Nigeria aims to boost its tax and customs revenue to a minimum of ₦17.85 trillion ($11.92 billion) by 2026, with technology playing a pivotal role in this ambition. As income from crude oil declines, tax revenues have become an increasingly vital source of government funding.

The bulk of this revenue is expected to come from value-added tax (VAT), corporate income tax, customs duties, and the electronic money transfer levy, as outlined in the 2025-2027 Medium Term Fiscal Framework and Fiscal Strategy Paper.

For 2025, the government targets ₦16.05 trillion ($10.72 billion) from these streams. Historically, inefficiencies such as poor administration, low compliance rates, and reliance on manual, paper-based systems have led to revenue leakages and corruption.

In response, Nigeria introduced new legislation in 2025 to tackle issues like multiple taxation on businesses. President Bola Tinubu remarked, “We have unlocked new economic opportunities and business prospects.” Yet, the true transformation hinges on the integration of digital technologies.

A 2023 study on enhancing tax collection efficiency emphasized that “embracing technology in tax administration can boost compliance, lower collection costs, and increase revenue.”

Technology as the Catalyst

To maximize revenue, Nigeria plans to broaden the network of VAT collection agents, streamline compliance processes, and reduce tax expenditures. Nevertheless, technology remains the cornerstone of this strategy, according to the fiscal policy document.

The country looks to replicate the achievements of nations like Rwanda, which digitized its customs operations through the Electronic Single Window system, and Kenya, which employs the iTax platform for tax administration.

Domestically, platforms such as TaxPro Max, launched in 2021, facilitate online taxpayer registration, filing, payment, and issuance of tax clearance certificates. From August 1, 2025, large enterprises with annual turnovers exceeding ₦5 billion ($3.34 million) must integrate their invoicing systems with the Federal Inland Revenue Service (FIRS) platform for real-time validation and reporting.

The government’s policy paper highlights, “Utilizing technology like automated tax administration systems (TaxPro Max and E-services) simplifies tax procedures, encourages voluntary compliance, enhances revenue collection, and fosters a taxpayer-friendly environment.”

Additionally, VAT collection in retail sectors such as supermarkets and hotels will be automated through real-time portals designed to curb revenue leakages.

FIRS plans to employ a real-time online data mining portal to conduct desk reviews, audits, and investigations, enabling verification of taxpayer information and identification of non-compliance.

“Nigeria’s digital economy has grown rapidly, reshaping business operations and transaction processing,” FIRS stated in July. “However, this growth has outstripped traditional tax monitoring methods, creating gaps in transaction oversight and compliance.”

To enhance enforcement, FIRS will connect its database with other agencies like the Nigeria Inter-Bank Settlement System Plc (NIBSS), Nigeria Customs Service (NCS), Nigerian Communications Commission (NCC), and Corporate Affairs Commission (CAC) to gather third-party intelligence.

NIBSS, the nation’s central payment gateway, handled over ₦1 quadrillion ($667.79 billion) in transactions in 2024. In July, it was reported that FIRS developed a real-time portal to monitor all VAT-applicable electronic transactions, mandating integration from banks, card schemes, fintech firms, and payment service providers.

The government emphasized the importance of “strengthening collaboration among stakeholders to prevent leakages, combat evasion, and improve compliance.”

Financial institutions will also be subject to enhanced scrutiny as FIRS reconciles remittances from the Electronic Money Transfer Levy (EMTL), a ₦50 charge on transfers of ₦10,000 and above.

On the customs front, the government is advancing a $3.2 billion customs modernization initiative, originally launched in 2015, aimed at fully automating and simplifying customs procedures, including payments.

Despite delays caused by legal challenges, the Federal High Court in Abuja dismissed a case in 2024 contesting the concession agreement tied to the project, clearing the way for progress.

For many businesses, the shift toward digital tax administration means stricter compliance and fewer opportunities for evasion. The International Monetary Fund notes, “There is a positive correlation between business digitalization and domestic tax revenue; countries with higher digital adoption among firms tend to have greater tax-to-GDP ratios.”

The Nigerian government remains optimistic about its revenue goals, setting an even more ambitious target of ₦19.73 trillion ($13.18 billion) for 2027. However, realizing these projections depends on overcoming challenges such as inadequate infrastructure, inconsistent policy enforcement, and political commitment.

As Taiwo Oyedele, chairman of the Presidential Fiscal Policy and Tax Reforms Committee, stated in July, “The future of tax administration hinges on modernization and enhanced technology adoption.”

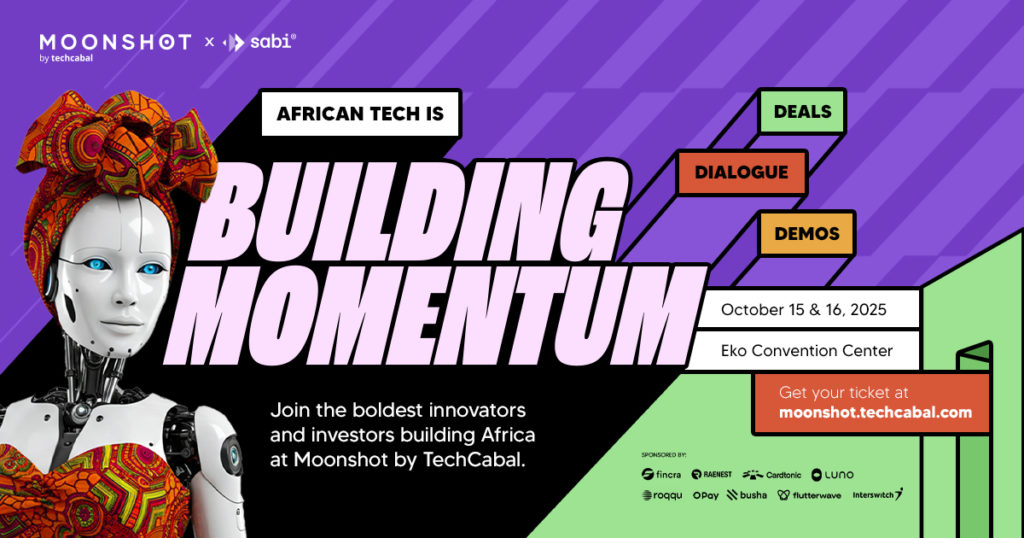

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com

0 Comments