Telkom Kenya has been overtaken by Finserve’s Equitel, losing its rank as the third-largest mobile network operator in the country. This shift follows a series of service interruptions, disconnections, and a steady decline in subscriber numbers.

According to recent figures released by the Communications Authority of Kenya (CA), Telkom’s active mobile subscriber base dropped sharply to 868,788 by June 2025, marking a nearly 40% decrease from approximately 1.4 million subscribers the previous year. Equitel has surged ahead, now boasting 1.5 million active users. Meanwhile, Safaricom continues to dominate the market with 49.9 million subscribers, followed by Airtel with 23.7 million.

This significant subscriber loss highlights the critical impact of network reliability in a competitive telecom landscape where customer volume directly influences revenue. It also illustrates how quickly a provider can lose market relevance when financial difficulties coincide with deteriorating service quality.

The decline in Telkom’s network performance began in 2023 when American Tower Corporation (ATC) disconnected nearly 900 of Telkom’s communication towers due to unpaid lease fees amounting to KES 7.1 billion ($55 million). This disconnection caused a severe drop in network coverage, forcing Telkom to acknowledge significant service degradation across multiple regions. As a result, many customers switched to competitors, with Safaricom and Airtel capturing the majority of the departing users.

The Communications Authority’s Quality of Service (QoS) report for the 2023/24 fiscal year rated Telkom at just 55% in end-to-end drive tests, falling well short of the mandatory 80% benchmark. In contrast, Safaricom achieved 86%, and Airtel met the minimum standard with 80%. Frequent call failures and inconsistent data connectivity made Telkom’s subscribers more susceptible to switching providers amid the network crisis.

Compounding Telkom’s challenges is its negligible presence in the mobile money sector. Its platform, T-Kash, holds almost no market share, depriving the company of the customer retention benefits that come from integrated mobile financial services. In comparison, Safaricom’s M-PESA and Airtel Money dominate the mobile payments market, collectively controlling over 99% of users.

Dropping to fourth place places Telkom in a precarious position, as it risks losing the scale necessary to secure investment or attract strategic partners capable of financing upgrades to 4G and 5G infrastructure. Plans for a government buy-back, once considered a potential solution for stabilizing the operator, have yet to progress.

Despite these setbacks, Telkom Kenya still holds valuable assets, including extensive fibre optic networks, subsea cables, landing stations, and data centres, which provide leverage and potential for future growth. The company manages over 4,000 kilometres of terrestrial fibre and operates stakes in several undersea cable systems such as TEAMS, LION2, EASSy, DARE-1, and PEACE.

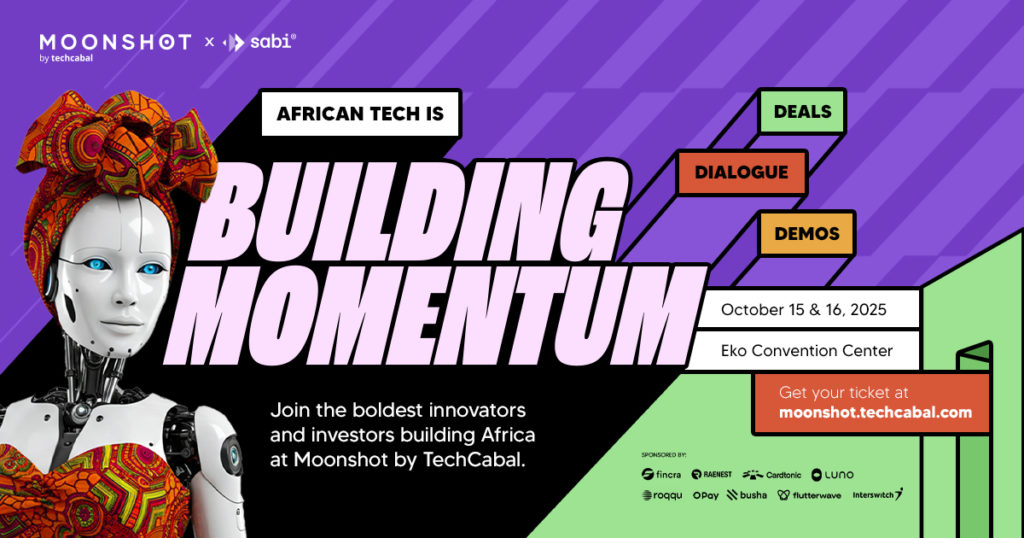

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, innovators, and tech visionaries for two days of inspiring talks, networking, and forward-thinking ideas. Secure your spot now at moonshot.techcabal.com

0 Comments