The pay-TV sector in Africa is on the verge of a historic shift as MultiChoice begins reorganising its South African business to pave the way for Canal+ to proceed with its R55-billion (approximately $3.17 billion) offer to acquire it.

In a statement to shareholders on Monday, MultiChoice reiterated that all the transactions necessary to restructure its South Africa Holdings are in place. This was one of the key conditions laid out by the Competition Tribunal for the French media group to proceed with its mandatory offer.

The reorganisation will see the unbundling of MultiChoice’s local business, paving the way for Canal+ to gain full ownership of the group. After the process is completed, a new timeline for the minority shareholders’ offer will be released, marking the final phases of one of Africa’s most highly anticipated corporate deals.

Vivendi Group-owned Canal+ has quietly built up its stake in MultiChoice since the beginning of 2024, ultimately making an offer of R125 per share to acquire the Johannesburg-listed company. The deal would lock in Canal+’s strength on the continent and give it a strong footprint in the pay-TV and streaming space, where the battle with global giants like Netflix, Amazon Prime Video, and Disney+ is intensifying.

What the takeover means for Africa’s streaming market

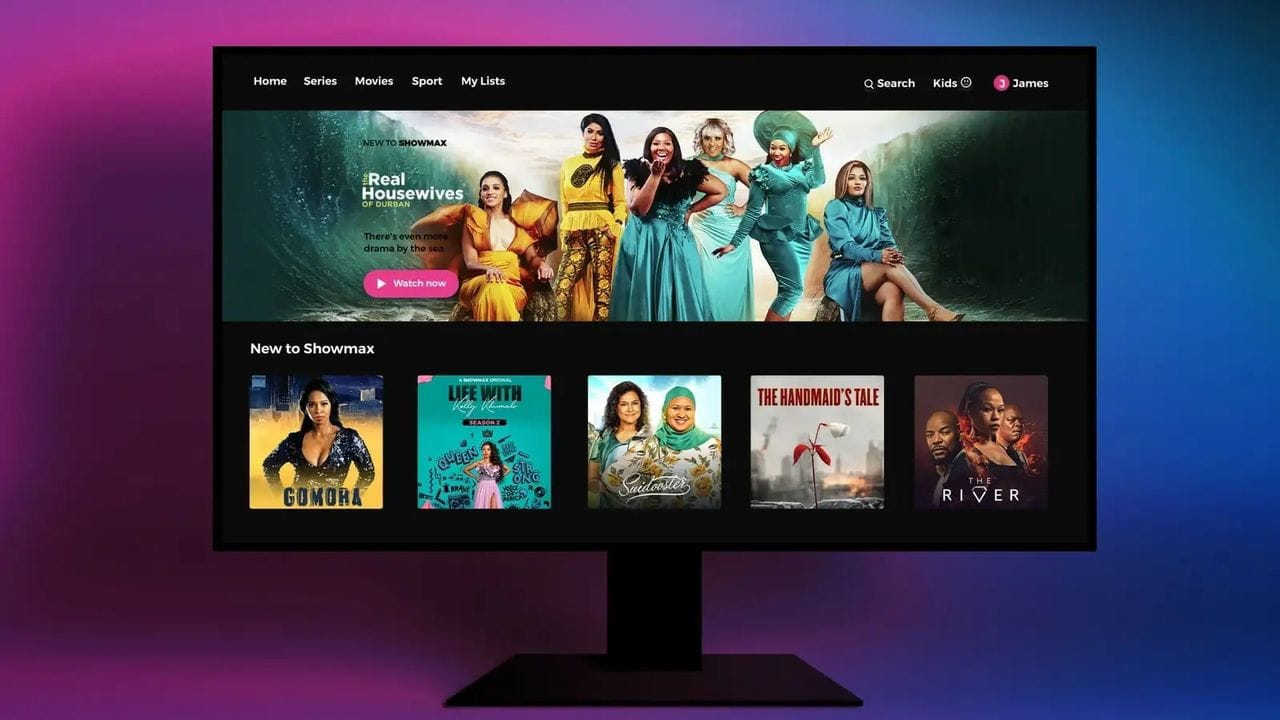

The Canal+ takeover will reshape Africa’s entertainment and media industry, creating one of the continent’s most powerful broadcast and streaming networks. MultiChoice’s video streaming arm, Showmax, which has been redesigned in partnership with Comcast-owned NBCUniversal and Sky, will be the flagship for this transformation. The service already carries a mix of African local content, global dramas, and exclusive sports coverage, and with the injection of capital from Canal+, its content weaponry and technical abilities are set to grow immensely.

The integration will allow Showmax to leverage Canal+’s large global content library and production capacity to deliver more local African content, enhance live sports coverage, and support the viewing experience with more advanced recommendation features, improved video quality, and seamless cross-device viewing. This could make Showmax a stronger challenger to Netflix, Amazon Prime Video, and Disney+, which have been slowly building their African subscriber bases.

See also: MultiChoice set to acquire new investors to modify Canal+ takeover

The agreement is also in line with MultiChoice’s vision to tap into Africa’s fast-growing digital economy. With internet penetration levels currently in excess of 40% in the majority of its core markets and smartphone penetration accelerating, there is increasing demand for affordable mobile-based streaming services.

MultiChoice will introduce more flexible plans with weekly and daily payment, aimed at addressing price-sensitive consumers, as well as partnering with telecom operators to offer bundled data packages that lower the threshold of viewing streaming content.

Outside of content, the rebuilding and ultimate consolidation under Canal+ will allow MultiChoice to rationalise its operational model, reduce redundancy within divisions, and redirect resources towards innovation. Ring-fencing of its South African operations, a critical requirement by the Competition Tribunal, will see domestic commitments to broadcasting within the country, such as free-to-air news, educational programming, and sport coverage, continue to be met even as the group expands its focus on digital growth.

After completing the acquisition, MultiChoice will register its place among Canal+’s global network of media assets with enhanced bargaining power against studios, sports leagues, and technology companies. Increased scale will probably lower the cost of content acquisition per subscriber and make it more profitable. The impact for African audiences could be increased choice of quality programming, increased investment in local narratives, and improved streaming quality that keeps pace with international standards.

Stofberg’s legacy at MultiChoice

As previously reported by Technext, the reorganisation follows the retirement of Cobus Stofberg, the co-founder of M-Net and MultiChoice, who spent 40 years in the industry defining Africa’s media landscape. Stofberg was instrumental in building MultiChoice into a pan-African entertainment giant, developing DStv from 70,000 subscribers in 1998 to 350,000 within one year after launching additional channels like BBC Prime and National Geographic.

With him at the helm, MultiChoice launched GOtv, Showmax, and DStv Stream, innovations that positioned MultiChoice to excel in the streaming service era. In 2020, MultiChoice had 20.1 million subscribers across 50 countries in Africa, cementing its dominance in pay-TV.

Even when confronted with economic pressures, having lost 243,000 subscribers in Nigeria alone in 2024 to inflationary pressures, Stofberg’s leadership kept the company afloat. His ability to negotiate primal partnerships, including with Koos Bekker and Jac van der Merwe, facilitated early funding by Naspers and dictated M-Net’s expansion.

His retirement also comes at the end of an era as MultiChoice commences a new chapter under Canal+, and this current restructuring is therefore symbolic and strategic for the future direction of the group.

0 Comments