Nigeria has postponed the replacement of its aging national satellite, NigComSat-1R, pushing the timeline from 2025 to 2028. This extension aims to solidify Nigeria’s foothold in the expanding digital landscape of West Africa. Launched in December 2011, NigComSat-1R is approaching the end of its operational life after serving the nation for over a decade. Manufactured in China with an expected lifespan of 15 years, the satellite is now running low on fuel, necessitating urgent plans for its successor.

Maximizing the Lifespan of NigComSat-1R

Weighing 5,150 kilograms and outfitted with 28 active transponders plus 12 backups, NigComSat-1R was designed to function for 15 years, which would have concluded around 2026. However, through meticulous fuel conservation and efficient orbit adjustments, its service life has been extended by two additional years, now expected to last until 2028.

“Geostationary satellites generally operate between 15 and 20 years,” explained Jane Nkechi Egerton-Idehen, Managing Director and CEO of Nigerian Communications Satellite Limited (NigComSat), in a recent interview. “The determining factor is the amount of propellant available-similar to fuel in a vehicle. Thanks to prudent management, we anticipate keeping this satellite operational until 2028, with plans to have its replacement ready by then.”

Satellites often continue functioning beyond their intended lifespan, but as fuel depletes and components like government/” title=”Idris Elba to … Sherbro Island Eco-City Project Backed by Sierra Leone’s …”>solar panels and electronics deteriorate, reliability diminishes. This can lead to weaker signals, service disruptions, or sudden failures, underscoring the importance of proactive replacement strategies.

Meanwhile, NigComSat has diversified its approach by partnering with global operators such as Eutelsat and OneWeb. These collaborations provide interim “gap filler” services, allowing traffic to be rerouted as needed to ensure uninterrupted connectivity for Nigerian users.

Replacing a satellite is a complex endeavor, typically spanning four to six years from vendor selection through design, construction, and launch. For instance, the EUTELSAT 36D satellite took approximately three years from contract signing with Airbus in March 2021 to launch and service commencement in March 2024. Egerton-Idehen is optimistic that Nigeria can accelerate this process: “With advancements in technology and groundwork laid since 2019, we aim to complete the replacement within 30 to 36 months.”

Currently, NigComSat is finalizing vendor evaluations, transitioning from technical assessments to financial negotiations.

Contributions of the Current Satellite

Despite its advancing age, NigComSat-1R remains a cornerstone of Nigeria’s digital infrastructure. Its multi-band capabilities-including Ka, Ku, C, and L bands-support diverse applications such as broadcasting, broadband internet, and specialized communications.

The Ku-band has been particularly vital for broadcasting, carrying signals for the Nigerian Television Authority (NTA), the National Broadcasting Commission (NBC), and over 100 other broadcasters nationwide. Under recent management, utilization of this band has surged from roughly 35% to more than 75%, reinforcing NigComSat’s leadership in the broadcasting sector.

“We primarily use the satellite for broadcasting,” shared an executive from a broadcast company who has relied on NigComSat-1R since 2015 and requested anonymity. “While there have been technological improvements, the satellite’s geostationary nature limits its broadband capacity.”

Broadband services, mainly delivered via the Ka-band, have expanded, especially in rural and underserved regions. Collaborations with local providers and initiatives like Hotspot’s deployment of 102 rural sites in Nasarawa have connected approximately 300,000 previously unserved individuals to the internet.

Nonetheless, the satellite’s capacity is limited. With about 1.5 GHz of total transponder bandwidth shared among broadcasting, VSAT, government, military, navigation, and broadband services, the quality and availability of service face constraints.

Latency is another significant limitation. Operating in geostationary orbit, NigComSat-1R experiences latency around 600 milliseconds, starkly higher than Starlink’s 25 to 60 milliseconds via low-earth orbit satellites. This difference impacts latency-sensitive applications such as video conferencing, online gaming, and real-time collaboration.

“Nigeria’s demand for satellite services-spanning security, internet, and broadcasting-has grown dramatically,” noted Diseye Isoun, CEO of Content Oasis, an internet service provider. “Expanding NigComSat’s capacity is essential to meet this rising need.”

Egerton-Idehen acknowledged that Ka-band usage has been slower than anticipated. When she took office in October 2023, utilization was at zero; nearly two years later, it has only reached about 7%. “Our target is to increase this to 60-70%. Broadband projects require longer lead times but will enable large-scale deployment rather than incremental growth,” she explained.

Beyond broadcasting and broadband, NigComSat offers specialized services for defense, navigation, and private networks serving government ministries, security agencies, and enterprises. These premium contracts have become a steady source of revenue.

