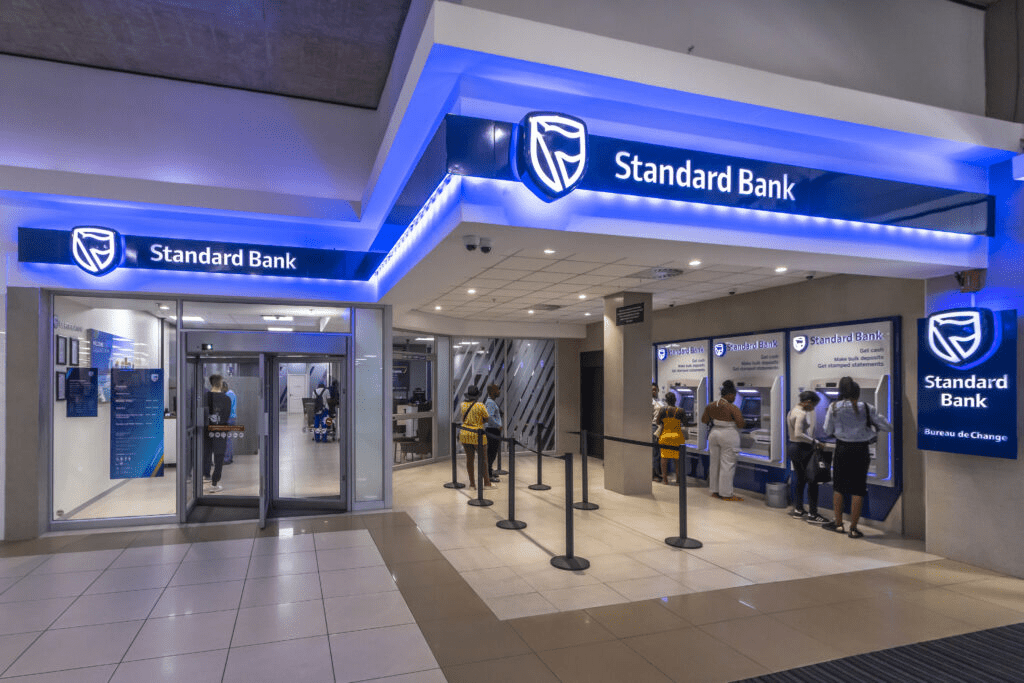

Standard Bank has reduced its ATM network in South Africa by 1,942 between 2020 and mid-2025, a significant decrease from 5,390 to 3,448. This substantial reduction reflects banks’ adaptation to the increasing shift toward mobile and digital transactions, as well as the corresponding decline in cash withdrawals.

Due to a significant decline in ATM usage and a rise in online banking, the bank is reducing its ATM network to cut costs. This shift reflects a broader trend within the financial sector’s move from traditional infrastructure to digital channels.

Major lenders like Absa, Nedbank, and First National Bank have also reduced their branch and ATM networks. Simultaneously, online banks such as TymeBank and Bank Zero have expanded without investing in physical infrastructure, underscoring the evolving preferences of South African financial service consumers.

Industry observers attribute the shift from cash to increased smartphone use, internet access, and demand for faster, more convenient transactions. This mirrors global trends in Europe, Asia, and North America, where banks are investing heavily in mobile technology over ATMs.

While the transition may seem easy in urban centres, it significantly impacts rural and poor communities.

Digital banking rises as cash declines

The decline in ATM usage indicates a shift away from cash transactions among South Africans. Today, customers can easily pay bills, transfer money, and shop online through various apps and websites, eliminating the need to visit physical branches or ATMs.

Many businesses are also transitioning to electronic payment systems, further reducing the prevalence and influence of cash.

The evolution of banking has significantly reduced the reliance on traditional ATM networks, which were once essential for cash withdrawals and other basic transactions. This transition is largely due to the increasing popularity and convenience of digital banking platforms.

With the rise of online and mobile banking, the need for physical ATMs has declined, reducing the incentive for banks to maintain costly ATM networks.

Read also: Nigerian banks shutdown 649 ATMs in 2020, here is why

Recognising the shift in customer behaviour and the evolving financial industry, Standard Bank has strategically reallocated resources to enhance its digital offerings, prioritising them over maintaining numerous ATM locations.

Standard Bank has invested heavily in upgrading its mobile app features and user interface. It has also strengthened the security and reliability of its digital systems. This strategy aims to give customers a smooth, safe, and easy digital banking experience, keeping pace with the banking industry’s evolution.

The bank’s strategic initiative aims to expand remote and convenient customer services. Following Standard Bank’s example, other banks are investing in mobile technology to enable customers to manage their banking activities directly from their phones.

The COVID-19 pandemic significantly accelerated changes in how consumers preferred to pay for goods and services. Due to various restrictions implemented during the pandemic, as well as heightened health concerns related to physical contact, many consumers actively sought to avoid using banknotes and coins.

Because people were worried about catching viruses from money, more started using electronic payments, which seemed safer and easier. This widespread change in customer preference towards electronic payment solutions has, in turn, enabled banks and other financial institutions to re-evaluate their operational infrastructure.

The rise of digital payments has enabled financial institutions to lessen their reliance on physical ATMs and branches. As customers use less cash and fewer in-person banking services, banks can optimise their physical presence and adopt more cost-effective service models.

Risks of excluding rural and low-income users

Even with these advantages, the removal of nearly 2,000 ATMs raises concerns for those reliant on cash. In rural areas with limited banking, ATMs are crucial. Furthermore, online platforms may not yet be viable alternatives for older citizens, informal businesses, and social grant recipients.

Machine shutdowns are forcing some citizens to travel further for cash withdrawals, and civil society groups caution that this may worsen financial exclusion. This is especially so in areas with low internet penetration and high data costs, as smartphone adoption remains incomplete, and some households cannot transition to electronic banking.

Standard Bank has addressed accessibility issues by partnering with retailers for checkout cash withdrawals and expanding its cell phone banking capabilities. However, adoption remains inconsistent, and concerns persist regarding access for vulnerable groups.

The South African Reserve Bank emphasised the importance of balancing inclusion and innovation, with regulators urging financial institutions to ensure technological advancements do not exclude low-income or rural customers.

Standard Bank’s closure of 1,942 ATMs highlights digital banking’s transformative impact on finance and the challenge of maintaining accessibility during modernisation. Balancing efficiency and inclusion will become increasingly critical as banks expand their digital presence.

0 Comments