Amid escalating trade frictions between the United States and China, both nations have introduced new port fees targeting each other’s shipping vessels. This development follows China’s recent restrictions on rare earth exports, a response to fresh trade limitations imposed by the Trump administration.

These additional port charges, effective from Tuesday, have raised concerns among experts who view maritime commerce as a critical arena in the ongoing economic rivalry between the two global powers.

Despite a temporary halt in tariff escalations, tensions have reignited just as President Trump is slated to meet Chinese President Xi Jinping during the upcoming Asia-Pacific Economic Cooperation (APEC) summit in South Korea later this month.

China has criticized the US for applying “double standards,” especially after Washington threatened to impose a 100 percent tariff on Chinese imports following Beijing’s rare earth export restrictions.

Below is an overview of the newly implemented port tariffs amid continuing trade discussions:

Overview of Port Fees Enforced by Both Nations

The US government, under the executive order titled “Restoring America’s Maritime Dominance,” mandated the US Trade Representative (USTR) to levy fees on Chinese-owned, operated, or built vessels docking at American ports starting October 14. The charges include:

- $50 per net ton for vessels owned or operated by Chinese entities, increasing to $140 by April 2028.

- $18 per net ton or $120 per container for Chinese-built ships, rising to $33 and $250 respectively by 2028.

- Fees capped at five voyages annually per vessel.

- Exemptions for long-term users of China-operated vessels transporting US ethane and liquefied petroleum gas (LPG) until December 10.

In retaliation, China announced on October 10 that it would impose similar fees on US-owned, operated, built, or flagged vessels entering Chinese ports from October 14, including:

- A charge of 400 yuan (approximately $56) per net ton for American-owned or operated vessels per voyage.

- The same fee applied to ships built in the US or flying the American flag.

- Fees limited to five trips annually, with an increase to 1,120 yuan ($157) per net ton planned.

- Exemptions for empty vessels entering Chinese shipyards for repairs and Chinese-built ships.

China’s Ministry of Transport described these tariffs as “countermeasures” responding to what it called the US’s “unjust and discriminatory” actions.

Additionally, China imposed sanctions on five subsidiaries of South Korean shipbuilder Hanwha Ocean, accusing them of aiding US investigations into Chinese trade practices.

The US initially introduced extra fees on Chinese-owned vessels in April, aiming to reduce Beijing’s dominance in global maritime industries and support American shipbuilding. This followed a Biden administration investigation revealing China’s extensive state-backed support for its maritime and shipbuilding sectors, which Washington claims distorts fair competition.

China promptly responded by announcing reciprocal fees to coincide with the US tariff implementation date.

China’s Ministry of Commerce stated on Tuesday: “If the US opts for confrontation, China will persist; if it chooses dialogue, China’s door remains open.”

