Undoubtedly, the fintech sector has emerged as a pivotal catalyst for financial inclusion and technological advancement throughout Africa and beyond. This dynamic industry continues to bring digital payment solutions closer to everyday users, extending its reach even into remote rural areas.

Beyond its transformative influence, fintech companies play a crucial role in attracting investment capital. In the first half of 2025 alone, fintech startups accounted for 45% of the $1.42 billion raised by African startups, securing $639 million. This highlights their growing appeal to global investors eager to tap into Africa’s burgeoning tech ecosystem.

Securing funding is vital for fintech firms to maintain market presence and relevance among users. This article highlights the CEOs leading the top 10 African fintech companies ranked by total funding raised.

Our analysis draws on data from previous funding rounds and reputable sources such as Africa: The Big Deal, TechCrunch, and verified reports on this platform. It is important to note that undisclosed funding rounds introduce some uncertainty regarding the exact amounts raised by several startups.

1. Mounir Nakhla – MNT-Halan

Established: 2017

Headquarters: Egypt

Capital Raised: $700M+

Company Valuation: $1.1B+

Mounir Nakhla, founder and CEO of MNT-Halan, brings over 15 years of expertise in telecommunications and technology, earning recognition for his contributions across the African continent.

He has carved out a reputation as a visionary entrepreneur in fintech, initially focusing on providing microfinance services to small businesses and individuals more than a decade ago.

Achieving unicorn status in 2023, MNT-Halan has amassed over $700 million through equity and debt financing. A significant $400 million was raised in 2023 alone, including a $120 million injection from international investors in September 2021.

Following its unicorn milestone, the company secured $157.5 million in July 2024, with $40 million contributed by the International Finance Corporation.

Most recently, in October 2025, MNT-Halan raised $71.4 million via bond issuance, reinforcing its strategy of leveraging debt to fuel expansive lending operations.

2. Gotring Wuritka Dauda – OPay

Founded: 2013

Base: Nigeria/China

Funds Raised: $500M+

Valuation: $2.5B+

After Olu Akanmu’s exit in 2023, Gotring Wuritka Dauda stepped in as Managing Director and CEO of OPay.

Prior to this role, Dauda was director of the trade and exchange department at the Central Bank of Nigeria and also ran for governor in Plateau state during Nigeria’s recent elections.

His leadership has been instrumental in steering OPay through heightened regulatory scrutiny and enhancing security measures, including scam alerts.

OPay’s innovative approach has significantly advanced financial inclusion in Nigeria. In 2019 alone, it raised $50 million within six months, followed by an additional $120 million.

The company attained unicorn status in August 2021 after a $400 million Series C round, with backing from SoftBank Vision Fund 2, Sequoia Capital China, and Redpoint China.

3. Jesse Moore – M-KOPA

Founded: 2011

Locations: U.K., Kenya

Capital Raised: $500M+

Valuation: $600M - $700M

Jesse Moore, co-founder and CEO of M-KOPA, has championed connected financing solutions for underserved populations.

He holds an MBA from Oxford University as a Skoll Scholar and a BA from the University of North Carolina as a Morehead Scholar. Recognized by the World Economic Forum as a Young Global Leader in 2017, Moore was also named among Kenya’s Top 40 under 40 by The Business Daily in 2016.

M-KOPA has raised over $500 million through a mix of debt and equity. In 2023, it secured $250 million in investments from Sumitomo Corporation and Standard Bank, marking one of the largest capital raises for an African fintech. Earlier that year, it also obtained $15 million in debt financing.

Current reports indicate M-KOPA is approaching a $160 million Series F equity round led by Sumitomo.

4. Olugbenga Agboola – Flutterwave

Founded: 2016

Origin: Nigeria

Funds Raised: $475M+

Valuation: $3B

Before co-founding Flutterwave with Iyinoluwa Aboyeji, Olugbenga Agboola gained experience as an application engineer at PayPal and held product management roles at Google.

He also serves as Vice Chairman of the U.S.-Africa Business Centre Board and is a member of influential groups like the Wall Street Journal CEO Council.

Flutterwave stands as a premier cross-border payment platform in Africa, having raised over $475 million. This includes a $250 million Series D round in February 2022, supported by Tiger Global, Avenir Growth, and DST Global.

