Last Friday marked a profoundly turbulent chapter in the history of cryptocurrency. In a matter of hours, Bitcoin’s value plummeted from an unprecedented peak above $125,000-achieved just days earlier-to approximately $102,000, wiping out weeks of consistent upward momentum.

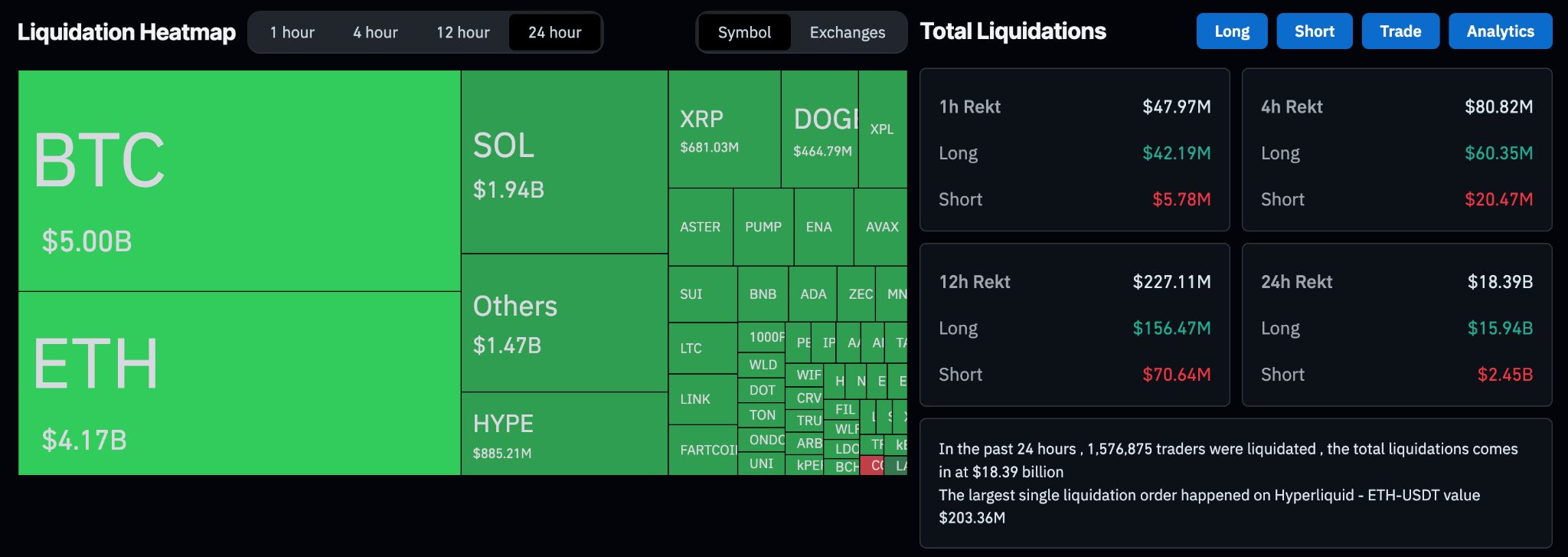

The fallout was devastating. Over $20 billion worth of leveraged positions were forcibly liquidated across exchanges worldwide. Trading platforms struggled under immense pressure, liquidity dried up rapidly, and investor confidence took a severe hit.

At first glance, the catalyst appeared clear: Donald Trump’s unexpected declaration of a 100% tariff on Chinese technology exports. This announcement reignited fears of an escalating global trade conflict, prompting investors to abandon riskier assets. Consequently, equities, commodities, and cryptocurrencies all suffered sharp declines simultaneously.

However, as the initial shock subsided, it became evident that the crash exposed deeper vulnerabilities. It served as a rigorous examination of a market overheated by excessive leverage, automated trading systems, and fragile infrastructure.

crypto market liquidations. Source: CoinGlass” class=”wp-image-263597″ />

crypto market liquidations. Source: CoinGlass” class=”wp-image-263597″ />This event was far more than a routine market correction-it was a systemic alarm bell.

