The Federal Competition and Consumer Protection Commission (FCCPC) has committed to enforcing the Central Bank of Nigeria’s (CBN) updated ATM management guidelines, which require banks to resolve failed transactions within 48 hours.

In a statement issued on Monday and signed by Ondaje Ijagwu, Director of Corporate Affairs, the FCCPC expressed support for the new 48-hour timeframe set for banks to refund customers after unsuccessful ATM transactions.

To ensure compliance, the commission plans to implement robust monitoring mechanisms aimed at identifying banks that fail to meet these standards.

“The Commission believes that enhanced cooperation among regulatory bodies will accelerate problem resolution, reduce recurrence, and boost consumer trust in Nigeria’s expanding digital economy,” the statement emphasized.

![FCCPC approves 173 digital lending platforms, bars illegal loan apps [FULL LIST]](https://lifeinlagos.com/wp-content/uploads/2025/09/FCCPC-withdraws-breach-of-compliance-case-against-MTN-Nigeria-executives.jpg)

The commission also outlined the proper channels for customers to report unresolved or failed ATM transaction issues.

Last week, the CBN unveiled the “Draft Guidelines on the Operations of Automated Teller Machines in Nigeria,” a revised framework designed to regulate ATM deployment and operations nationwide.

According to section 10 of the guidelines, reversals for ‘failed on-us’ ATM transactions must be immediate, while ‘failed not-on-us’ transactions should be reversed within 48 hours. In cases where technical difficulties affect ‘failed on-us’ transactions, manual reversals are required within 24 hours.

This regulation is a critical step toward establishing a more reliable ATM infrastructure, offering enhanced protection for consumers. The FCCPC noted that this rule addresses long-standing concerns over delays in resolving transaction failures.

Additionally, the updated guidelines require banks to disable the ATM’s ability to retract cash during technical malfunctions. For example, if an ATM fails to dispense cash properly, it will no longer be able to reclaim the money, preventing customer losses.

When a failed transaction occurs, customers are advised to first contact their bank or the CBN. If the issue remains unresolved, they can escalate their complaints to the FCCPC through the following platforms:

- Complaint portal: complaints.fccpc.gov.ng

- Email: [email protected]

- Phone: 0805 600 2020

Also read: FCCPC withdraws criminal charges against MultiChoice following pricing dispute.

FCCPC Recognizes ATM Regulations as a Direct Response to Consumer Feedback

The FCCPC praised the CBN’s new ATM guidelines as a timely intervention addressing widespread consumer grievances.

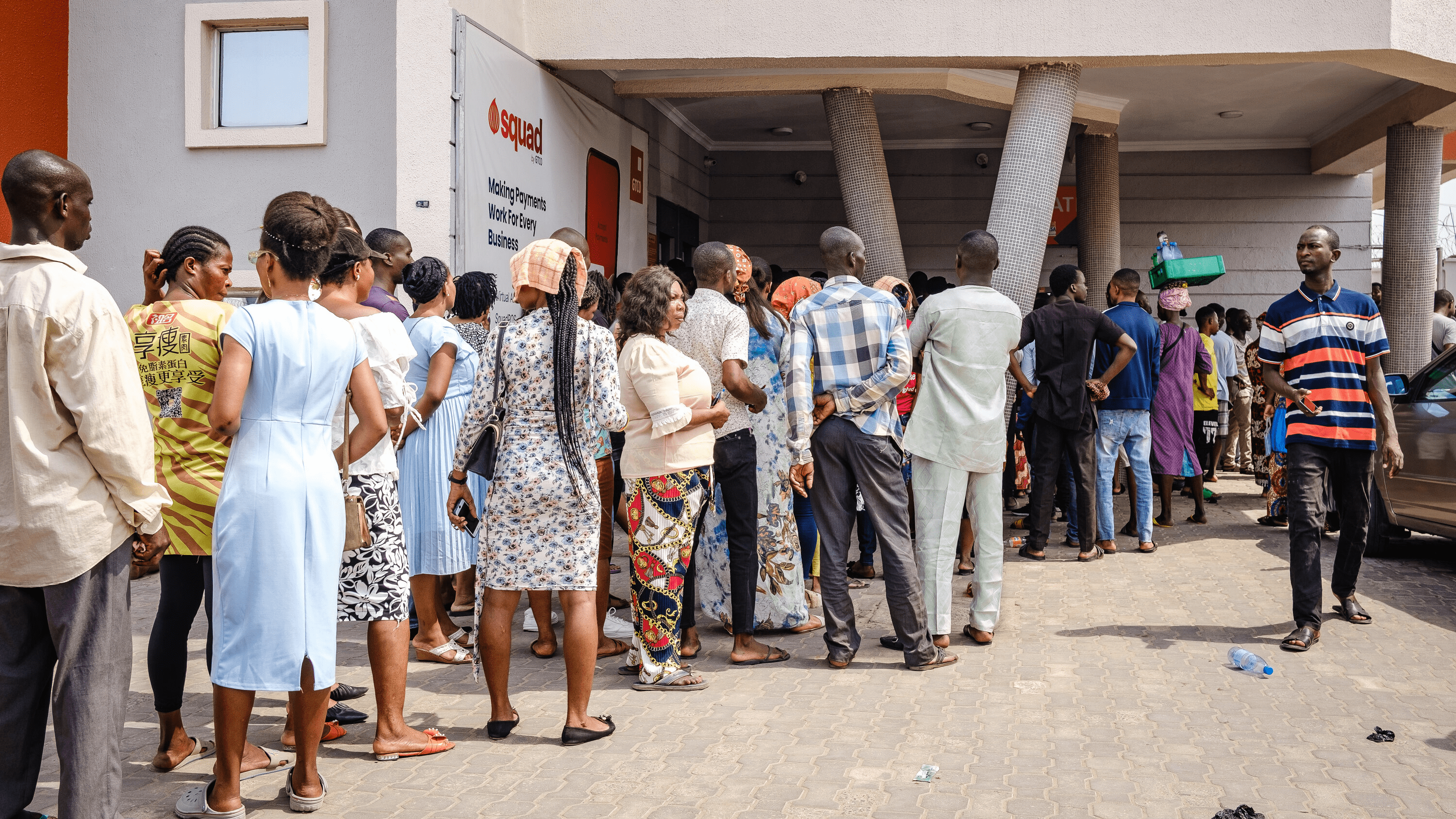

In its September 2025 “Consumer Complaints Data Report,” the commission revealed that 9,091 complaints were filed between March and August 2025. The banking sector accounted for the largest share with 3,173 complaints, while fintech companies received 1,442.

The FCCPC highlighted that the revised CBN rules directly tackle common issues such as failed transactions, unauthorized deductions, and delayed refunds. The commission views the draft guidelines as a vital step toward strengthening regulatory oversight and protecting consumers.

The FCCPC urged the CBN to expedite the formal adoption and enforcement of these regulations, emphasizing that prompt implementation will hold financial institutions accountable and promote fairness.

“Early enforcement will offer immediate relief to consumers who frequently face delays or unresolved electronic transaction reversals,” the statement added.

This development marks a significant milestone in tackling a persistent challenge within Nigeria’s financial sector. By enforcing stricter timelines for reversing failed transactions, it fosters greater consumer confidence and accountability in banking services.

0 Comments