The debate over the significance of digital assets in shaping the future of finance remains unresolved, yet a growing number of skeptics are discovering compelling practical reasons to embrace stablecoins.

Last week’s most notable development in the sector was MoneyGram’s announcement on September 17 of its collaboration with Crossmint to incorporate stablecoin payments into its international remittance network. Unlike competitors such as Western Union and fintech firms like Remitly, which have largely confined themselves to pilot programs and backend integrations, MoneyGram appears poised to be the first traditional remittance company to launch a stablecoin product directly accessible to consumers.

The advantages of stablecoins have become well-established: immediate transaction finality (T+0), reduced costs by eliminating intermediaries, enhanced liquidity accessible worldwide, and the absence of transfer limits that typically constrain conventional remittance services.

The rise of a robust stablecoin ecosystem poses a direct challenge to global banks and remittance providers that have historically dominated cross-border money transfers. This dynamic is driving two key trends: increased adoption of stablecoins by both businesses and individuals, and a competitive rush among established institutions to protect their market share from digital asset disruption.

Clash for dominance in remittance markets

Nigeria represents a lucrative market for remittance leaders like Western Union and MoneyGram, fueled by a large diaspora community. Since 2010, remittance inflows to Nigeria have consistently exceeded $17 billion annually. Local banks often serve as cash collection points for recipients, but the typical settlement period can extend beyond five days (T+5), reflecting the inefficiencies of traditional systems.

In 2022, just before MoneyGram’s privatization, global money transfers accounted for 91% of its revenue. With worldwide remittances totaling approximately $843 billion that year, Nigeria’s share-about 2.4%-makes it a significant battleground for MoneyGram’s competitive efforts.

However, the growing prominence of stablecoins threatens to erode the protective barriers that companies like MoneyGram and Western Union have long relied upon.

Tether, the US-based issuer of the USDT stablecoin, stands out as the primary beneficiary of this shift. As one of the most profitable firms globally, Tether reported a net profit of $4.9 billion in Q2 2025 alone. According to Yellow Card, a pan-African stablecoin payments platform, Nigerians transacted $22 billion in stablecoins between mid-2023 and mid-2024, with USDT being the preferred choice.

Within Nigeria, stablecoins have evolved into essential infrastructure for individuals, freelancers, and enterprises needing to hold or transfer dollars amid a depreciating local currency and sluggish banking services. They serve as tools for safeguarding savings, receiving international payments, sending remittances, and settling supplier invoices.

Oluwatimilehin Oluwasanmi, CEO of Cryptonia-a Nigerian startup specializing in stablecoin payments-explained that most users turn to digital currencies to hedge against naira devaluation, facilitate cross-border transactions, access global digital platforms, and enable swift peer-to-peer payments.

“Our primary users include freelancers who avoid delays in dollar payouts, small businesses paying overseas suppliers without banking hurdles, and traders who need to convert earnings rapidly into local currency,” Oluwasanmi shared.

Unexpected institutional embrace of stablecoins

Stablecoin adoption has expanded well beyond individual users, with institutional engagement gaining momentum. Chainalysis data reveals that sectors such as energy and merchant payments dominate large-scale stablecoin transactions worldwide. What started as a personal hedge has transformed into a foundational tool for industries managing substantial financial flows.

Nigerian startup Shiga Digital exemplifies this evolution by positioning itself as a “stablecoin bank” for corporate clients. It offers payment rails tailored to businesses requiring reliable dollar access, serving clients ranging from oil and gas companies to fintech firms handling international settlements and payroll.

“We support five fintech companies that utilize stablecoins for various purposes,” co-founder Dami Etomi told TechCabal. “These include international settlements, transferring investor funds into Nigeria, and managing payroll operations.”

Etomi’s decade-long experience in the oil and gas industry, where cross-border payments and dollar liquidity are vital, highlighted the shortcomings of Nigeria’s banking infrastructure and inspired Shiga’s corporate-focused platform.

He cited the example of Mercury, a US fintech bank that ceased onboarding Nigerian startups after Nigeria was placed on the FATF Greylist in 2023.

“Nigerian startups rely on Mercury to access USD from investors,” Etomi noted. “Those fintechs excluded from services like Mercury can now use stablecoins to transfer funds without enduring lengthy delays or fearing jurisdictional restrictions.”

In June, Tether’s investment in Shiga signaled strong confidence from the leading stablecoin issuer. Shiga’s CEO, Abiola Shogbeni, emphasized that trust is fundamental to institutional stablecoin adoption for payments, payroll, treasury management, and even individual use.

“Concerns about scams and limited wallet knowledge persist,” Shogbeni said. “Building trust depends on ensuring payments are transparent and instantaneous.”

Shiga’s approach-leveraging stablecoins and establishing deep foreign exchange liquidity pools for businesses-mirrors a wider trend of companies embracing digital assets out of necessity. According to Etomi, demand is already substantial; the challenge lies in developing scalable platforms to meet it.

Emergence of a parallel financial ecosystem

Stablecoins are effectively creating an alternative financial system in Nigeria, bridging the gaps left by traditional banks.

“Stablecoins have become the lifeline for fintechs and businesses in Nigeria,” Etomi remarked. “They provide real-time dollar access and transfer capabilities when conventional banking systems fall short.”

Although institutional uptake is increasing, the absence of clear regulatory frameworks across Africa means many companies hesitate to publicly disclose their stablecoin usage. Consequently, this parallel financial network grows discreetly, lacking the transparency that would accompany open operation.

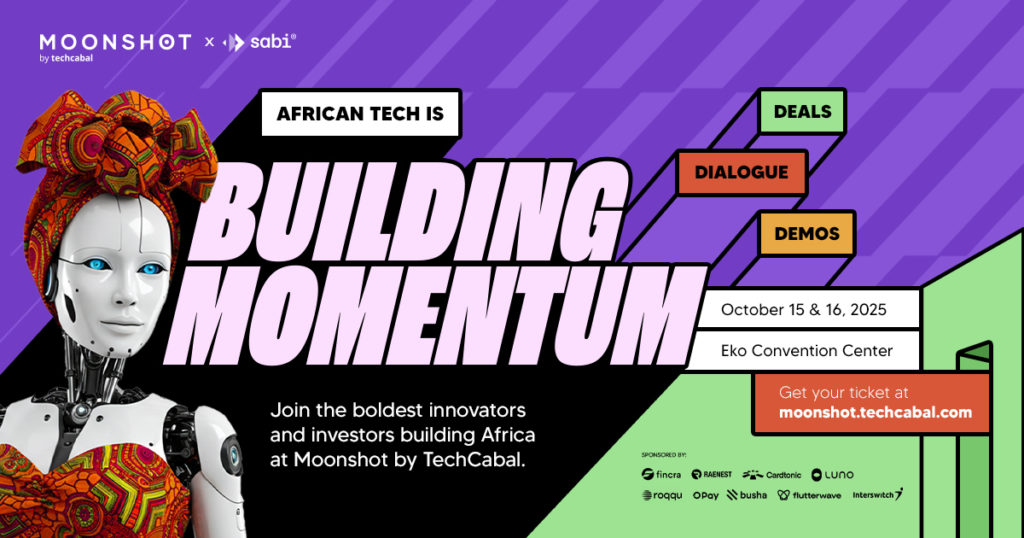

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com

0 Comments