When discussing the potential for business growth in Africa, common highlights include the continent’s booming population, increasing internet access, and the rapid adoption of mobile money as an alternative to traditional banking. While these factors are undeniably significant, a crucial yet often overlooked aspect is how companies manage the flow of funds across these diverse markets. Selecting the appropriate payment gateway can either propel a business forward or bring its progress to a halt.

Unlike the more unified payment ecosystems found in Europe or North America, Africa’s payment infrastructure is highly fragmented. For instance, Kenya’s digital economy largely depends on M-Pesa, whereas Nigeria’s landscape features a variety of mobile wallets such as Opay and PalmPay, alongside conventional bank transfers. In the Democratic Republic of Congo, mobile money services are divided among providers like Vodacom, Orange, and Airtel, with cash transactions still prevalent among many consumers.

Expanding a business across African borders means navigating not only multiple currencies but also a patchwork of payment systems and networks.

Key Features to Consider in an African Payment Gateway

So, what defines an effective payment gateway in this multifaceted environment? Primarily, it must offer more than just card payment processing. With card ownership below 10% in numerous African countries, the most successful gateways emphasize mobile money transactions while also supporting cards, QR code payments, and point-of-sale (POS) options where applicable.

Secondly, local expertise is just as critical as regional reach. A gateway that operates in 15 countries but lacks solid connections with local banks and telecom operators in each market will fall short. Businesses require confidence that payment settlements comply with local regulations and that transactions won’t be delayed due to poorly maintained integrations.

Thirdly, modern payment platforms should integrate communication tools. Payments rarely occur in isolation-they demand real-time confirmations, alerts, and customer engagement. For example, a shopper in Uganda or Zambia expects immediate notification after making a payment. Bulk SMS remains one of the most dependable communication channels, especially in areas where internet access is inconsistent.

