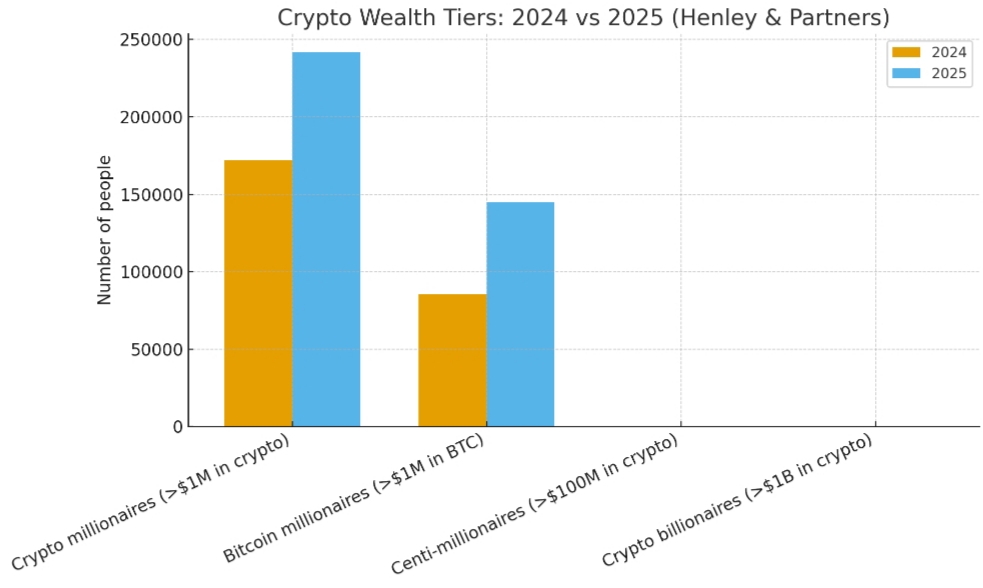

By mid-2025, the global population of cryptocurrency millionaires had soared to approximately 241,700, marking a remarkable 40% increase compared to the previous year. This surge is primarily attributed to Bitcoin’s impressive price rally and the overall crypto market capitalization surpassing $3.3 trillion in July, as detailed in Henley & Partners’ Crypto Wealth Report 2025.

The wealth accumulation is heavily skewed toward the upper echelons. Utilizing data from New World Wealth alongside publicly available blockchain information, Henley & Partners identified 450 centi-millionaires-individuals possessing over $100 million in crypto assets-a 38% rise from the prior year.

Moreover, the report notes the emergence of 36 crypto billionaires, reflecting a 29% growth since mid-2024. This rapid expansion at the top tiers is fueled by increased institutional investments and rising asset valuations, which amplify the concentration of wealth.

Bitcoin remains the dominant catalyst behind this trend. The number of Bitcoin millionaires surged by 70% year-over-year, reaching 145,100. This growth aligns with significant inflows into spot Bitcoin ETFs and a renewed institutional interest in Bitcoin as a hedge against macroeconomic uncertainties.

The crypto ecosystem itself is expanding broadly. Henley estimates that around 590 million individuals worldwide are engaged with cryptocurrencies as of mid-2025. However, the disproportionate rise in millionaires compared to user growth suggests that wealth gains are predominantly captured by early adopters and existing holders rather than new entrants.

Financial institutions, wealth advisors, and migration consultants are increasingly attuned to these developments. Private banks are evolving their offerings to accommodate digital asset portfolios, while residency and citizenship programs are beginning to accept cryptocurrency as a legitimate source of funds. This evolution is reshaping how ultra-high-net-worth individuals approach global mobility and tax optimization.

Geographical Concentration of Emerging Crypto Wealth

Henley’s analysis highlights a select group of regions that have become magnets for crypto millionaires. The Asia-Pacific and North American markets continue to be pivotal due to their robust technology sectors and institutional capital bases. However, other jurisdictions are rapidly gaining traction by fostering crypto-friendly policies and attractive migration schemes.

Key hotspots include Singapore, Hong Kong, the United States, Switzerland, and the United Arab Emirates. These locations excel in combining widespread crypto adoption, strong institutional frameworks, regulatory transparency, and favorable tax and residency programs.

Additional destinations drawing crypto wealth include Malta, the Cayman Islands, the Bahamas, and Panama, each offering unique blends of regulatory clarity, tax benefits, and private banking services.

Interest in “golden visa” programs and crypto-compatible investment migration is on the rise, even though direct crypto payments for these schemes remain limited due to compliance challenges. Notably, younger generations, particularly Gen Z, show a stronger inclination toward migration options that align with their borderless digital assets.

This evolving demographic represents a highly mobile, digitally native wealthy class that prioritizes jurisdictions offering clear crypto regulations, minimal restrictions on capital flows, and competitive tax environments.

Governments are responding by discreetly enhancing services tailored to the needs of crypto-affluent individuals.

However, the concentration of wealth also introduces vulnerabilities. Market volatility can swiftly diminish substantial paper gains, and regulatory uncertainties pose ongoing risks for those holding large, concentrated crypto positions.

Industry experts suggest that the coming quarters will be critical in determining whether the market stabilizes under clearer regulatory frameworks and deeper institutional custody solutions or faces intermittent disruptions from policy shifts.

Outlook for Crypto Wealth in 2026

Should the momentum observed throughout 2024 and 2025 persist, Henley projects a continued rise in the number of crypto millionaires in 2026.

Conservatively extrapolating current trends-assuming moderate growth in market capitalization and Bitcoin’s sustained role as a preferred store of value-the global count of crypto millionaires could approach the mid-300,000s next year, provided institutional ETF inflows and macroeconomic conditions remain favorable.

It is important to note that this projection is a scenario based on recent growth patterns and ongoing institutional interest, rather than a definitive forecast.

Key factors to watch include ETF capital flows, regulatory developments in the U.S. and European Union, and any significant risk-off moves by major institutional investors.

Should regulators impose stricter controls or if macroeconomic pressures intensify, the market could experience rapid reversals in wealth accumulation.

Conversely, ongoing institutional adoption, enhanced custody solutions, and favorable tax or residency incentives could accelerate the creation of crypto wealth.

Henley’s report emphasizes that this transformation extends beyond mere price fluctuations; it signifies a fundamental shift in how affluent individuals preserve and transfer value in the digital age.

0 Comments