United Bank for Africa (UBA), boasting a market valuation of ₦1.93 trillion ($1.29 billion) and operations spanning 20 African nations, successfully reduced its fraud-related losses by 45.35% to ₦288 million ($192,130) during the first half of 2025. This improvement came alongside a 6.06% rise in profit after tax, which reached ₦335.53 billion ($223.84 million), as detailed in the bank’s recent financial report.

The majority of these fraud losses were traced back to electronic platforms and unauthorized fund transfers. UBA revealed that transactions amounting to ₦2.40 billion ($1.60 million) were flagged as potential fraud attempts in H1 2025, yet only 12% of these attempts culminated in actual financial losses.

Comparatively, in the first half of 2024, fraud attempts totaled ₦2.39 billion ($1.59 million), with a higher loss rate of 22%, resulting in ₦527.01 million ($351,579) lost. Electronic fraud expenses dropped significantly from ₦229.10 million ($152,837) in H1 2024 to ₦99 million ($66,044) in H1 2025. Despite only seven recorded fraudulent transfer cases in the recent period, losses stood at ₦148 million ($98,733), marking a 47.43% decrease from ₦281.53 million ($187,814) in the same period the previous year.

Although these fraud losses represent a minor fraction of UBA’s overall earnings, they highlight the persistent risks financial institutions face from fraudulent activities. This reduction in fraud coincides with substantial investments in IT infrastructure and technology services made by banks throughout 2024.

In 2024, UBA allocated ₦48 billion ($32.02 million) towards technological enhancements. For the first half of 2025, IT-related expenditures were recorded at ₦6.72 billion ($4.48 million), a slight increase from ₦6.70 billion ($4.47 million) in H1 2023.

According to Nabila Mohammed, a research analyst at Chapel Hill Denham, improved IT frameworks are instrumental in curbing fraud incidents and minimizing financial damage to customers, as she explained to TechCabal in April.

UBA’s report emerges amid growing demands on Nigerian banks to strengthen their fraud prevention measures. While the number of reported fraud cases fell by 33.8% in Q1 2025, the total value involved surged by over 240%, based on data from the Financial Institutions Training Centre (FITC).

“This trend clearly indicates that fraud schemes are becoming more sophisticated rather than less frequent,” FITC noted. Although exact figures are pending, Nigerian banks suffered ₦1.39 billion ($927,297) in fraud losses during Q4 2024, an 86.3% drop from ₦10.12 billion ($6.75 million) in Q3 2024. Despite declines in fraud across web, branch, and mobile platforms, incidents involving POS and ATM channels are on the rise.

FITC also highlighted a staggering 19,470.8% increase in cheque-related fraud losses, emphasizing the urgent necessity for stronger cheque security protocols.

In response to these challenges, the Central Bank of Nigeria mandated in January that the Nigeria Inter-Bank Settlement System (NIBSS) debit the settlement accounts of banks receiving fraudulent funds, aiming to compel tighter internal controls and reduce illicit financial flows.

UBA affirmed in its H1 2025 report that “internal control mechanisms are established to reasonably protect the bank’s assets and to detect and prevent fraud and other irregularities.”

Note: Exchange rate applied: ₦1498.98 per $1

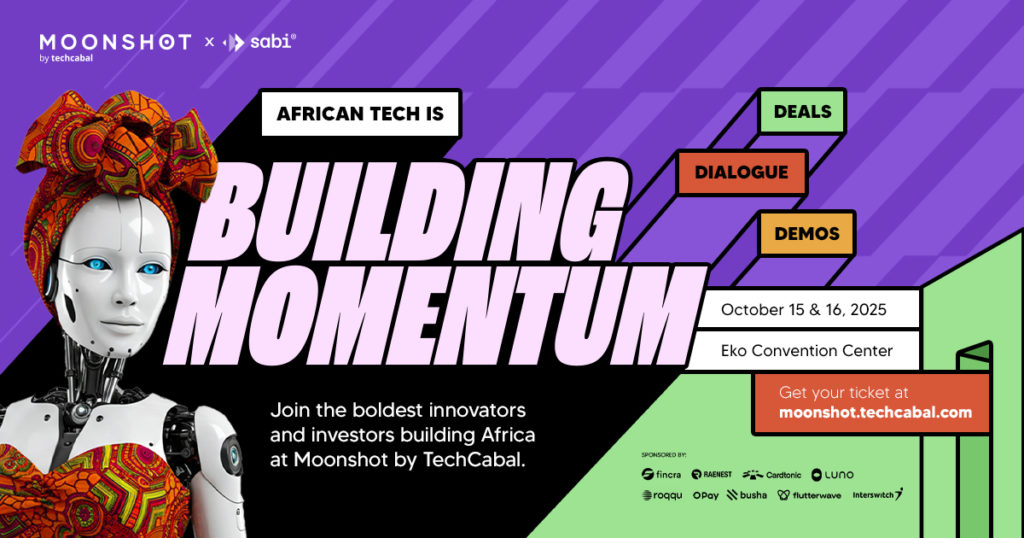

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading entrepreneurs, creatives, and tech innovators for two days filled with inspiring keynotes, networking events, and forward-thinking discussions. Secure your spot now at moonshot.techcabal.com

0 Comments