The Rise of Unified Payment and Communication Platforms

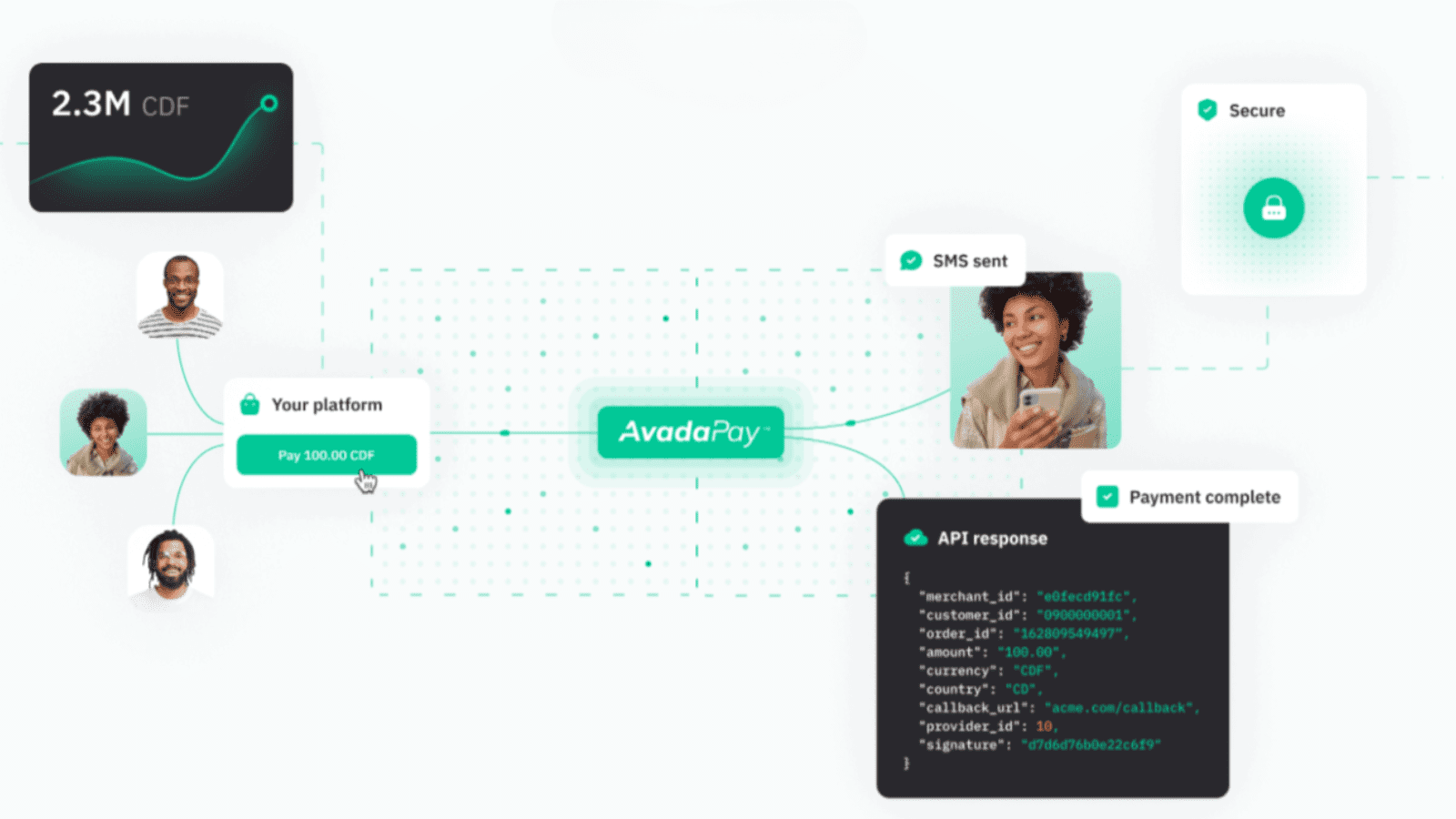

This growing need for seamless payment and communication has driven the emergence of integrated platforms that combine these functions within a single interface. AvadaPay exemplifies this trend by supporting mobile money, card, and POS transactions across over 20 African countries, with plans to expand further. For a retailer based in Nairobi aiming to serve customers in Kinshasa or Lagos, this means avoiding the hassle of onboarding separate gateways for each market.

The iGaming industry highlights this necessity well. Operators must ensure that deposits and withdrawals happen instantly, whether through Airtel Money in the DRC or bank transfers in Nigeria. Utilizing an integrated payment gateway enables these companies to scale efficiently across borders while maintaining a consistent user experience. Similarly, logistics and fast-moving consumer goods (FMCG) businesses benefit from processing thousands of low-margin transactions swiftly and reliably every day.

Why Payment Gateway Selection Is a Strategic Business Choice

From discussions with fintech leaders and entrepreneurs, a common misunderstanding is that choosing a payment gateway is purely a technical matter for IT departments. In reality, this decision is strategic and directly impacts how rapidly a company can grow.

The ideal payment partner streamlines currency settlements, minimizes regulatory complications, and enhances customer confidence. Conversely, a poor choice results in manual transaction reconciliations and frequent customer dissatisfaction due to failed payments.

Artur Mildov, Chief Visionary Officer at Velex Group, emphasizes that payment gateways have evolved beyond mere backend tools-they are now vital growth enablers. In Africa’s diverse and complex market environment, the right gateway can distinguish a business that struggles to keep up with transactions from one that successfully expands across regions.

AvadaPay, part of the Velex Group portfolio, embodies this vision by positioning payment infrastructure as a strategic lever for growth. Its unified platform consolidates mobile money, card, QR, and POS payments into one system, enabling businesses to operate fluidly across borders without the friction of juggling multiple providers.

Africa’s payment ecosystem is intricate and will remain so for the foreseeable future. Nevertheless, with the right gateway, companies can transcend reliance on single markets and lay the groundwork for regional expansion.

Closing Reflections

For enterprises committed to scaling in Africa, selecting the appropriate payment gateway is a critical decision that should not be underestimated. It goes beyond mere payment processing-it’s about fostering customer trust and ensuring smooth operations across varied markets. Platforms that integrate payment handling with dependable communication exemplify this approach.

If you’re prepared to grow your business with a payment gateway tailored for Africa’s unique landscape, partnering with AvadaPay offers a pathway to scale confidently and efficiently.

Contributing Authors

Maurice Bisungo, Key Accounts Manager, AvadaPay

Related Read: How payment switches power cashless transactions in Nigeria

0 Comments