Nigeria’s power grid is currently facing a shortfall of $8.5 million, primarily due to unpaid electricity bills from three neighboring West African nations.

The defaulting entities include Togo’s Compagnie Energie Electrique du Togo (CEET), Benin Republic’s Société Béninoise d’Énergie Électrique (SBEE), and Niger’s Nigerian Electricity Company (NIGELEC).

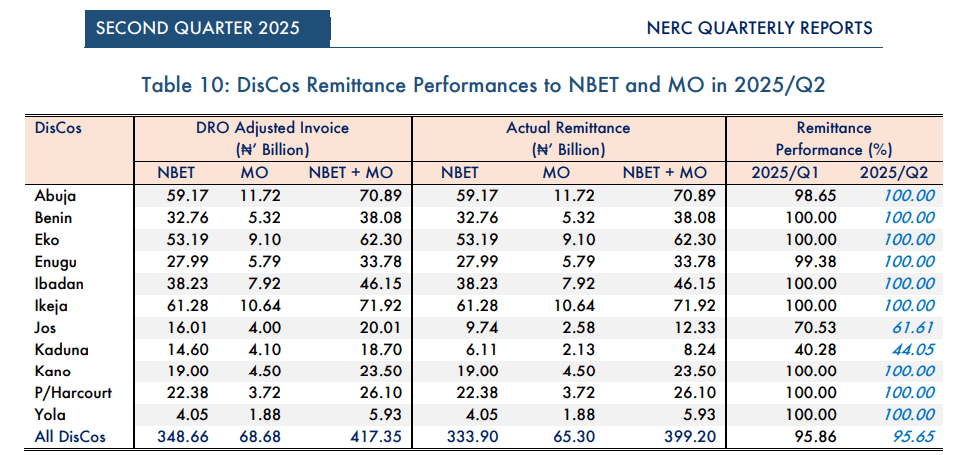

According to the Nigerian Electricity Regulatory Commission’s (NERC) latest quarterly review for Q2 2025, these international power purchasers have not fully settled their accounts with Nigeria’s generation companies (GenCos).

The combined invoiced amount to these foreign clients was $17.54 million, yet only $9.015 million was paid, reflecting a payment rate of just 51.33%.

This ongoing issue of unpaid dues from Nigeria’s neighbors continues to place significant financial pressure on the country’s electricity sector, threatening the overall stability of the power market.

Among the defaulters, Togo’s CEET stands out as the largest non-payer, having made no payment against its $4.31 million electricity bill for the quarter.

Benin’s SBEE, which sources power from Transcorp and Paras Energy, paid $6.42 million but still owes a balance on its $9.52 million invoice. Niger’s NIGELEC showed better compliance, settling $2.59 million of its $3.71 million bill.

Local Debtors Compound Financial Challenges

Non-payment issues are not confined to international clients; domestic electricity consumers are also falling behind on payments.

The report highlights that local bilateral customers remitted only N1.401 billion against an invoiced amount of N2.79 billion, achieving a payment rate near 50%.

A significant concern is the outstanding debt owed by Ajaokuta Steel Company Limited and its surrounding community, which failed to pay any portion of the N1.27 billion invoice from Nigerian Bulk Electricity Trading (NBET) Plc, along with an additional N0.12 billion in MO invoices for Q2 2025.

NERC emphasized that Ajaokuta’s non-payment is a persistent problem and has urged federal authorities to intervene.

While Trans-Amadi (OAU/FMPI) managed to clear N10.53 million in arrears from previous quarters, the overall debt burden continues to strain Nigeria’s power generation finances.

The Nigerian government faces an urgent task to ensure both neighboring countries and key domestic consumers fulfill their payment obligations to safeguard the electricity grid’s reliability and financial health.

Advancements in Metering and Customer Relations

Despite these financial setbacks, Nigeria’s power sector recorded meaningful progress in customer service and metering during the second quarter of 2025.

Distribution companies (DisCos) installed 225,631 new meters, representing a 20.55% increase compared to the previous quarter. Most of these installations were facilitated through the Meter Asset Provider (MAP) and Meter Acquisition Fund (MAF) initiatives.

Nonetheless, NERC reports that the national metering coverage remains at 54.33%, leaving nearly half of the 11.82 million registered customers without meters.

To protect unmetered consumers from inflated bills, NERC continues to enforce a monthly energy cap policy that limits estimated billing amounts.

Customer complaints across all DisCos decreased by 10.67%, falling from 254,404 in Q1 to 227,267 in Q2, signaling some improvement in service delivery.

However, NERC expressed concern over the low resolution rate at its Central Complaint Unit (CCU), where only 1,129 out of 2,474 complaints were addressed, a 45.63% resolution rate. The predominant issues remain metering inaccuracies, billing disputes, and power outages.

Additionally, two Forum Offices were closed during the quarter, reducing the total active offices to 24.

Out of 1,418 active appeals (including 1,040 new cases), the adjudication panel resolved 958, achieving a 67.56% resolution rate, down from 74.10% in the previous quarter.

In April, NERC imposed penalties on eight DisCos-Abuja (AEDC), Ikeja (IKEDC), Eko (EKEDC), Enugu (EEDC), Jos (JEDC), Kaduna Electric, Kano (KEDCO), and Yola (YEDC)-for breaching the energy cap policy on estimated billing for unmetered customers.

The fines exceeded N628 million, and the companies were instructed to issue credit adjustments to affected consumers.

0 Comments