Table of Contents

Understanding eRITS

Reasons Behind KRA’s eRITS Implementation

How Landlords Engage with eRITS

Consequences of Failing to Comply with MRI Tax Rules

The Kenya Revenue Authority (KRA) has rolled out the Electronic Rental Income Tax System (eRITS), an online platform designed to streamline the registration of rental properties, submission of tax returns, and payment of Monthly Rental Income (MRI) tax. Officially launched in April 2025, the system mandates full adherence by all landlords by September 2025.

KRA developed eRITS to tackle a persistent challenge: while rental income tax collections currently bring in about KES 17 billion annually (approximately $131.6 million), the actual potential revenue is estimated to surpass KES 100 billion (around $774 million). This discrepancy highlights widespread underpayment among landlords.

Through eRITS, landlords must input detailed property information, including their tenants’ Personal Identification Numbers (PINs). This enhanced transparency enables KRA to monitor rental income more effectively, reducing opportunities for tax evasion. Non-compliance can lead to penalties such as fines, retroactive tax assessments, frozen bank accounts, and legal proceedings.

In essence, eRITS represents KRA’s strategic effort to close loopholes in the rental sector and ensure landlords fulfill their tax responsibilities.

Understanding eRITS

The Electronic Rental Income Tax System (eRITS) is a government-backed digital tool launched in April 2025 to facilitate landlords in registering their rental properties, submitting monthly tax returns, and paying the Monthly Rental Income (MRI) tax. By September 2025, all property owners are required to have their properties registered on this platform.

Access to eRITS is available via erits.kra.go.ke or through the eCitizen portal. The system operates on the government’s Gava Connect integration platform, allowing real-time processing of tax filings and payments.

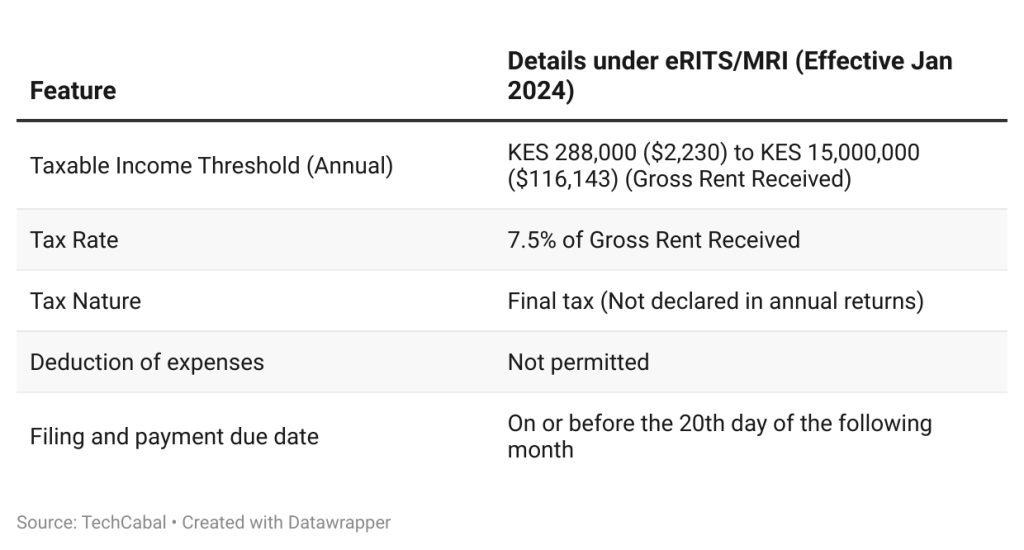

About the Monthly Rental Income (MRI) Tax

It’s important to note that eRITS does not introduce a new tax but enforces the existing Monthly Rental Income (MRI) tax, which has been effective since 2016. This tax targets individuals or entities earning between KES 288,000 ($2,229) and KES 15 million ($116,144) annually from residential rental income.

The applicable tax rate is currently set at 7.5% of the gross rent, reduced from the previous 10% to encourage compliance. This tax is final, meaning landlords cannot deduct expenses or claim allowances against their rental income.

Landlords are obligated to file their MRI returns and remit payments by the 20th day of the month following the rental period. In months where no rent is collected, a NIL return must still be submitted.

Reasons Behind KRA’s eRITS Implementation

1. Bridging the Rental Tax Revenue Gap

Currently, KRA collects roughly KES 17 billion ($131.6 million) annually from rental income taxes, yet the sector’s full potential is estimated at over KES 100 billion ($774 million). This significant shortfall indicates that many landlords are not fulfilling their tax obligations. Previous initiatives like iTax and tax amnesties have had limited success in addressing this issue.

With eRITS, the government aims to broaden the tax base by bringing more landlords into the formal tax system, thereby increasing revenue to support Kenya’s expanding fiscal needs. For instance, in the 2023/2024 fiscal year, KRA recorded collections of KES 14.4 billion, marking a slight improvement from prior years.

2. Widening the Taxpayer Base

eRITS forms part of KRA’s broader strategy to capture untaxed income from the real estate sector, which has traditionally been difficult to regulate due to informal landlord operations. By leveraging digital innovations such as Gava Connect, advanced data analytics, and geographic information systems, KRA can now accurately identify properties, verify ownership, and enforce compliance more effectively.

3. Enhanced Data Integration and Enforcement

A key advantage of eRITS is its interoperability with other government databases. For example, integration with the Ministry of Lands’ Ardhisasa system enables KRA to cross-reference rental income declarations against official land ownership records, making it harder for landlords to conceal assets or underreport income.

The platform also facilitates tax collection at source by allowing property managers to act as tax agents who deduct the 7.5% MRI tax directly from rent payments and remit it to KRA, ensuring faster and more efficient revenue collection.

