Sterling Bank, a prominent Nigerian tier-2 financial institution with a market value of ₦390.9 billion, has announced that its indigenous core banking system, SEABaaS, successfully handled two billion transactions over the last year without experiencing any downtime.

In 2024, Sterling Bank transitioned from the internationally recognized T24 platform, developed by Geneva-based Temenos AG, to its proprietary SEABaaS solution. This move reflects a broader trend within Nigeria’s banking sector, where institutions are migrating their core systems. Unlike competitors such as GTBank and Access Bank, which continue to rely on foreign platforms like Finacle, Sterling opted for a domestically developed system. The migration initially caused service interruptions, leaving over three million customers unable to access their accounts for several days, which triggered widespread dissatisfaction on social media.

This strategic switch occurred amid growing demands on Nigerian banks to reduce operational expenses while managing a surge in digital transactions. According to a report by TechCabal, commercial banks in Nigeria typically allocate a minimum of $10 million annually to maintain their core banking infrastructures, depending on the system’s complexity.

Abubakar Suleiman, Sterling Bank’s CEO, revealed on Tuesday that adopting SEABaaS has resulted in substantial cost savings, amounting to millions of dollars in avoided fees. The platform was developed collaboratively by Bazara Tech Inc. and Peerless Technologies. Peerless highlighted that beyond improving efficiency, SEABaaS has generated over $10 million in operational savings for its clients.

Suleiman also emphasized that the migration has fueled a remarkable increase in transaction activity, coinciding with an aggressive customer acquisition campaign. “Our transaction volumes have surged dramatically, and for eight consecutive months, we have set new records in attracting new customers to Sterling,” he stated.

Peerless Technologies reports that SEABaaS now supports over five million end-users across various platforms, including notable clients such as Alternative Bank and ARM, as featured on their website.

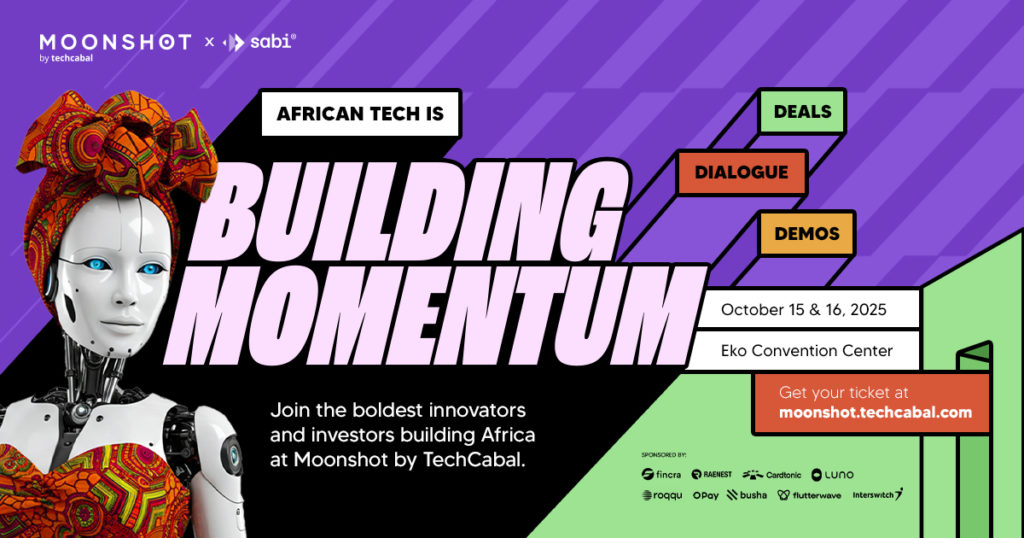

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, innovators, and tech visionaries for two days filled with inspiring keynotes, networking events, and cutting-edge ideas. Early bird tickets are currently available at a 20% discount-don’t miss out! Visit moonshot.techcabal.com for details.

0 Comments