In March 2021, the company secured $170 million in Series C funding, achieving a valuation exceeding $1 billion and becoming Africa’s third fintech unicorn.

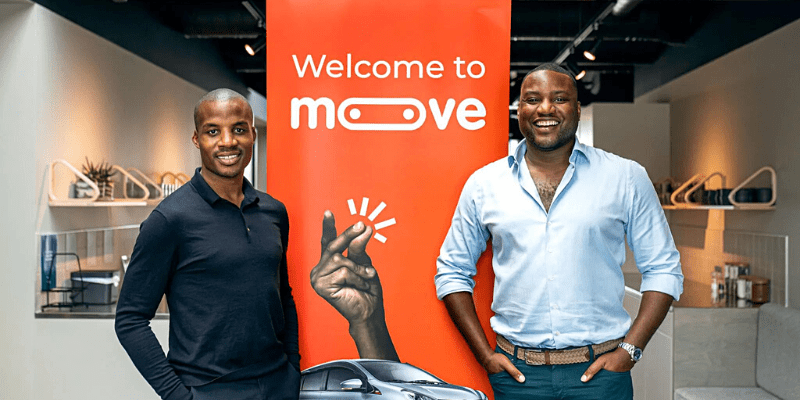

5. Ladi Delano and Jide Odunsi – Moove

Founded: 2019

Base: Nigeria

Funds Raised: $400M+

Valuation: $750M+

Co-founders and co-CEOs Ladi Delano and Jide Odunsi lead Moove, a fintech innovator in African mobility solutions.

Both entrepreneurs are UK-based Nigerians with academic credentials from the London School of Economics, Oxford University, and MIT. Delano has a background in entrepreneurship, while Odunsi previously worked as an investment banker at Goldman Sachs and a management consultant at McKinsey.

Moove has attracted over $400 million from investors including Uber, which led a $100 million Series B round in May 2024, Mubadala Investment Company, Speedinvest, and Stride Ventures.

In August 2023, the company raised $76 million, followed by an oversubscribed $105 million Series A2 round (combining equity and debt) in March 2022. Earlier, it secured $23 million in Series A funding.

Moove aims for a $2 billion valuation and plans to raise $300 million by late 2025, alongside a $1.2 billion debt round to support expansion into the U.S. autonomous vehicle market.

6. Dare Okoudjou – Onafriq

Founded: 2009

Origin: South Africa

Capital Raised: $300M+

Valuation: $300M - $500M

Dare Okoudjou, founder of Onafriq (formerly MFS Africa), aims to build Africa’s largest digital payments network, focusing on omnichannel infrastructure to facilitate cross-border transactions and boost financial inclusion.

With an engineering degree and an MBA from INSEAD, Okoudjou has experience as a consultant and startup professional. He served as Senior Manager for Business Strategy and Head of MTN Mobile Money International Development at MTN Group from 2006 to 2009.

Previously, he was a senior consultant at PwC and was named a 2021 Foundry Fellow at MIT.

Onafriq’s mission is to reduce the friction of borders by creating a robust payment infrastructure that supports intra-African trade and financial access. The company has connected millions of mobile wallets and bank accounts across the continent.

The South African fintech has raised over $300 million, including a $100 million Series C round in November 2021 co-led by AfricInvest FIVE, Goodwell Investments, and LUN Partners Group.

Earlier, it secured $4.5 million in Series B funding led by LUN Partners Group in 2018, marking the first time an African fintech received backing from a China-based global investment firm.

In June 2022, Onafriq raised an additional $100 million in equity and debt financing led by Admaius Capital Partners.

7. Ham Serunjogi – Chipper Cash

Founded: 2018

Headquarters: United States

Funds Raised: $300M+

Valuation: $1.25B+

Ham Serunjogi, co-founder of Chipper Cash, was once a competitive swimmer representing his country at the Youth Olympics.

The concept for this African cross-border payment platform was conceived during a 2016 road trip with co-founder Maijid Moujaled, leading to the creation of one of Africa’s foremost fintech companies.

Chipper Cash raised $6 million in seed funding in December 2019, followed by $2.3 million in May 2020.

It then secured $13.8 million in a Series A round in June 2020, and $30 million in a Series B led by Ribbit Capital later that year.

A $100 million Series C round led by SVB Capital in May 2021 propelled Chipper Cash to unicorn status with a $1 billion valuation. An extension of this round in November 2021, led by FTX, increased the valuation to $2.2 billion, though it was later adjusted down to $1.25 billion.

