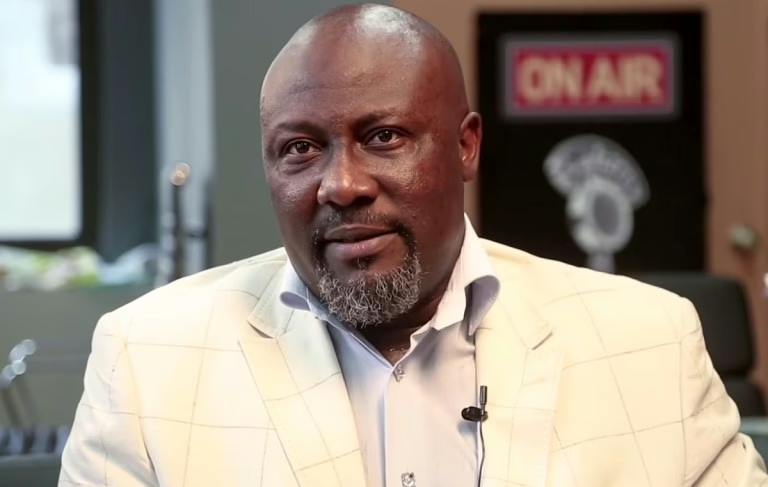

Senator Dino Melaye Faces Allegations of Tax Evasion Amounting to N509.6 Million

Senator Dino Melaye is currently under scrutiny for allegedly evading taxes totaling N509.6 million for the fiscal years 2023 and 2024. Authorities have indicated that, beyond the principal amount, he may be liable for substantial fines and accrued interest, significantly increasing his financial obligations.

Details of the Tax Assessment and Potential Consequences

The Nigerian tax authorities have conducted a thorough review of Senator Melaye’s financial declarations, resulting in the assessment of over half a billion naira in unpaid taxes. This figure encompasses income and other relevant tax liabilities for the two-year period. If confirmed, the senator could face not only the repayment of the assessed sum but also punitive charges designed to deter tax evasion.

Contextualizing Tax Compliance in Nigeria’s Political Sphere

Tax compliance remains a critical issue among public officials in Nigeria, with recent years witnessing increased enforcement efforts. For instance, in 2023, the Federal Inland Revenue Service (FIRS) reported a 15% rise in tax audits targeting high-net-worth individuals and politicians, reflecting a broader governmental push to enhance revenue collection and accountability.

Implications for Public Trust and Governance

Cases like Senator Melaye’s highlight ongoing challenges in ensuring transparency and fiscal responsibility among elected representatives. Tax evasion allegations can erode public confidence and underscore the necessity for robust legal frameworks and enforcement mechanisms. Comparable situations in other countries, such as the 2022 tax investigations involving prominent lawmakers in South Africa, demonstrate the global relevance of these issues.

Source: Premium Times Nigeria

0 Comments