How Landlords Engage with eRITS

1. Property Registration

Landlords earning rental income in Kenya must register their properties on the eRITS platform via the iTax portal or the eCitizen website. During registration, landlords provide details such as property type, monthly rental amount, and crucially, the tenant’s Personal Identification Number (PIN).

Providing the tenant’s PIN is mandatory as it links the property to the tenant, enabling KRA to verify that declared rental income aligns with actual tenancy. This requirement strengthens KRA’s ability to detect discrepancies and challenge inaccurate declarations.

2. Filing Returns and Making Payments

After registration, landlords must submit their Monthly Rental Income (MRI) returns through eRITS. The system automatically computes the 7.5% tax based on the reported rent. If landlords have tax credits or withholding certificates, these are factored into the final payable amount.

Upon filing, a Payment Registration Number (PRN) is generated, which landlords use to complete payments via mobile money or bank transfers. Returns and payments are due by the 20th of the month following the rental period. Even in months with no rental income, landlords must file a NIL return.

3. Advantages of Compliance

Utilizing eRITS simplifies tax filing, reduces administrative burdens, and minimizes paperwork. Compliant landlords benefit from smoother interactions with KRA and can better manage their financial planning. The reduced tax rate of 7.5% was introduced to incentivize adherence to tax obligations.

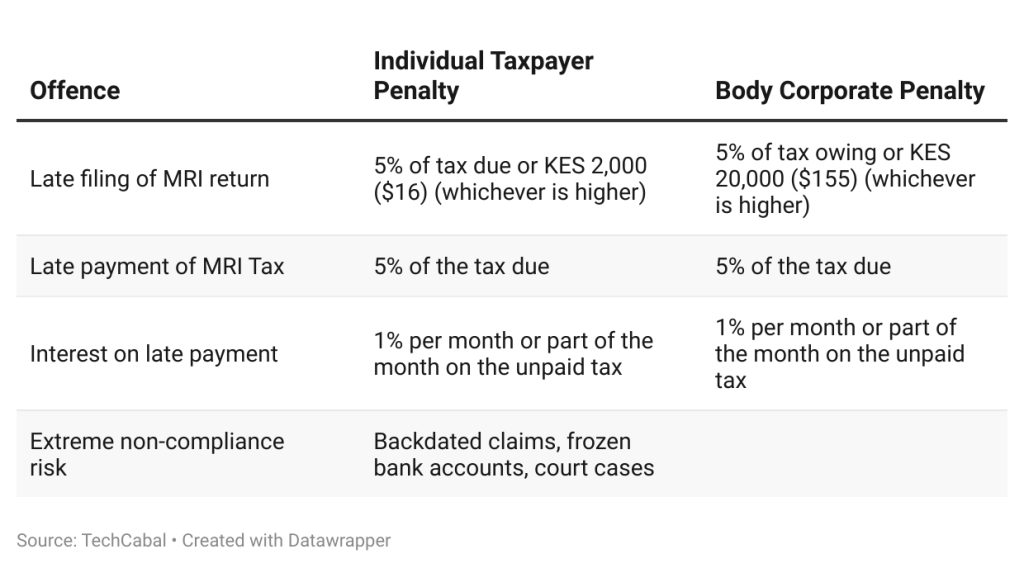

4. Penalties for Non-Compliance

Failure to comply with eRITS requirements carries significant penalties. Late filing of MRI returns attracts a penalty of 5% of the tax due or KES 2,000 (for individuals) / KES 20,000 (for companies), whichever is greater. Late payments incur a 5% penalty plus 1% interest per month on the outstanding tax. Neglecting to deduct or remit withholding tax results in a 10% penalty on the tax amount involved.

Beyond monetary fines, KRA may impose backdated tax assessments, freeze bank accounts, or initiate legal action. Given eRITS’ integration with other government systems, KRA’s assessments are robust unless landlords can provide compelling evidence to dispute them. Poor record-keeping will no longer protect landlords from penalties.

Consequences of Failing to Comply with MRI Tax Rules

Implications for Tenants and Data Privacy

A contentious aspect of eRITS is the mandate for landlords to collect and submit tenants’ KRA PINs. KRA asserts this measure verifies rental agreements and cross-checks declared income. While this strengthens KRA’s ability to detect underreporting, it raises privacy concerns for tenants.

Under Kenya’s Data Protection Act, a PIN is classified as personal data. Tenants have the right to understand how their information is handled, and KRA must ensure transparency and implement safeguards to protect this data. Although KRA may use the data as legally required, clearer communication is necessary to reassure tenants that their information is used solely for rental verification and not for broader financial scrutiny.

Moreover, eRITS formalizes the rental market by requiring landlords who previously operated informally to maintain proper records and register tenants. This shift may reduce landlords’ net earnings since the tax applies to gross rent without deductions. Over time, some landlords might transfer this tax burden to tenants through increased rent.

Conclusion

The introduction of the Electronic Rental Income Tax System marks a pivotal move by KRA to bridge the estimated KES 83 billion annual shortfall in rental tax collections. For landlords who comply, eRITS offers a transparent and efficient tax management system. Conversely, non-compliance risks substantial penalties, retroactive tax claims, and asset freezes.

Tenants face concerns regarding the mandatory submission of their PINs, underscoring the need for KRA to uphold data privacy standards and communicate clearly about data usage.

Next steps include:

- For landlords: Promptly register your properties on eRITS, maintain accurate financial records, and ensure tenant information is current.

- For tenants: Understand your rights under the Data Protection Act and seek clarity from KRA on how your data is utilized.

- For KRA: Improve system reliability, provide clear guidelines for handling technical issues, and offer alternative compliance channels such as USSD to accommodate all taxpayers.

0 Comments