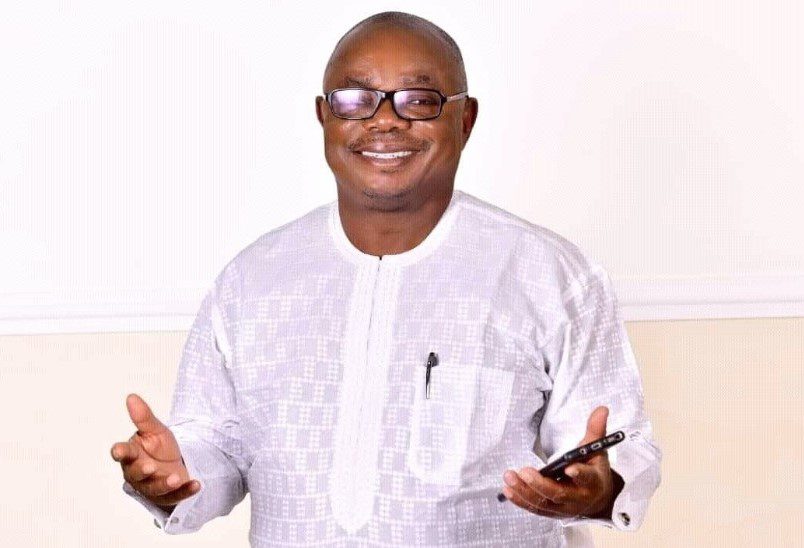

8. Mitchell Elegbe – Interswitch

Founded: 2002

Origin: Nigeria

Funds Raised: $300M+

Valuation: $1B+

Mitchell Elegbe, founder and CEO of Interswitch, holds a degree in Electrical/Electronic Engineering from the University of Benin, Nigeria. His early career at Schlumberger and TELNET laid the foundation for his entrepreneurial vision.

Recognizing the need to revolutionize electronic payment processing in Nigeria, Elegbe built Interswitch into a leading fintech company.

Interswitch has raised over $300 million, including a $110 million investment in 2022 from LeapFrog Investments and Tana Africa Capital.

In November 2019, Interswitch became a unicorn after Visa acquired a minority stake, investing $200 million for a 20% share.

From its Nigerian base, Interswitch has expanded operations to countries including Uganda, Gambia, and Kenya.