Revisiting the Sequence of the Crash

The day began under a cloud of uncertainty. Global financial markets were already fragile, grappling with rising inflation, decelerating economic growth, and aggressive monetary tightening. Then came the tariff announcement, which caught both human traders and algorithmic systems off guard. Bitcoin swiftly breached critical support levels near $112,000, triggering a cascade of sell orders.

As prices fell, automated liquidations of leveraged long positions kicked in, creating a brutal chain reaction. Data aggregated from various sources indicated that forced liquidations totaled nearly $20 billion within 24 hours-the largest single-day loss ever recorded in the crypto space.

Liquidity evaporated as panic intensified. Order books became sparse, buy orders disappeared, and bid-ask spreads widened sharply. Binance reported temporary instability in stablecoins like USDe from the Ethena protocol, which further exacerbated forced liquidations tied to collateralized assets.

The crash resembled a steep vertical plunge driven by a feedback loop of liquidations amid thin liquidity. Traders reported delays in order execution and frozen interfaces at critical moments. Many lamented that their stop-loss orders failed to activate, leaving them vulnerable to deeper losses.

By the end of the day, the turmoil had engulfed the entire crypto ecosystem. Altcoins suffered catastrophic declines, with some dropping between 50% and 80% within hours. Ethereum fell below $4,500, Solana dipped under $150, and meme tokens virtually disappeared. The total market capitalization of cryptocurrencies contracted by over $250 billion in just one day.

Despite the chaos, steadfast investors such as Michael Saylor’s MicroStrategy maintained their positions, underscoring the divide between conviction-driven capital and speculative leverage.

Underlying Market Weaknesses Beyond the Tariff Shock

While Trump’s tariff announcement ignited the sell-off, the underlying vulnerabilities had been accumulating for months.

The primary issue was excessive leverage. Throughout Q3, Bitcoin’s surge toward $125,000 attracted a wave of leveraged bets from both retail and institutional traders. When the market reversed, automatic liquidation mechanisms accelerated the downturn.

Secondly, exchange instability played a critical role. Several platforms, including Bybit, Hyperliquid, and Binance, experienced operational slowdowns or outages during peak volatility. Traders voiced frustration, alleging systemic breakdowns that prevented timely trade executions and order closures.

In response, Crypto.com CEO Kris Marszalek has called for regulatory scrutiny. On social media, he urged authorities to investigate whether exchanges manipulated prices, delayed order processing, or mispriced assets. He highlighted the exchanges with the highest liquidation volumes:

- Hyperliquid – $10.3 billion

- Bybit – $4.65 billion

- Binance – $2.41 billion

- OKX, HTX, and Gate.io also reported significant but smaller losses.

Marszalek’s stance emphasizes that even in decentralized markets, principles of fairness and transparency must be upheld.

The third factor was fragmented liquidity. As market makers withdrew during the sell-off, bid-ask spreads ballooned. The scarcity of liquidity magnified price swings, turning even modest trades into significant market movers.

Fourth, herd behavior intensified the panic. Momentum-based algorithms joined retail investors in exiting positions, creating a feedback loop that pushed prices down faster than fundamentals warranted.

Lastly, macroeconomic pressures exacerbated the situation. Rising U.S. Treasury yields, a strengthening dollar, and ongoing trade tensions reduced investors’ appetite for risk, with crypto assets bearing the brunt as high-volatility instruments.

Recovery Efforts and the Road Ahead

By Saturday morning, Bitcoin showed signs of stabilization. Buyers cautiously entered the market near $102,000, and by Monday, prices had rebounded to the $114,000-$115,000 range.

Historically, October has been a favorable month for Bitcoin, often referred to as “Uptober” due to its tendency to deliver strong gains.

Some market analysts pointed out that previous declines exceeding 5% during October were frequently followed by rebounds of up to 20% within a week. If this pattern holds, a return to the $124,000 level remains within reach.

Nevertheless, market sentiment remains delicate. Many traders are adopting a wait-and-see approach, seeking assurance that the worst is behind them and that exchanges can be relied upon.

Institutional investors share this caution. The incident has revived concerns about counterparty risk, especially on offshore platforms with limited transparency. Encouraged by Marszalek’s call for oversight, U.S. regulators may now push for enhanced audit requirements and stronger trading protections.

0 Comments