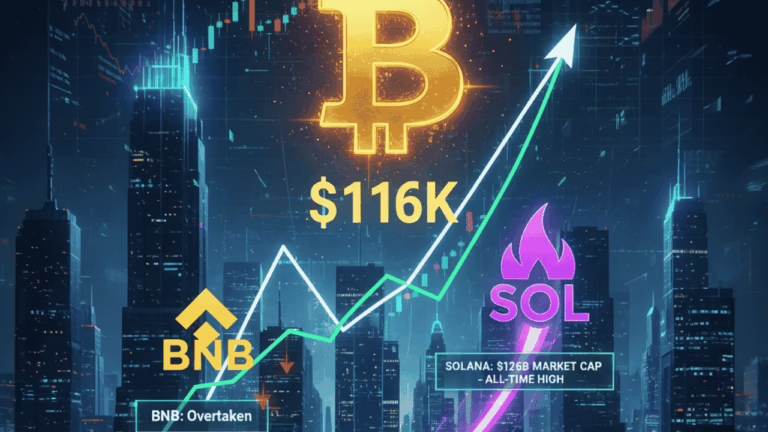

In 2025, Solana (SOL) has emerged as one of the fastest-growing cryptocurrencies, overtaking Binance Coin (BNB) to claim the position of the fifth-largest digital currency by market capitalization. Its valuation has soared beyond $126 billion, setting a fresh all-time high. This surge coincides with Bitcoin’s resurgence above the $116,000 mark, reinforcing a broadly optimistic atmosphere across the crypto landscape.

The impressive upswing in Solana’s value is driven by a blend of investor confidence, robust on-chain metrics, and heightened interest from institutional players. Over the past week, the network has witnessed a notable uptick in transaction volumes and developer engagement. As capital flows increasingly favor promising Layer-1 blockchains, Solana stands out as the primary recipient of this influx.

Beyond speculative trading, genuine adoption is propelling Solana’s expansion. The platform has experienced growing demand for decentralized finance (DeFi) applications and non-fungible token (NFT) marketplaces, both of which benefit from Solana’s rapid processing speeds and minimal transaction fees.

Market analysts highlight that steady capital inflows into Solana-focused investment vehicles are further bolstering demand. Recently, funds tracking SOL have seen consistent net inflows, signaling strong institutional backing and confidence in Solana’s long-term prospects.

Transition from BNB to SOL Dominance

For a considerable period, Binance Coin held the fifth spot in the cryptocurrency hierarchy, largely due to the extensive reach of Binance’s exchange ecosystem. However, Solana’s rapid ascent has disrupted this status quo, reflecting a shift in investor preference toward blockchain platforms that emphasize scalability and decentralization.

While BNB remains a formidable contender, recently achieving new all-time highs, Solana’s ecosystem has expanded at a comparatively faster pace. Its enhanced transaction capacity, active developer community, and flourishing DeFi landscape provide it with a distinct competitive edge. This momentum has culminated in SOL overtaking BNB in market capitalization-a milestone that carries significant symbolic weight within the crypto sector.

Bitcoin Surges Past $116,000

Amid Solana’s rise, Bitcoin has also staged a powerful recovery, climbing back above the $116,000 threshold. This resurgence arrives at a pivotal moment for the world’s leading cryptocurrency, which has experienced a series of historic peaks, corrections, and periods of consolidation in recent months.

Several catalysts have contributed to Bitcoin’s upward trajectory. Signals from the US Federal Reserve hinting at potential interest rate cuts have rekindled enthusiasm for risk assets. Historically, lower rates tend to increase the appeal of non-yielding assets like Bitcoin. Additionally, the growing popularity of Bitcoin exchange-traded funds (ETFs) has attracted institutional investors, further solidifying Bitcoin’s reputation as a reliable store of value.

On-chain analytics reveal that Bitcoin is consolidating within a critical trading band between $110,000 and $116,000. Buyers have consistently stepped in during price dips, establishing a robust support level. Should Bitcoin sustain its position above this range, experts anticipate the onset of the next bullish phase.

Wider Crypto Market Resurgence

The simultaneous gains in Solana and Bitcoin signal a broader revival across the cryptocurrency market. Altcoins have notably benefited from renewed investor confidence, with Ethereum, XRP, and other major tokens posting significant advances.

Market watchers attribute this trend partly to capital rotation. As Bitcoin stabilizes at elevated price points, investors often diversify into altcoins that offer higher growth potential. Solana, with its solid technical foundation and expanding ecosystem, has emerged as a prime beneficiary of this shift.

Despite the prevailing optimism, risks remain. Some short-term investors are already engaging in profit-taking, and sharp pullbacks could occur if momentum falters. Moreover, the global macroeconomic environment continues to influence market dynamics. Inflation trends, central bank policies, and regulatory developments will all shape the trajectory of digital assets in the near future.

For Solana to sustain its upward momentum, it must deliver more than speculative interest. Continued network stability, vibrant developer participation, and widespread adoption across DeFi, gaming, and NFT sectors are essential. Any disruptions could dampen investor enthusiasm and stall growth.

Solana’s leap past Binance Coin to secure the fifth-largest market cap, alongside Bitcoin’s reclaiming of $116,000, underscores a renewed wave of confidence in the cryptocurrency space. These milestones highlight both Solana’s expanding ecosystem and Bitcoin’s enduring dominance as the market’s cornerstone.

If these digital assets maintain their current trajectories, the crypto market may be poised to enter a fresh phase of bullish expansion.

0 Comments