By June 2025, the number of DStv subscribers in Kenya had plummeted to 188,824, a sharp decline from 1.2 million the previous year, according to recent figures released by the Communications Authority of Kenya (CA). Similarly, GOtv, another MultiChoice-owned service, experienced a drastic drop from 2.8 million to 314,520 subscribers during the same timeframe.

This significant downturn represents the bulk of the 77% shrinkage witnessed in Kenya’s pay-TV sector over the past year, highlighting a rapid exodus of households from traditional subscription television.

The most pronounced decline was seen in digital terrestrial television, the platform on which GOtv operates, with subscriptions tumbling by 89% year-over-year. Competitor StarTimes also saw its subscriber base shrink from 1.7 million to 492,330.

Satellite-based direct-to-home (DTH) services were not spared, experiencing a 67% reduction in subscribers, with DStv suffering the steepest losses. In contrast, Wananchi Group’s Zuku cable service bucked the trend, growing its subscriber count by 20% to exceed 64,000.

MultiChoice has implemented five subscription price hikes over the last three years. Currently, DStv Premium, the company’s top-tier package, costs approximately KES 11,700 ($91) monthly, up from KES 7,500 ($58) in 2022. Several subscribers interviewed by TechCabal expressed reluctance to continue absorbing these increases, especially given the availability of more affordable alternatives.

“Once you remove bars, eateries, a handful of offices, and local football viewing spots, the subscriber base is almost nonexistent,” remarked Paminus Osike, a former DStv user. “When satellite dishes started appearing on street corners, it was a clear sign of the direction things were heading.”

Netflix, offering plans starting at KES 200 ($1.55) for mobile-only and KES 1,100 ($8.50) for premium access, has gained traction as a substitute for general entertainment, despite lacking live sports content.

Showmax, a MultiChoice streaming service, charges KES 520 ($4) monthly for its entertainment package. Until early 2024, Showmax Pro included Premier League and other sports broadcasts on television, but MultiChoice discontinued this in favor of a mobile-only sports streaming plan priced at KES 450 ($3.50) per month. Many former DStv customers find this less appealing, as it disrupts the traditional experience of watching football together on a TV screen.

Another challenge facing the industry is piracy. Illegal streaming platforms and apps widely distribute football matches and premium shows. With MultiChoice’s Premier League broadcasting rights set to expire this year, some Kenyan viewers suggest that the company should reconsider renewing these rights, arguing that the high costs are no longer justified by the dwindling audience numbers.

While bars and hotels remain among the few consistent users of DStv, even these venues are exploring cheaper or unauthorized viewing options as profit margins tighten.

This upheaval coincides with French media giant Groupe Canal+ completing its acquisition of a 46% stake in MultiChoice at R125 ($7.20) per share, with further acceptances anticipated.

The merger creates a combined subscriber base exceeding 40 million across nearly 70 countries. However, Kenya’s sharp subscriber decline highlights the difficulties in retaining premium satellite customers amid a shift toward streaming services, free-to-air channels, and illicit content sources.

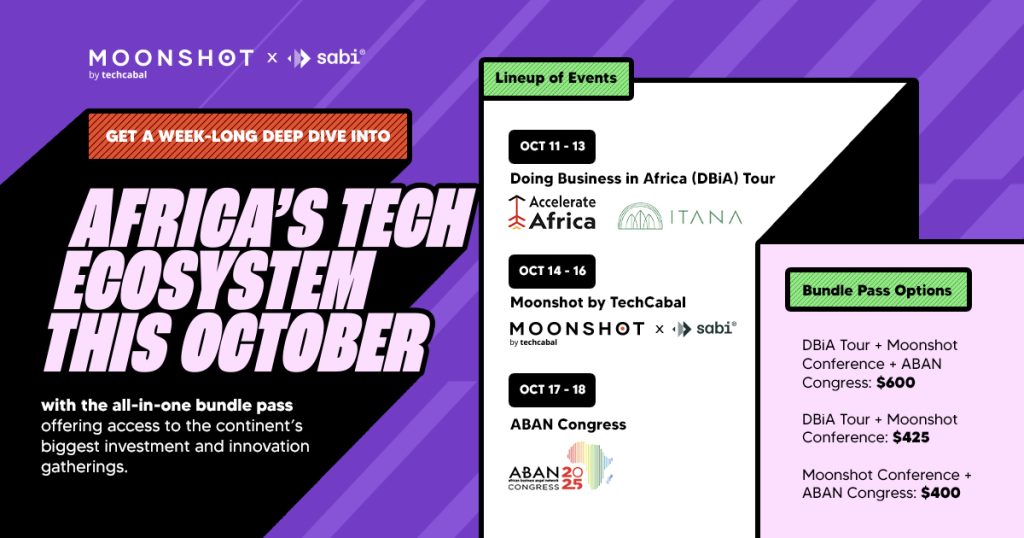

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days of inspiring talks, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com

0 Comments