Nigeria stands as a global frontrunner in cryptocurrency adoption. According to a 2023 Chainalysis report, it ranks second worldwide, with Triple-A estimating that over 22 million Nigerians-more than 10% of the population-own digital assets. Despite this widespread enthusiasm for crypto, the integration of blockchain technology within Nigeria’s fintech sector has been comparatively slow, with many leading platforms hesitant to fully incorporate it.

On peer-to-peer (P2P) crypto exchanges, Nigerians trade volumes that surpass those of numerous developed nations. Yet, even with this robust grassroots engagement, prominent fintech companies-from digital banks to payment service providers-have been cautious about embedding blockchain into their core operations. The pressing question is: will this stance evolve soon?

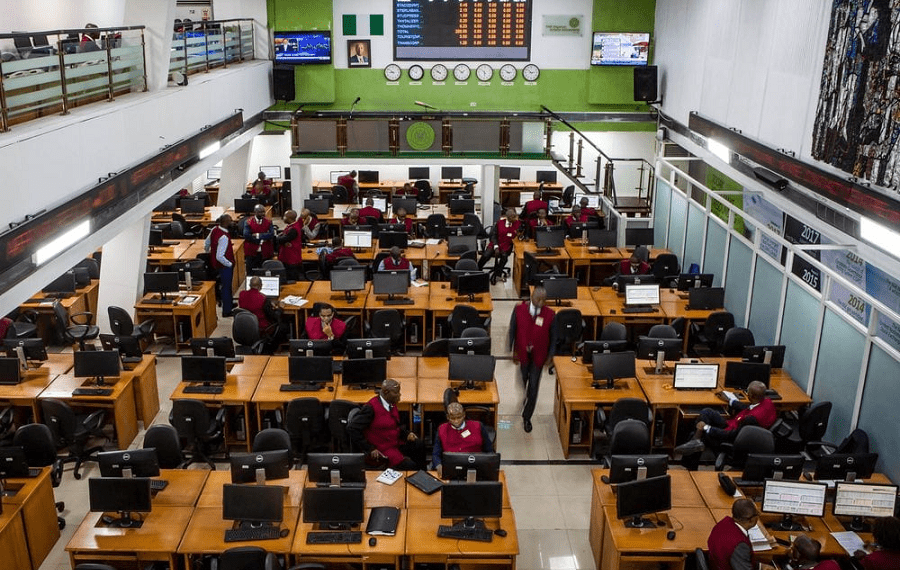

Over the last ten years, Nigeria’s fintech landscape has revolutionized financial transactions. Payment processors handle trillions of naira annually, while digital banks like Kuda and FairMoney have attracted millions of users. Additionally, mobile-centric lending apps have expanded credit access to individuals traditionally excluded from formal banking.

Remittances further illustrate this transformation. Nigeria is Africa’s leading recipient of remittance inflows, receiving upwards of $20 billion each year. Fintech innovations have made these transfers faster and more affordable for users.

Nevertheless, despite these advancements, most fintech platforms still depend heavily on conventional banking infrastructure. Blockchain technology-with its potential for instantaneous cross-border payments and enhanced transparency-remains largely peripheral to their main services.

For fintech entrepreneurs operating in Nigeria, blockchain is viewed not as a fleeting trend but as an essential evolution.

“Nigeria’s fintech sector has thrived by addressing everyday challenges such as payments and financial inclusion,” explains Chike Okonkwo, Marketing Manager at YDPay. “In the coming three to five years, blockchain will extend its reach to tackle deeper systemic challenges like transparency, security, and seamless cross-border interoperability.”

One critical area ripe for blockchain disruption is remittances. Despite being a top global remittance destination, Nigeria faces some of the highest transaction fees worldwide.

Another significant issue is trust and transparency. Users often encounter hidden fees and opaque reconciliation processes, breeding frustration. Blockchain’s immutable and verifiable ledger could restore confidence by making every transaction traceable. Additionally, settlement speed is a major advantage. “Traditional reconciliations can take hours or even days,” Okonkwo notes. “Blockchain enables near-instant clearing and settlement, which is transformative.”

The volatility of the naira also makes blockchain solutions attractive. Many Nigerians already use dollar-pegged stablecoins informally to hedge against currency fluctuations. Fintech companies see an opportunity to integrate these stablecoins into regulated platforms. “Stablecoins offer users a safer, more accessible store of value during periods of local currency instability,” he adds.

Beyond payments, blockchain holds promise for enhancing identity verification and security. Its decentralized and tamper-proof records can strengthen Know-Your-Customer (KYC) processes, reduce fraud, and streamline onboarding. According to Chike, “This is less about hype and more about an unavoidable progression.”

Read also: Ugochukwu Aronu’s Asset Chain: Pioneering Blockchain Ownership in Africa

Contextualizing Nigeria’s Fintech Evolution

In the past decade, Nigeria’s fintech industry has dramatically expanded financial accessibility. Payment gateways like Paystack and Flutterwave have empowered thousands of businesses to operate online effortlessly, while mobile money services have introduced digital transactions to millions previously reliant on cash. Digital banks such as Kuda, FairMoney, and Carbon now rival traditional banks by offering accounts, loans, and savings products through user-friendly mobile applications.

This rapid transformation is evident in the numbers. The Nigerian Inter-Bank Settlement System (NIBSS) reported that electronic payment transactions surged from ₦1 trillion in 2012 to over ₦600 trillion in 2024, underscoring fintech’s role in normalizing cashless payments.

Lending platforms, initially focused on microloans, have scaled to provide substantial credit, fueling entrepreneurship and consumer spending.