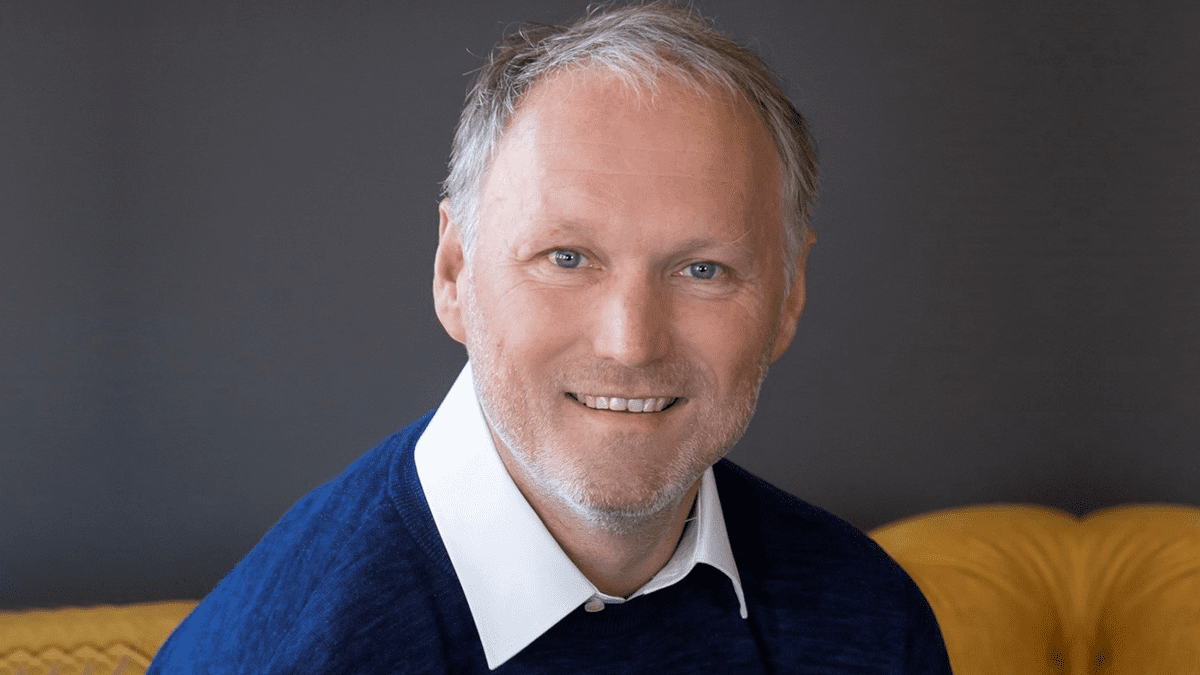

9. Karl Westvig – Tyme Bank

Founded: 2019

Origin: South Africa

Funds Raised: $250M+

Valuation: $1.4B+

Karl Westvig was appointed CEO of Tyme Bank on October 1, 2024, succeeding Coenraad Jonker, who became Executive Chairman to focus on global expansion.

Previously, Westvig served as Chief Executive for Retail and Business Banking at Tyme Bank, bringing deep expertise in lending and fintech leadership. Upon his appointment, he committed to elevating the bank into the top three for customer satisfaction.

Tyme Bank is recognized as one of the fastest-growing digital banks globally and the first in Africa to achieve profitability.

In December 2024, Tyme Bank joined the ranks of African unicorns with a $250 million Series D round led by Nubank, which invested $150 million, alongside M&G Catalyst Fund and other existing shareholders.

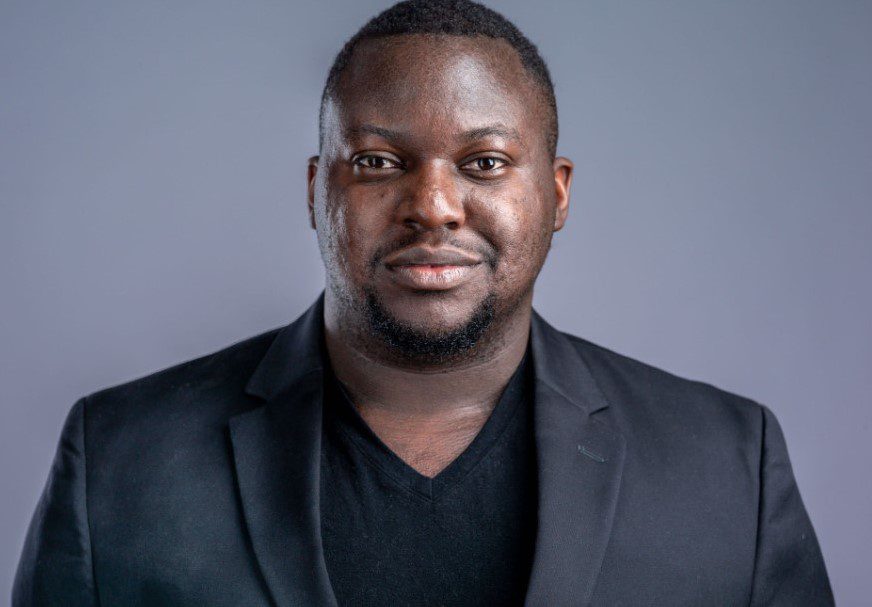

10. Tosin Eniolorunda – Moniepoint

Founded: 2015

Origin: Nigeria

Funds Raised: $170M+

Valuation: $1B+

Tosin Eniolorunda began his career at Interswitch in 2009 as a software engineer, progressing to senior software manager, head of application development, and product manager. In 2015, he left to co-found Moniepoint (formerly TeamApt) alongside Felix Ike.

Under their leadership, Moniepoint has raised over $170 million. The initial $50 million funding round in August 2022 included participation from QED Investors.

In November 2024, Moniepoint secured $110 million in a Series C round led by Development Partners International (DPI), with contributions from Google’s Africa Investment Fund, Verod Capital, and Lightrock. This round elevated the company to unicorn status, becoming Africa’s eighth fintech unicorn.

Shortly after, in January, Moniepoint raised an additional $10 million in Series C funding backed by Visa.

0 Comments