Broadcasting remains NigComSat’s strongest domain, especially since competitors like Starlink do not provide broadcast services. However, broadband is viewed as the key growth area, with national broadband penetration still below 50%. Demand is expected to surge as individuals and industries adopt technologies such as the Internet of Things, smart agriculture, and digital public services.

Funding the Next Generation Satellite

Securing financing is among the most challenging aspects of the replacement project. NigComSat-1R was funded through a $250 million loan from China’s Exim Bank, supplemented by $50 million from Nigeria. While effective at the time, this approach is no longer the sole option.

“This time, the process is more transparent,” Egerton-Idehen stated. “Multiple vendors and investors are competing, reflecting confidence in our market and the expertise we’ve developed over the past 20 years.”

Much of the funding is expected to come from export-credit agencies backed by national governments, with commercial banks providing additional support. Although complex, investor interest remains strong, bolstered by NigComSat’s proven track record.

Nigeria’s earlier experience with NigComSat-1, which failed after 18 months due to solar array issues, was a difficult lesson. However, NigComSat-1R’s decade-plus of reliable service demonstrates Nigeria’s capability to manage such sophisticated projects.

Preserving Nigeria’s Orbital Positions

Another critical challenge is safeguarding Nigeria’s assigned orbital slots-limited geostationary positions allocated by the International Telecommunication Union (ITU). Losing these slots would jeopardize Nigeria’s presence in space.

“Nigeria holds three orbital slots. We currently utilize one with our satellite, but it’s vital to retain the other two,” Egerton-Idehen emphasized. “The initial plan was to have three satellites operational by now. We are committed to protecting these valuable assets.”

Expanding Horizons: A Regional Satellite Hub

Perhaps the most visionary element of NigComSat’s strategy is its regional ambition. With NigComSat-1R already covering sub-Saharan Africa, Europe, and parts of Asia, Nigeria aims to establish itself as a satellite communications hub for West Africa.

“No other West African nation owns a communications satellite, except for a regional operator called Rascom,” Egerton-Idehen noted. “This unique position allows us to lead the broadcast and broadband markets across the region.”

For investors, this regional scale elevates NigComSat beyond a national utility, positioning it as a continental player capable of serving markets lacking indigenous space infrastructure.

However, some industry insiders express concerns about the planning process for the new satellite. They argue that NigComSat has not sufficiently engaged with key clients who could provide valuable input to tailor the satellite’s design to market demands.

“There has been limited consultation, which is a misstep,” said a broadcast industry executive who wished to remain anonymous. “Operators are not always the best judges of user needs. Engaging end-users would help avoid repeating past mistakes related to orbital positioning and coverage.”

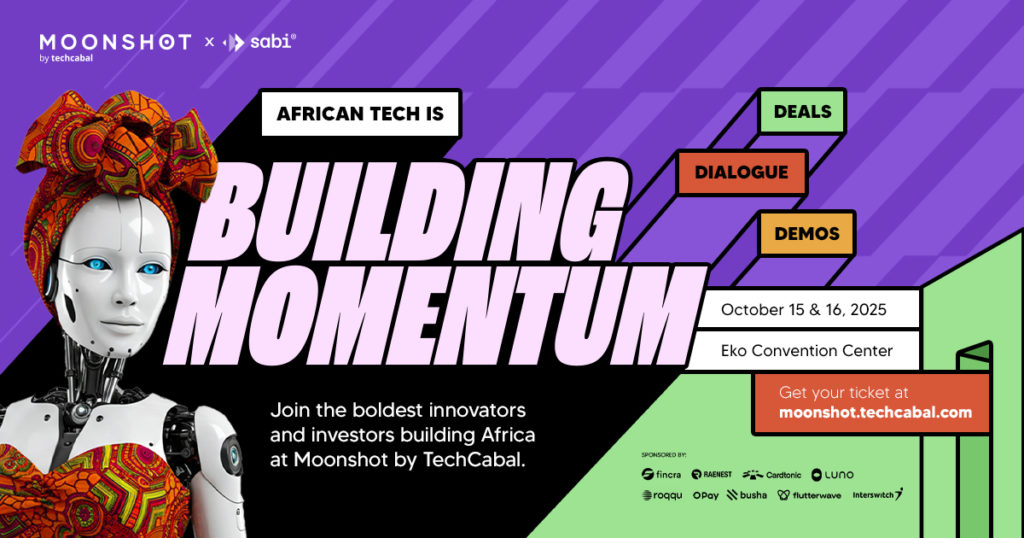

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking ideas. Secure your tickets now at moonshot.techcabal.com

0 Comments