In recent years, African startups have heavily prioritized rapid user growth, often pursuing expansion aggressively to attract investor attention. Yet, the landscape is shifting. In 2024, funding for African technology ventures dropped sharply to $1.1 billion-a 50% decline compared to 2023. Meanwhile, the cost of acquiring customers is climbing, driven by infrastructural challenges and the need for tailored marketing strategies. With over 678 fintech companies operating continent-wide-up from 576 in 2021 according to Disrupt Africa-the battle for customer attention is fiercer than ever. So, what strategies will enable emerging unicorns to secure sustainable growth?

Drawing from my experience scaling fintech and SaaS solutions both within Africa and internationally, I’ve observed that having the largest user base doesn’t guarantee success. A closer look at Africa’s current unicorns reveals a common thread: those that endure focus on retaining their existing customers. Retention fuels long-term growth, enhances customer lifetime value, and builds resilient businesses capable of weathering tighter capital conditions.

The rising expense of growth is unsustainable

Startups across Africa are now grappling with unprecedented customer acquisition costs. Data from Ingressive Capital indicates that marketing and acquisition consume between 20% and 40% of operational budgets. Additionally, digital advertising expenses in key hubs like Nigeria and Kenya have doubled over the last three years. Each new user costs more to acquire and tends to convert less effectively.

When acquisition costs dominate budgets, losing a customer means not only forfeited revenue but also wasted investment. Conversely, improving retention rates by just 5% can increase profits by 25% to 95%, compounding growth without proportional spending. For African entrepreneurs, the path to growth is shifting from relentlessly adding new users to nurturing and keeping the ones they already have.

Retention: The true catalyst for growth

Retention amplifies growth without escalating expenses. In my view, startups with robust retention strategies experience revenue growth two to three times faster than those relying predominantly on new user acquisition. For African ventures facing rising acquisition costs and dwindling funding, this difference can be the deciding factor between thriving and folding.

Moreover, retention provides founders with stable, investor-friendly metrics. Controlling churn elevates customer lifetime value, reduces cash burn, and accelerates the timeline to profitability-advantages that are crucial in capital-constrained markets. Loyal customers also generate referrals, lower support demands, and create a competitive moat. In Africa’s saturated tech ecosystem, this loyalty often represents the most sustainable advantage.

Why retention matters more in Africa’s unique market

The African market intensifies the consequences of customer churn. Fragmented payment systems, low consumer trust, and inconsistent internet connectivity make acquiring users challenging and retaining them even more so. For example, in Sub-Saharan Africa, the median cost of 1 GB of mobile data accounts for 15.3% of the monthly GDP per capita for the lowest income group, making continuous digital engagement costly for many users.

Competition is escalating rapidly. The number of fintech startups in Africa grew by 17.7% over two years, pushing acquisition costs higher and making retention vital for margin protection. Additionally, localized marketing efforts and offline customer support inflate re-engagement expenses, often making it two to three times more costly to win back a lost customer than to keep an existing one.

This dynamic means that even small improvements in retention rates can dramatically enhance unit economics. Founders who design products resilient to intermittent connectivity, incorporate offline engagement channels, and foster trust through transparent pricing will outperform those chasing scale through unsustainable advertising budgets.

Insights from Africa’s established unicorns

Leading African startups demonstrate that retention is key to achieving unicorn status. Take Flutterwave, valued at over $3 billion, which strengthens customer loyalty through APIs, recurring billing, and social commerce features-not just by onboarding merchants. Wave, with a $1.7 billion valuation, retains users by offering ultra-low 1% transaction fees, free deposits and withdrawals, and round-the-clock support to keep mobile money customers engaged.

Jumia, Africa’s top e-commerce platform, employs subscription services like Jumia Prime to encourage repeat purchases and reduce churn, while expanding rural agent networks to secure customer loyalty. These examples highlight how retention strategies underpin company valuations, investor trust, and sustainable expansion.

Retention-first founders will lead Africa’s next decade

For entrepreneurs and investors in Africa, the message is clear: acquiring new users is becoming more difficult and costly, while retaining existing customers is increasingly valuable. The next wave of unicorns will succeed not by outspending competitors on advertising but by embedding their products deeply into users’ lives.

This requires integrating retention-focused approaches from the outset-crafting onboarding experiences that resonate, designing seamless interactions that accommodate spotty connectivity, maintaining transparent pricing models, and fostering community-driven loyalty. Investors should prioritize retention metrics over superficial acquisition figures when assessing early-stage startups.

Ultimately, retention offers the strongest defense against rising acquisition costs, shrinking investment pools, and intensifying competition, shaping the future of Africa’s tech unicorns.

______

Stephen Akadiri is a specialist in organic growth with over six years of experience scaling fintech, media, and SaaS brands worldwide. As Senior SEO Growth Manager at Grey (YC W22), he champions sustainable expansion across diverse markets.

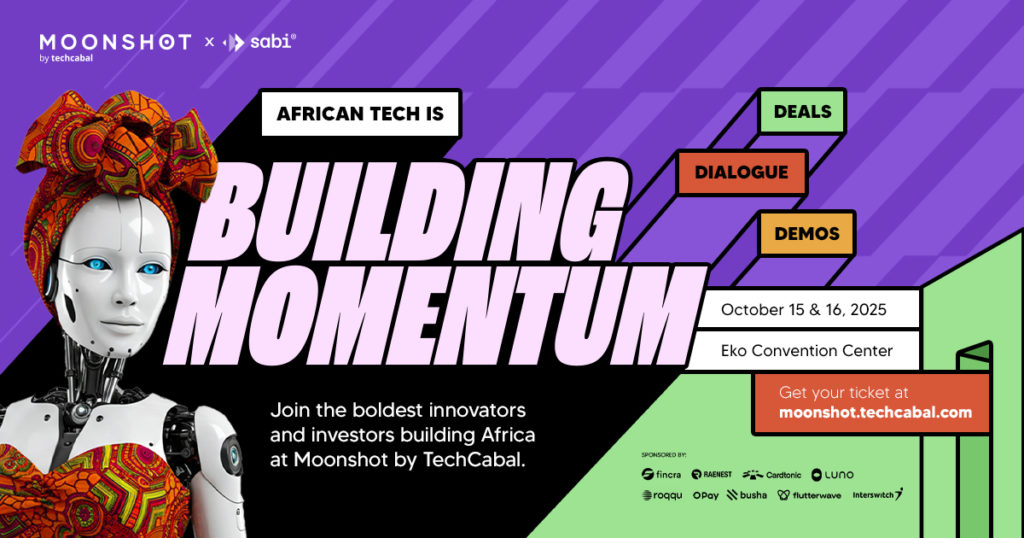

Save the date! Moonshot by TechCabal returns to Lagos on October 15-16. Join Africa’s leading founders, creatives, and tech innovators for two days of inspiring keynotes, networking, and forward-thinking discussions. Secure your tickets now at moonshot.techcabal.com

0 Comments