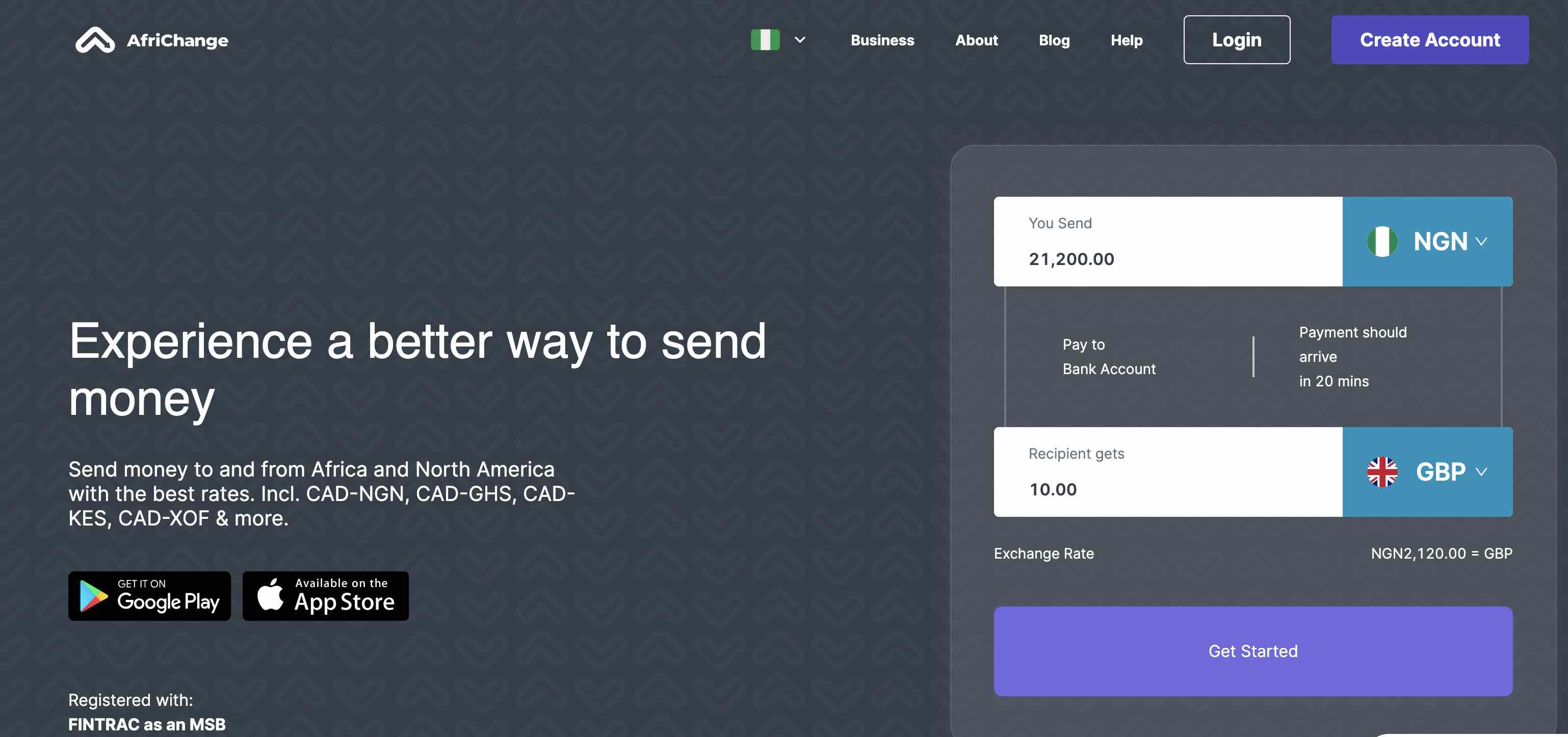

Canada-based remittance firm Africhange Technologies Limited is broadening its service offerings by incorporating cryptocurrency functionalities into its established remittance platform. The company has unveiled three innovative features that seamlessly blend crypto-coins-bull-run-blockdag-pengu-bonk-pepe/” title=”Ride the … Bull Run: Why BlockDAG, PENGU, BONK & PEPE Are Poised to Soar!”>digital assets with traditional money transfer services.

Operating across Nigeria, the UK, Canada, and Australia, and facilitating transactions between Africa and Europe, Africhange now provides USD virtual accounts, stablecoin funding options, and crypto payment solutions tailored to meet the needs of Africa’s expanding digital currency user base.

This strategic move aligns with the rising adoption of cryptocurrencies in Sub-Saharan Africa. According to Chainalysis, the region saw over $205 billion in on-chain transactions from July 2024 to June 2025, marking a 52% increase year-over-year. In Nigeria alone, nearly 26 million individuals-approximately 12% of the population-are engaged with digital assets.

Zero-fee USD Virtual Accounts and Stablecoin Support

Africhange’s introduction of USD virtual accounts addresses a common challenge in the remittance sector: costly deposit fees. Unlike many competitors who impose charges for account funding, Africhange offers these USD accounts without any deposit fees.

