.

“We are observing law firms, courts, and regulators gradually embracing digital solutions-from case management software to AI-driven legal assistants. This shift is both inevitable and exciting because legal systems have historically been resistant to change. Once innovation takes hold, the impact will be profound,” he remarked.

As the sector prepares for broader adoption, Obinnaya outlines a collaborative approach as essential. He stresses that all stakeholders must unite to foster technology integration.

He advocates for legal professionals and institutions to view technology as a facilitator rather than a threat, encouraging the embrace of AI to streamline operations and spark innovation. Furthermore, he calls for strategic alliances among regulators, law firms, startups, and professional bodies like the Nigerian Bar Association.

“At the NBA Conference, I highlighted how disruptive AI can be for the legal industry. Collaboration among all parties is crucial to avoid working in isolation,” Obinnaya stated.

Lastly, he underscores the importance of building trust and awareness among lawyers and the public regarding the benefits of legal tech, as acceptance hinges on understanding its value.

Also Read: Ngozi Nwabueze is pioneering a ‘Shopify for lawyers’ with PocketLawyers.

Prospects for Legal Technology in Africa

Legal technology in Africa is still taking its initial steps, but the outlook is encouraging. However, it remains uncertain whether legal tech will expand as rapidly as fintech has on the continent.

The number of legal tech startups is steadily increasing, with notable players like Pocket Lawyers, Case Radar, Legarly, Judy, and Afriwise gaining traction. A surge in investments and funding could further elevate the sector’s profile, mirroring fintech’s success.

Obinnaya firmly believes that legal tech is on a trajectory to become a dominant force in Africa, albeit requiring patience and sustained effort. Just as fintech’s rise was gradual, legal tech may need nearly a decade of continuous innovation, regulatory support, and user adoption to reach its full potential.

“I anticipate the industry gaining significant momentum within the next five to seven years, especially as AI-driven solutions make legal services more affordable, efficient, and accessible to millions who were previously marginalized by the justice system,” he added.

He boldly predicts, “Legal technology has the potential to stand alongside fintech as one of Africa’s most transformative sectors.”

0 Comments