With more than 500 active startups in Lagos alone, Nigeria has cemented its status as Africa’s fintech hub, impacting a broad spectrum of users-from ride-hailing drivers to market vendors.

Why Blockchain Is Poised to Transform Nigerian Fintech

The argument for blockchain adoption in Nigerian fintech centers on three persistent challenges: high costs, slow transaction speeds, and lack of trust. Payment reconciliations remain sluggish, remittance fees rank among the highest globally, and hidden charges continue to alienate users. For many industry insiders, blockchain offers solutions that traditional financial infrastructure has long failed to provide.

Chike Okonkwo emphasizes that this is not mere hype but a practical necessity. “Blockchain isn’t a cure-all, but it addresses longstanding inefficiencies that conventional systems have struggled to resolve,” he asserts.

“Just as fintech revolutionized mobile money and digital banking, platforms like YDPay aim to transform cross-border payments, transparency, and financial resilience. This shift is inevitable, not speculative.”

This inevitability is already reflected in how Nigerians engage with blockchain. Stablecoins have quietly become a popular hedge against inflation and naira depreciation, with millions informally storing wealth in dollar-pegged tokens. Formalizing stablecoin use within fintech wallets could mainstream this practice, enhancing both security and transparency.

Cross-border payments reveal a similar opportunity. As one of the world’s largest remittance recipients, Nigeria could benefit immensely from blockchain’s ability to transfer funds internationally within minutes rather than days. Okonkwo highlights that “blockchain significantly reduces costs and settlement times by eliminating unnecessary intermediaries, providing users with faster, cheaper access to their money.”

Beyond payments, blockchain’s immutable ledgers can bolster KYC procedures and combat fraud-critical in a market where trust is fragile. “Every transaction becomes traceable and verifiable,” he explains.

Collectively, these advancements suggest a future where blockchain is not an alternative but the backbone of Nigerian fintech, resolving inefficiencies and restoring user confidence in a rapidly evolving financial ecosystem.

Currently, blockchain is already embedded in everyday financial activities, albeit outside mainstream fintech apps. Freelancers often request payments in USDT or USDC to avoid banking delays and currency losses. Market traders and small businesses use P2P exchanges to receive remittances within minutes. Young savers allocate parts of their income to stablecoins as a safeguard against naira depreciation.

Data underscores this quiet revolution. The World Bank reports that remittance fees into Nigeria average between 6% and 8%, among the highest globally. In contrast, blockchain-based transfers can cost less than 2% and settle in under ten minutes. Chainalysis estimated that Nigerians traded over $56 billion worth of crypto on P2P platforms in 2023 alone, surpassing the financial volumes of many African countries.

These user-driven behaviors have created a parallel financial ecosystem where blockchain is the preferred choice for speed, stability, and international reach.

For fintech companies, this reality presents both a challenge and an opportunity: either integrate blockchain technology into their offerings or risk losing relevance to unregulated platforms already trusted by millions.

Navigating the Regulatory Landscape

The cautious pace of blockchain adoption by Nigerian fintech firms is largely influenced by regulatory uncertainty. The Central Bank of Nigeria (CBN) has historically maintained a conservative stance, notably restricting banks from facilitating cryptocurrency transactions in 2021.

Conversely, the Securities and Exchange Commission (SEC) has adopted a more progressive approach, introducing a regulatory framework for Virtual Asset Service Providers (VASPs) and granting provisional licenses to select companies.

Read also: Everything You Need to Know About SEC’s New Crypto Investment Regulations in Nigeria

Okonkwo interprets this as a sign of shifting attitudes. “While the CBN remains cautious, the SEC is leading with regulatory frameworks,” he says. “Both institutions recognize that blockchain cannot be ignored, and that outright bans are less effective than structured collaboration. The SEC’s provisional licenses indicate a willingness to engage with industry stakeholders.”

This evolving regulatory environment presents fintech companies with a delicate balancing act: moving too quickly risks regulatory pushback, while moving too slowly could mean losing market share to more agile competitors.

Okonkwo advocates for strategic partnerships. “We anticipate clearer guidelines, sandbox initiatives, and licensing regimes from the CBN that will enable blockchain-powered fintech firms to innovate responsibly,” he adds.

Nonetheless, challenges remain. Public understanding of blockchain is limited, with many consumers associating it solely with speculative cryptocurrency trading. Infrastructure costs for integrating blockchain alongside existing systems are significant. Moreover, regulators could reverse course if adoption outpaces their capacity to manage risks.

Critics often dismiss blockchain as a passing fad. Okonkwo counters this view: “Blockchain becomes ‘hype’ only when disconnected from real-world problems and reduced to mere speculation. In Nigeria, the issues are tangible: exorbitant remittance fees, slow transaction settlements, lack of trust, and currency instability.”

The key challenge is demonstrating blockchain’s ability to address these problems in ways that resonate with users and satisfy regulators. Until then, skepticism will continue to temper its growth.

The Road Forward

Although Nigerian fintech platforms have yet to fully embrace blockchain, the indicators are unmistakable. Adoption is already occurring at the grassroots level, regulatory frameworks are gradually opening, and industry leaders view blockchain as an essential foundation rather than an optional enhancement.

“Stablecoins for cross-border payments and remittances will emerge as the breakthrough application,” Okonkwo predicts. “Nigeria ranks among the world’s largest remittance markets, yet transaction costs remain prohibitively high. Blockchain enables instant, affordable, and transparent transfers that can positively impact millions of households.”

The pivotal question now is not if Nigerian fintech will adopt blockchain, but which company will have the vision and courage to pioneer this transformation.

0 Comments