Safaricom, Kenya’s leading telecommunications provider with a subscriber base exceeding 35 million, has successfully executed the most extensive upgrade of the M-PESA core system since the platform was localized ten years ago. Services were fully restored early Monday morning following a three-hour transition period.

This major enhancement, dubbed Fintech 2.0, transitions Africa’s second most popular mobile money platform to a cloud-native infrastructure. At launch, the system can handle up to 6,000 transactions per second, with scalability designed to accommodate double that volume as user demand intensifies.

In a statement released Monday morning via Twitter, Safaricom confirmed, “The planned M-PESA upgrade has been completed successfully, and all services are now operational. We are committed to delivering improved and seamless experiences to our customers.”

The modernization expands M-PESA’s capacity to manage increasing transaction loads and streamlines the process for Safaricom to introduce new functionalities. Additionally, it facilitates easier integration for banks and fintech companies, a crucial development as the digital payments landscape becomes more competitive.

An insider familiar with the upgrade, speaking on condition of anonymity, shared with Techcabal that engineers are closely observing the system for any anomalies. This monitoring phase is expected to continue for several days as real-time transaction data flows through the revamped core.

Handling over 21 billion transactions annually, M-PESA supports payments, credit services, remittances, and e-commerce for more than 50 million users across the continent.

The previous infrastructure was nearing its maximum capacity of 4,500 transactions per second, limiting growth and adaptability. The new architecture, built on microservices and hosted on Huawei Cloud locally, enables Safaricom to update individual components without disrupting the entire platform-marking a significant improvement in reliability and operational speed.

Two additional sources close to Safaricom’s operations, who preferred to remain unnamed to speak candidly, revealed that the company is now focusing on how banks, fintech firms, and developers will integrate with the upgraded system.

This move is expected to foster more collaborations, continuing the vision set by the late former CEO Bob Collymore, who envisioned Safaricom evolving into a platform-centric business rather than a closed ecosystem. The new system is anticipated to accelerate API deployment, partner onboarding, and innovation in services such as merchant credit and cross-border payment solutions.

Completing this migration provides Safaricom with a strategic advantage as competitors intensify their efforts in the mobile money sector. Rivals like Airtel Money and emerging digital-first companies have been steadily gaining ground, posing a challenge to M-PESA’s dominance.

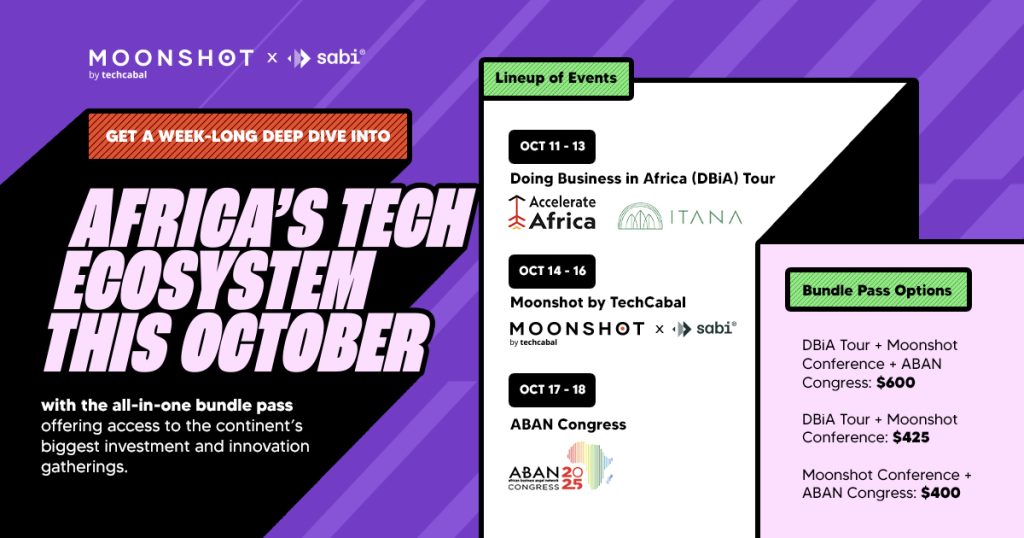

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Early bird tickets are now available at a 20% discount-don’t miss out! Visit moonshot.techcabal.com

0 Comments