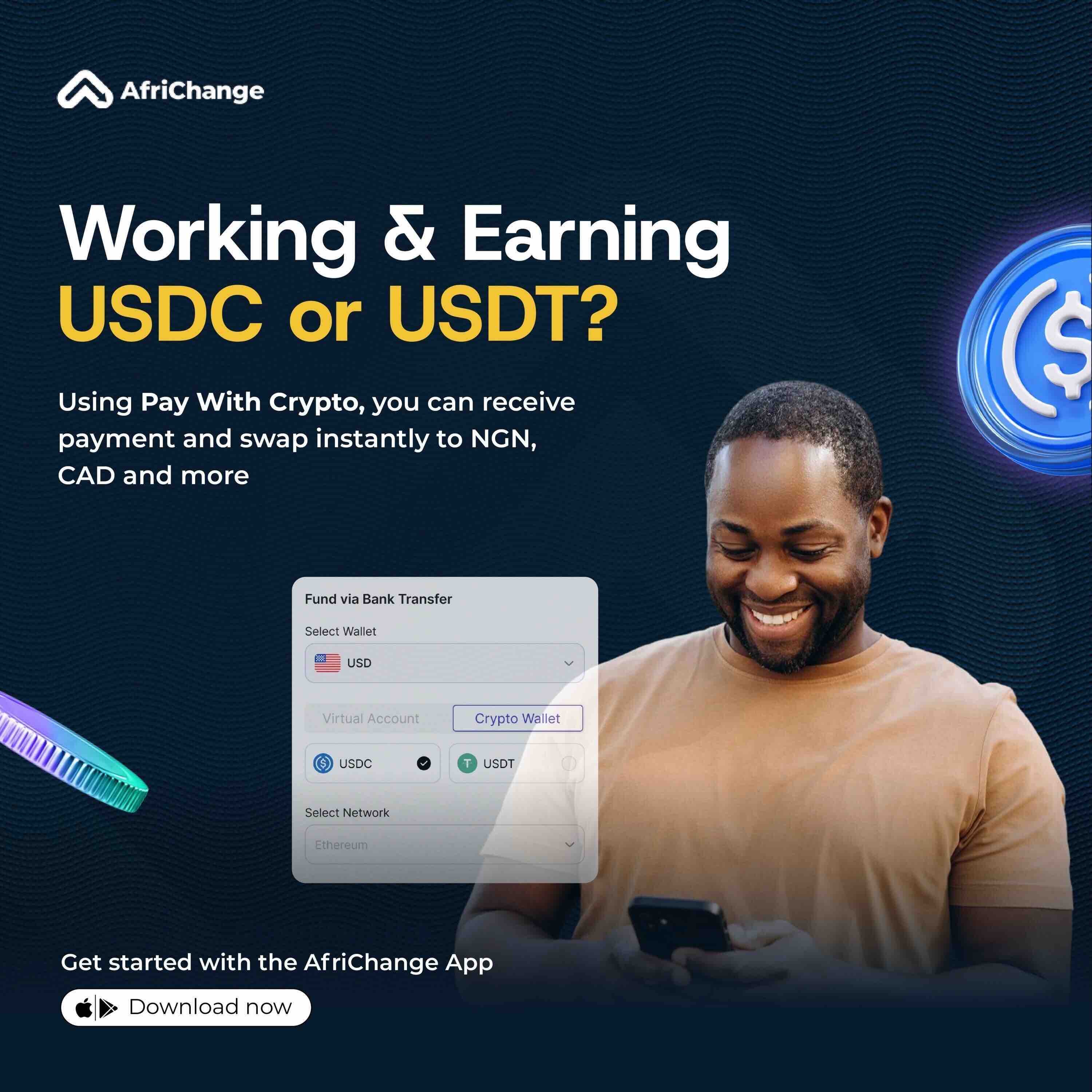

Users can maintain USD balances, exchange currencies at competitive rates, and transfer funds efficiently. The platform also supports funding these accounts with stablecoins such as USDT and USDC, acknowledging the difficulties crypto holders face when converting digital currencies into spendable money without resorting to peer-to-peer exchanges or accepting unfavorable rates.

Clients can directly deposit stablecoins from popular exchanges like Coinbase or Bybit into their Africhange accounts, enabling immediate use for standard remittance transactions. This feature also facilitates businesses in accepting payments via stablecoins, enhancing transactional flexibility.

Introducing “Pay with Crypto” and Platform Consolidation

Africhange is among the first traditional remittance providers to roll out a “Pay with Crypto” option, allowing users to fund transfers using cryptocurrencies alongside conventional payment methods. When initiating a remittance, users receive a wallet address to send crypto from their preferred wallets or exchanges.

Recipients receive funds in their local currency through standard banking systems, meaning only the sender needs familiarity with cryptocurrencies. For example, a sender in London can remit USDC, while the recipient in Lagos collects Nigerian naira seamlessly.

Simultaneously, Africhange is winding down NairaEx, its crypto-focused subsidiary, opting instead to merge its functionalities into the main Africhange platform. This integration aims to create a more comprehensive and resilient remittance service.

“We are closing NairaEx but incorporating many of its features into Africhange to build a stronger, unified remittance platform,” the company stated.

This consolidation reflects Africhange’s vision to develop an all-encompassing financial ecosystem for African corridors, combining traditional and digital currency transactions within a single infrastructure.

Strategic Market Positioning and Future Prospects

Building on its regulatory licenses in Nigeria, the UK, Canada, and Australia, Africhange leverages its established remittance corridors across Africa, Europe, and North America to introduce these crypto-enabled services.

“Our existing infrastructure and licenses make it straightforward to expand into cryptocurrency services,” the company explained.

The new offerings cater to users at the crossroads of traditional remittances and crypto adoption, including diaspora communities holding digital assets, cross-border entrepreneurs, and individuals seeking cost-effective alternatives to peer-to-peer crypto trading.

This launch coincides with broader fintech trends in Africa, where cryptocurrency use is accelerating due to currency volatility and increasing digital literacy. By merging crypto capabilities with conventional remittance services, Africhange is positioning itself to serve both long-standing customers and the emerging population of crypto-savvy users-eliminating the need to switch between multiple platforms.

0 Comments