Mirova, a sustainability-focused investment firm based in Paris, has committed $10 million to ARC Ride, a Kenyan electric mobility startup. This marks Mirova’s inaugural investment in Africa’s electric vehicle sector.

The capital injection comes from Mirova’s $282 million Gigaton Fund, which targets climate-driven ventures in emerging economies. This funding will support ARC Ride’s expansion of its battery-swapping infrastructure for electric motorcycles across Kenya’s urban areas.

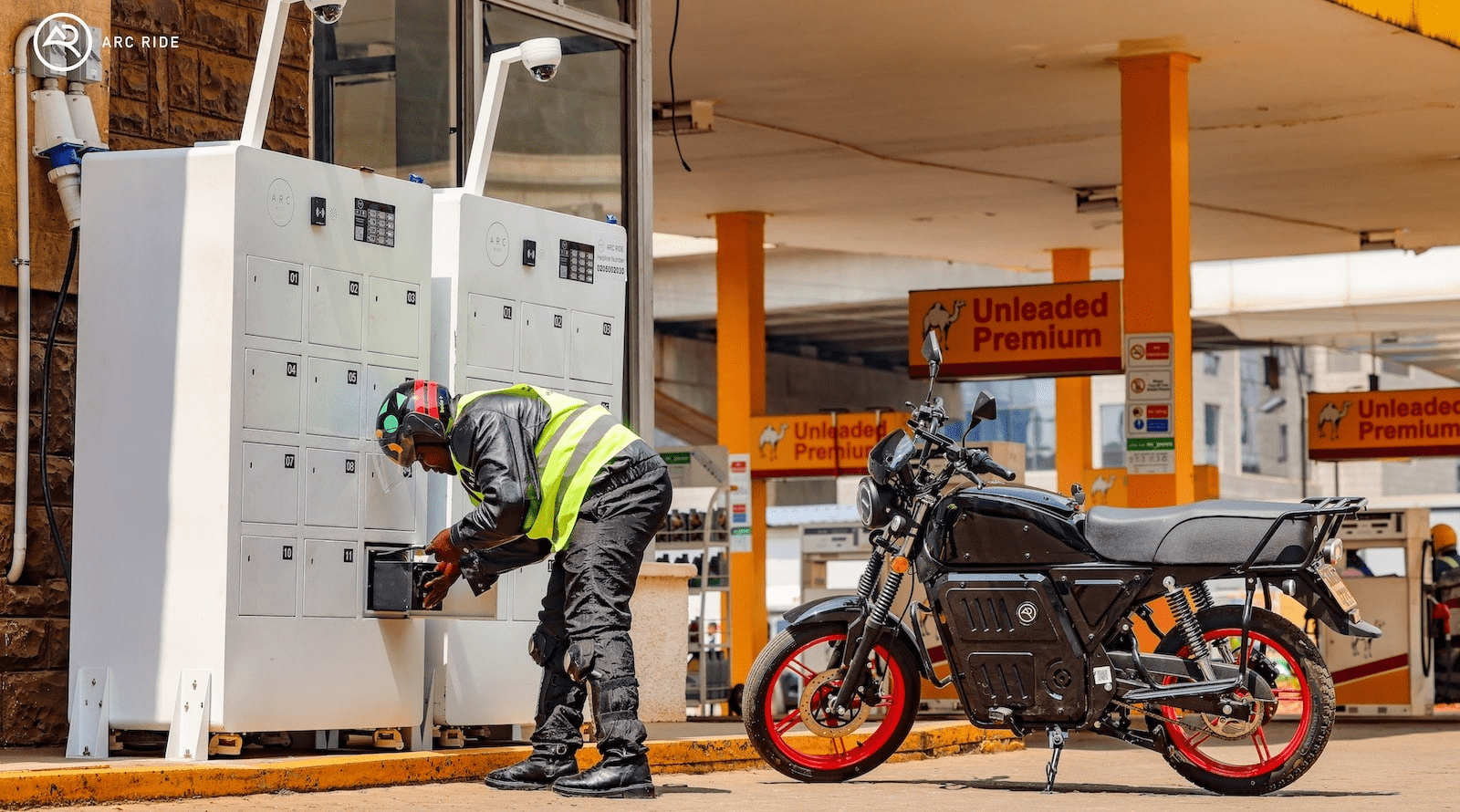

Specifically, ARC Ride plans to install over 600 battery-swapping stations and distribute 25,000 batteries nationwide. This expansion aims to provide boda boda riders-Kenya’s motorcycle taxi operators-with affordable access to electric motorcycles, eliminating the burden of high upfront costs and concerns about recharging.

ARC Ride’s innovative Battery-as-a-Service (BaaS) system allows riders to quickly swap depleted batteries for fully charged ones, significantly lowering operational costs by removing fuel expenses and reducing maintenance.

Joseph Hurst-Croft, CEO of ARC Ride, described this partnership as a pivotal step toward making electric transportation accessible, cost-effective, and environmentally friendly throughout Africa.

Expanding Battery-Swapping Services to Over 100,000 Riders

With this new capital, ARC Ride is set to scale its operations to serve upwards of 100,000 riders in key cities such as Nairobi, Mombasa, and Kisumu. Each electric motorcycle is expected to reduce carbon emissions by roughly two tonnes annually, potentially cutting 50,000 tonnes of CO₂ emissions per year.

For boda boda operators, who often work in the informal gig economy, switching to electric motorcycles means saving between $1 and $2 daily on fuel and reducing maintenance costs by up to 40% annually.

The BaaS model not only lowers the initial investment barrier for electric vehicle ownership but also alleviates range anxiety by providing widespread battery-swapping stations, encouraging more riders to transition from petrol-powered bikes.

Hurst-Croft emphasized that this investment highlights the feasibility of sustainable, scalable urban transport solutions in African cities, benefiting both riders and the environment.

Rising Investor Interest in Africa’s Electric Mobility Market

This funding round underscores the increasing global enthusiasm for Africa’s electric mobility sector, particularly in the two-wheeler segment, which dominates urban transport across many African cities.

Motorcycle taxis, commonly known as boda bodas, are a primary mode of transport in cities like Nairobi, Mombasa, and Kisumu. Transitioning to electric motorcycles offers significant economic savings and environmental benefits.

Industry analysts forecast that Africa’s electric motorcycle market will grow at an annual rate of 10.6% through 2029, presenting a lucrative opportunity for startups like ARC Ride to scale rapidly and establish a strong presence in the e-mobility landscape.

Also read: Kenyan e-mobility startup BasiGo secures $3 million equity investment from CFAO Group

East Africa has emerged as the leading region for venture capital in Africa in 2024, accounting for 33% of the continent’s total $2.2 billion funding.

Kenyan startups have been at the forefront, raising $638 million-representing 88% of East Africa’s total and nearly 29% of Africa’s overall venture capital inflows.

Kenya’s position as a top investment destination is largely driven by its thriving climate technology sector, which has become the country’s most dynamic and well-funded industry. This growth is supported by institutions such as the Kenya Climate Innovation Centre (KCIC), Kenya Climate Ventures (KCV), and Octavia Carbon.

Noteworthy funding rounds this year include d.light’s $176 million securitization facility in July, SunCulture’s oversubscribed $27.5 million Series B, and BasiGo’s $44.5 million Series A aimed at deploying 1,000 electric buses across East Africa within three years.

Collectively, these three climate tech companies have raised $248 million in 2024, accounting for approximately 39% of Kenya’s total funding this year. Since 2019, climate technology startups have attracted 44% of all venture capital in Kenya, totaling around $1.5 billion.

0 Comments