Key Players in the Global Maritime Industry

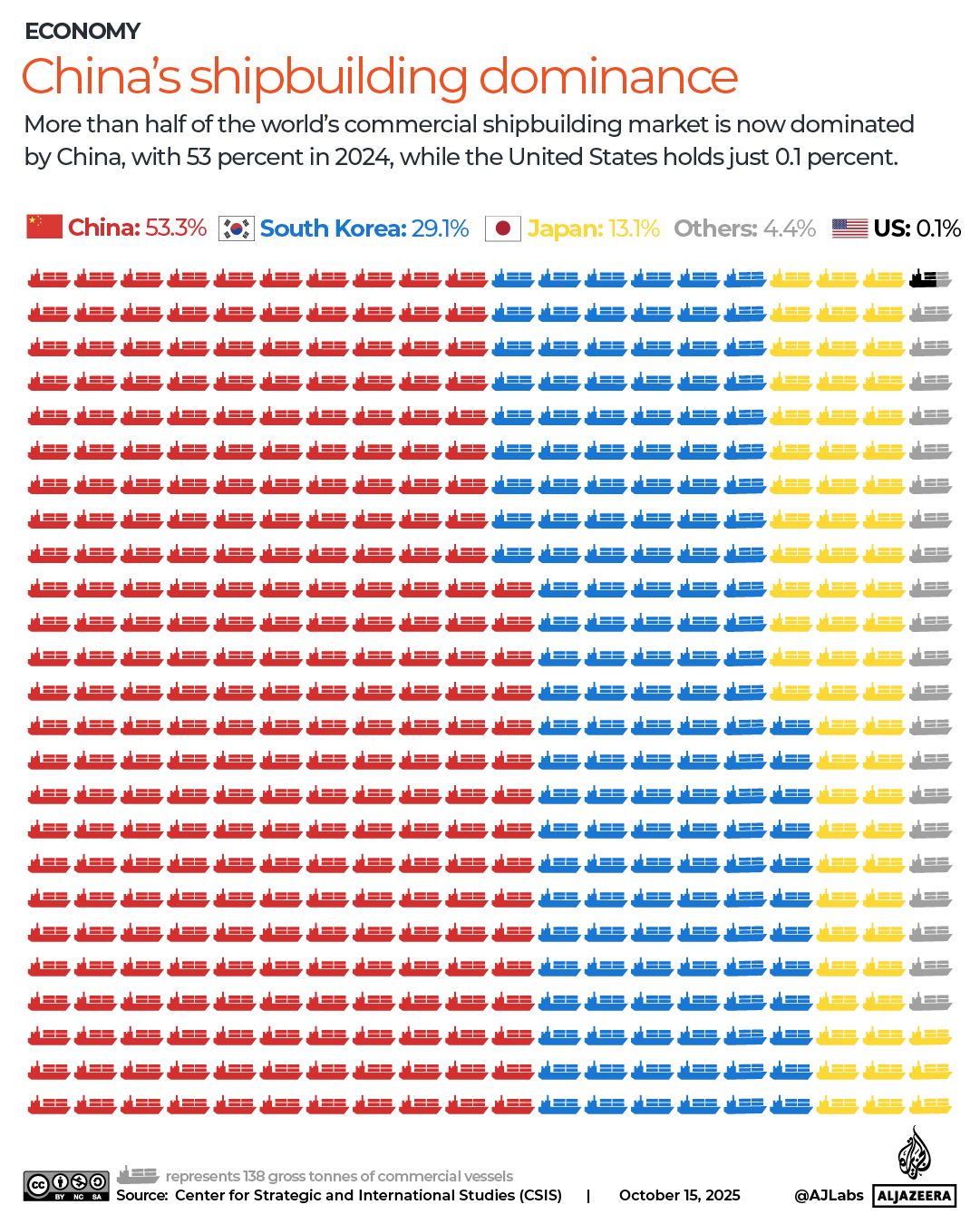

According to the Center for Strategic and International Studies (CSIS), China leads the commercial shipbuilding sector worldwide, followed by South Korea and Japan.

In 2024, China was responsible for constructing 53% of commercial vessels globally, whereas the US accounted for a mere 0.1%. The China State Shipbuilding Corporation (CSSC), a state-owned enterprise, stands as the dominant force in this market, having built more commercial ships by tonnage in 2024 than all US shipbuilders combined since 1945.

CSSC also produces naval warships, contributing to China’s status as the owner of the world’s largest naval fleet by number of ships-355 vessels as of 2020, compared to the US’s 293, according to a US Department of Defense report.

While the US Navy is widely regarded as the most powerful in terms of firepower, China’s supremacy in shipbuilding has been a growing security concern in Washington for several years.

Rationale Behind US Restrictions on Chinese-Built Ships

The US aims to diminish China’s overwhelming influence in maritime industries.

Concerns first surfaced in May 2024 when five US trade unions petitioned the USTR to address what they described as China’s “unfair” maritime and shipbuilding practices, highlighting extensive government subsidies that give Chinese companies an undue advantage.

Following investigations, the USTR concluded in January 2025 that China’s policies “burden and restrict” US commerce, prompting plans for countermeasures. Public hearings ensued, featuring testimonies from trade unions and industry advocates, culminating in President Trump’s April executive order “14269 – Restoring America’s Maritime Dominance.”

In a March address to Congress, President Trump pledged to revitalize the US shipbuilding sector, including both commercial and military vessels, and announced plans to establish a dedicated “office of shipbuilding.”

“We are committed to rebuilding the American shipbuilding industry, which has declined significantly,” Trump stated, receiving applause from House Republicans. “This initiative will greatly enhance our national security.”

Matthew Paxton, president of the Shipbuilders Council of America, lauded the president’s commitment, emphasizing that leveraging existing domestic shipyard capacity could meet defense needs, restore competitiveness, and generate thousands of skilled jobs nationwide.

Impact of Tariffs on Global Trade

Industry analysts warn that these reciprocal port fees are already disrupting international shipping operations. Chinese container carrier COSCO is expected to face the brunt of US charges, potentially incurring costs up to $3.2 billion.

Shipping intelligence firm Clarksons Research highlighted that China’s new port fees could heavily impact oil tanker traffic, which constitutes 15% of global shipping capacity, according to Reuters.

Major shipping companies such as Denmark’s Maersk, Germany’s Hapag-Lloyd, and France’s CMA CGM have reportedly rerouted China-affiliated vessels away from US routes to avoid the new fees.

Ed Finley-Richardson, an independent dry bulk shipping analyst, described the current situation as a “chaotic phase” where industry players are scrambling to find alternative solutions with mixed success.

There are unconfirmed reports that some US shipowners operating non-Chinese vessels are attempting to divert cargoes to other destinations while en route to China to circumvent the tariffs.

Meanwhile, South Korean shipbuilder Hanwha Ocean faces Chinese sanctions on five of its US-linked subsidiaries. Hanwha, one of the world’s largest ship manufacturers and owner of the Philadelphia-based Philly Shipyard, saw its shares drop nearly 6% following the announcement.

Additional Trade Restrictions and Potential for Escalation

China, which holds a near-monopoly on essential rare-earth metals critical for electronics manufacturing, tightened export controls on five more elements on October 9, including holmium, erbium, thulium, europium, and ytterbium. These restrictions supplement earlier curbs on seven other metals announced in April.

In response, President Trump has threatened to increase tariffs on Chinese imports to 100% starting November 1.

Earlier in his presidency, Trump imposed substantial tariffs on Chinese goods to address perceived trade imbalances. These tariffs were temporarily eased following a September agreement that established a 90-day pause, set to expire around November 9.

However, the recent rare earth export limits by China and the newly imposed port fees have reignited tensions. Experts caution that a full-scale trade war between the US and China could severely disrupt global markets and potentially trigger a worldwide economic downturn.