Pesalink has joined forces with Nairobi-based fintech TendePay to accelerate both bulk and individual payments, enabling small enterprises to instantly transfer up to KES 999,999 ($7,700) across all banking institutions. This collaboration highlights the growing role of private sector innovators in expanding payment solutions for businesses amid slower regulatory reforms.

Operated by the Kenya Bankers Association (KBA), PesaLink serves as a unified network linking local banks, mobile money platforms, and fintech companies. Originally launched as a petty cash management tool, TendePay has evolved into a comprehensive spend management system. Through this alliance, businesses can now manage payroll, supplier payments, utility bills, and customer collections seamlessly via a single platform regulated by the Central Bank of Kenya (CBK), featuring automatic transaction reconciliation-an essential feature for organizations handling large volumes of daily payments.

“Our partnership marks a significant step in our transformation into a full-scale spend management solution,” stated Abel Masai, CEO of TendePay. “Leveraging Pesalink’s robust infrastructure, we provide businesses with a dependable, secure, and cost-effective platform to handle payments of any size, at any time.” This development comes as the CBK is actively exploring the introduction of a new fast payment system (FPS) aimed at reducing costs and enhancing interoperability for business transactions. The CBK’s 2024 announcement to launch an instant payment network represents a major leap forward in Kenya’s financial transfer capabilities.

Although the exact rollout schedule remains uncertain, key payment providers like Pesalink, M-PESA, and Airtel Money have significantly increased their investments over the past year to enhance system capacity. They have also intensified collaborative efforts to foster greater integration across the payments ecosystem.

“Collaboration is fundamental to transforming how businesses transact,” said Ken Lisudza, Pesalink’s Chief Commercial Officer, in an interview with TechCabal. “Pesalink was designed with interoperability at its core, simplifying payments by enabling instant, affordable transfers throughout Kenya’s financial landscape.”

Pesalink has become the preferred payment platform among industry stakeholders. Both Safaricom and the KBA argue that creating an entirely new payment infrastructure could cost upwards of $200 million and take four years to complete, effectively duplicating existing systems. Instead, they advocate for enhancing the current payment rails.

Safaricom has been actively extending M-PESA’s capabilities to include bank transfers. A recent update in September increased the per-transaction limit to KES 500,000 ($3,900) via a Pesalink mini app, providing SMEs and larger corporations with greater flexibility to process high-value payments. These initiatives reflect a rapidly evolving market striving to meet the growing demand for instant, high-value digital transactions.

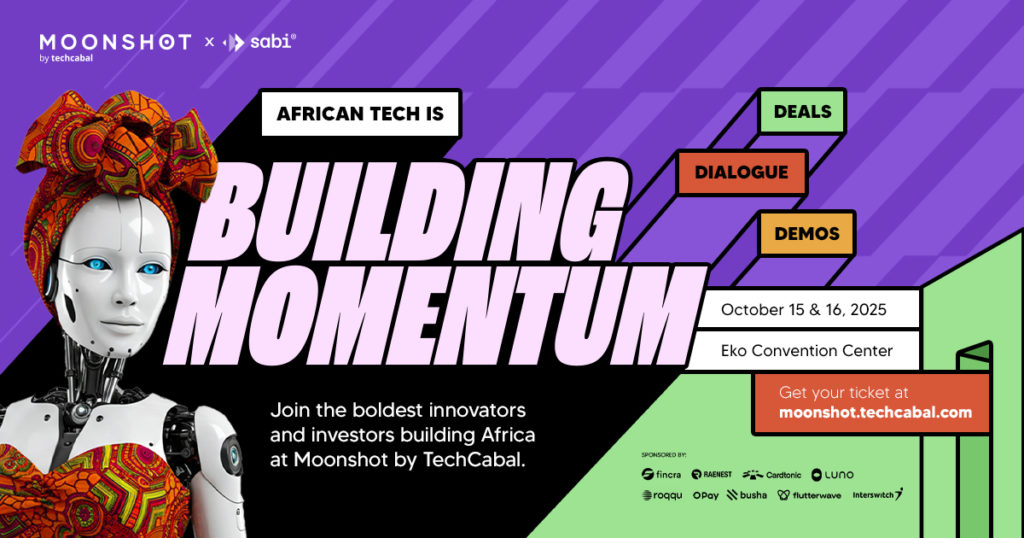

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16! Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Secure your tickets now at moonshot.techcabal.com

0 Comments