Welcome to Follow the Money, our weekly deep dive into the earnings, business models, and growth tactics of African fintech companies and transactions-vs-banks/” title=”Discover Why Fintech … Outpace … Every Time”>financial institutions. Tune in every Monday for fresh insights.

To support its economic development and meet rising expenditure demands, the Nigerian government is intensifying efforts to boost revenue through tax reforms and addressing shortfalls in oil production. A key component of this strategy is the Electronic Money Transfer Levy (EMTL), a ₦50 fee imposed on every electronic transfer of ₦10,000 ($6.72) or more.

Through this levy, the government aims to generate approximately ₦796.01 billion ($534.99 million), a sum sufficient to fund the construction and completion of the Lagos-Ibadan expressway twice over. The projected annual revenue is broken down as ₦228.85 billion ($153.81 million) in 2025, ₦263.68 billion ($177.22 million) in 2026, and ₦303.48 billion ($203.97 million) in 2027.

Already in 2024, the government surpassed its target by collecting ₦219.11 billion ($147.26 million), exceeding the forecasted ₦174.24 billion ($117.11 million) by ₦44.87 billion ($30.16 million).

Introduced under the Finance Act 2020, the EMTL replaced the Stamp Duty and initially applied solely to banks. This levy was designed to diversify government income away from oil dependency and capitalize on Nigeria’s rapidly expanding digital payments ecosystem, which reached a staggering ₦1 quadrillion in transaction value in 2024.

The revenue generated from the EMTL is distributed among the federal government (15%), state governments (50%), and local governments (35%).

Government forecasts anticipate that taxable online transactions will exceed 5 billion by 2026 and surpass 6 billion by 2027. Interestingly, the volume of transactions already topped 11 billion in 2024, explaining the higher-than-expected revenue collection that year.

Impact of Fintech Expansion

A significant factor in the government’s optimistic revenue projections is the extension of the EMTL to fintech platforms such as Opay, PalmPay, and Moniepoint. While the levy initially targeted banks, it was broadened in December 2024 to include fintech companies.

This policy shift led to an 84.22% year-over-year increase in EMTL revenue, reaching ₦185.86 billion ($124.91 million) between December 2024 and May 2025.

Despite initial apprehensions that the levy might hinder the adoption of cashless payments, evidence from other African countries suggests otherwise. For example, Ghana implemented a similar electronic levy that encompassed informal sector transactions, which ultimately boosted domestic revenue without stalling digital payment growth.

Nigeria’s mobile-first neobanks have been instrumental in expanding financial inclusion, reaching demographics that traditional banks have struggled to serve. Opay reportedly handled 100 million transactions daily with 10 million active users in 2024, while PalmPay boasts a user base exceeding 35 million.

“A considerable portion of the adult population remains unbanked, and fintech companies have a crucial role in bridging this gap,” stated Chika Nwosu, Managing Director of PalmPay, in a recent interview.

Transaction volumes on these platforms surged by an astonishing 2,507.94% from 2020 to 2024.

The government is confident that enhanced compliance and monitoring of all financial institutions will further improve revenue collection in the coming years.

“We are intensifying oversight to ensure banks and fintechs reconcile transactions properly and remit the Electronic Money Transfer Levy accordingly,” the government noted in a recent policy update.

The EMTL exemplifies a broader shift in government strategy, recognizing digital transactions as a vital revenue stream amid the surge in cashless payments. While the ₦50 fee per transfer above ₦10,000 may seem minimal to individual users, when aggregated across billions of transactions, it becomes a substantial source of funding for the government’s initiatives.

Note: Exchange rate used is ₦1,487.9 to $1.

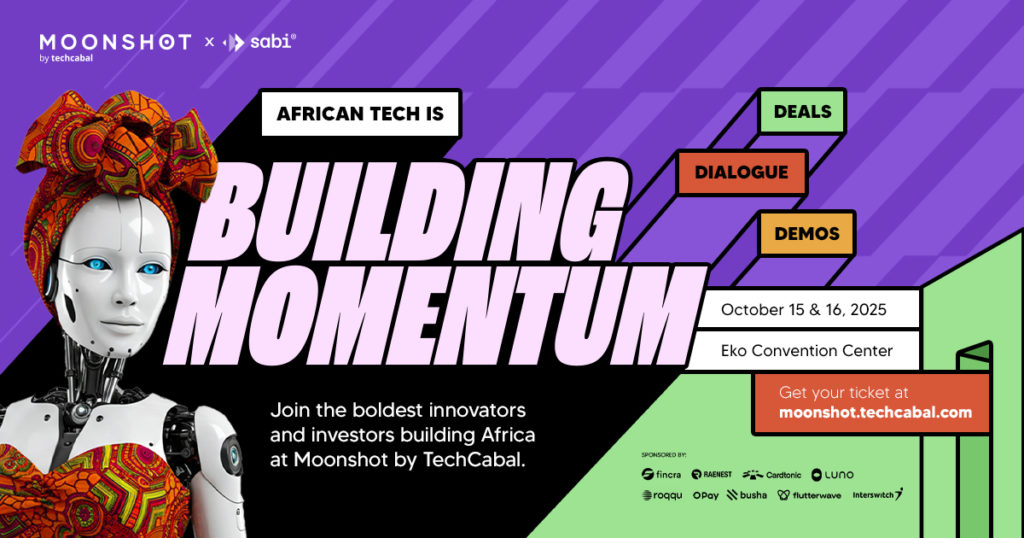

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Secure your tickets now at moonshot.techcabal.com.

0 Comments